- Joined

- Nov 28, 2011

- Messages

- 26,190

- Reaction score

- 23,133

- Gender

- Undisclosed

- Political Leaning

- Other

It's not just wealthy people, it's most Californians. Rich people don't want affordable housing built in their backyards. Middle-class people want affordable housing, but not if it's going to mean a big tower built close to them. Poor and minority people want affordable housing, but don't want to lose their neighborhoods to gentrification.I have little doubt that much of the cause of California's housing crisis comes from wealthy landowners not wanting to loosen their chokehold on the limited supply of housing by allowing the promotion of more development.

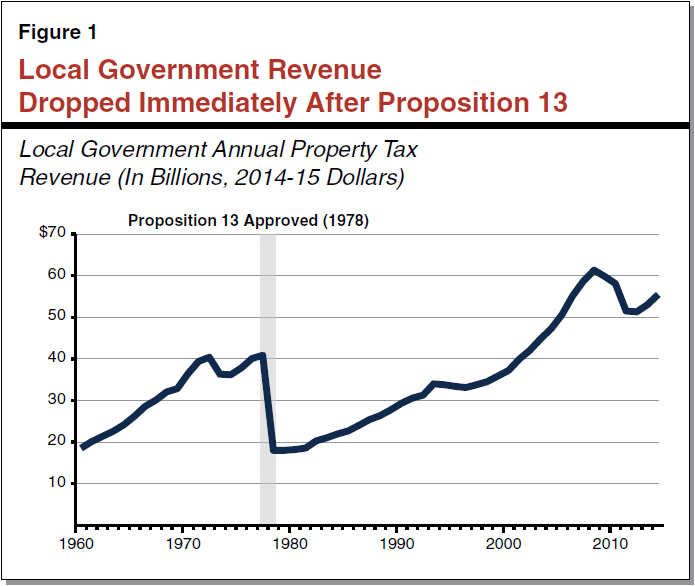

Everyone hates paying taxes, which is why Prop 13 is a third rail for CA politics.

Yeah, so here's the thing. Taxes have to get paid, one way or another.As much as I love the work of Professor Milton Friedman, he was not exactly an advocate for the interests of those living on fixed incomes who managed to purchase and pay off their homes during their working years....

Property taxes are not regressive, they're generally flat. As the value of the home rises, so does the tax payment. The only way you'll pay more taxes on your home is if the home increases in value.

Needless to say, the people living on fixed incomes would blow a gasket if the value of their home didn't at least keep up with inflation.

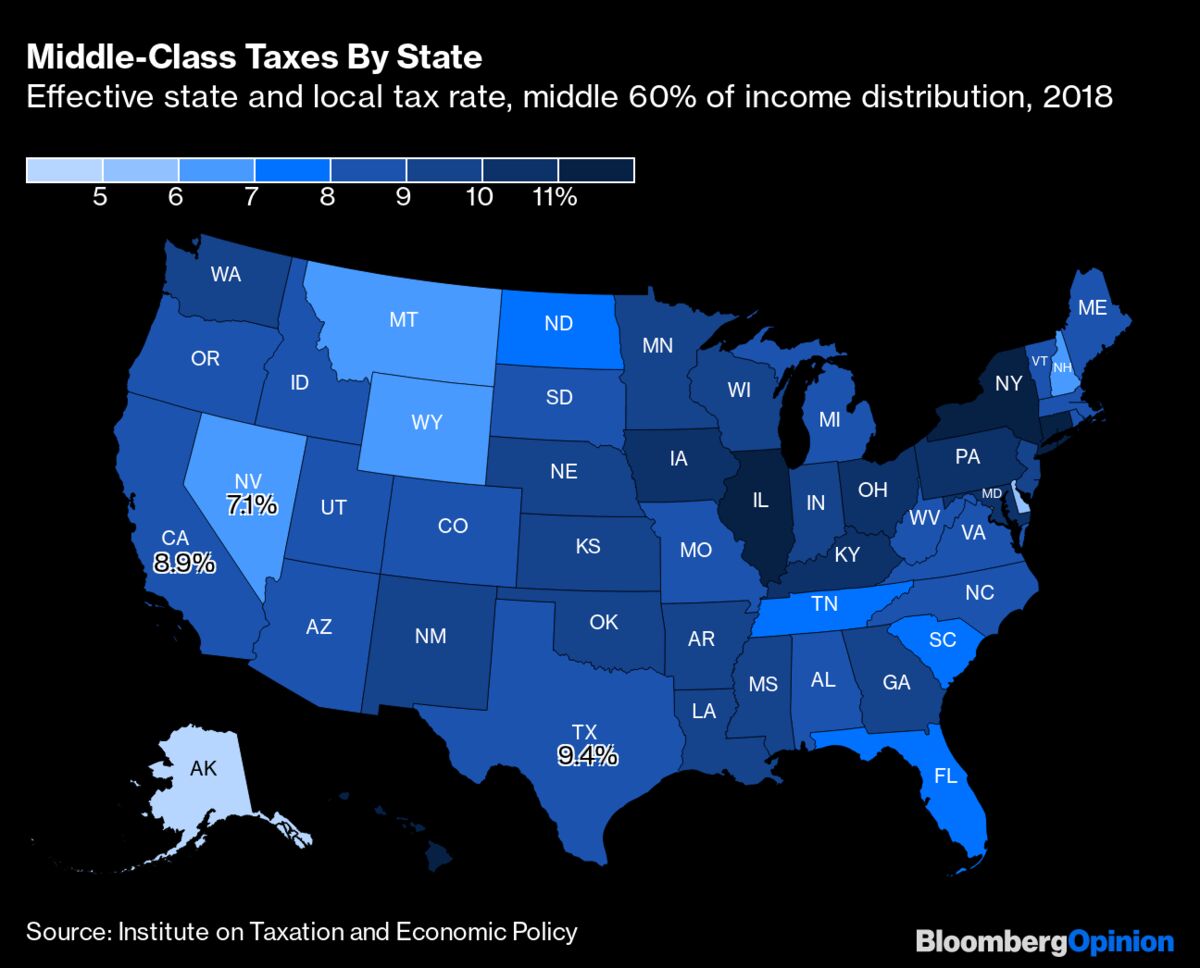

The problem that Prop 13 has created for CA is that tax revenues are too heavily based on things like sales and income taxes, which fall during a recession. As a result, revenues drop at exactly the time when the state needs to spend more. Sales taxes are the most regressive type of tax available.

Income taxes are progressive -- until they aren't. The ultra-wealthy now mostly get paid not with income, but with assets. For example, Zuckerberg makes a big deal of getting a $1 salary, but the real reason he does it is because the appreciation on his Facebook stock is so massive, and isn't taxed until he sells any stock. But instead of selling it, what he can do is borrow against it, and roll over those debts indefinitely. When he passes on, the estate can pay any outstanding debts by selling stock -- whose value resets when Zuckerberg passes on. (ProPublica is running a big series on the ways that the ultra-rich use these types of setups to avoid paying taxes.)

Meaning what, their property taxes effectively go down every single year? Thus forcing CA to figure out other, more regressive, ways to increase taxes? Pass.The only way I think such a proposal would be just is if the basis amount that folks paid on was capped at their original home purchase price with no further increase.

Meaning what, she should be able to increase her net worth by $960,000 and never pay taxes on it? Sorry, but that doesn't sound fair at all.That way an old widowed grandmother collecting Social Security and a small pension and who managed to buy and pay off a home that she and her husband paid $40,000.00 for it in Los Angeles in the 1970sand that is now worth $1,000,000.00 can remain in her neighborhood and pass it on to her descendants preserving the family wealth.

:max_bytes(150000):strip_icc()/128013432-5bfc2b96c9e77c0026b4fb00.jpg)