- Joined

- Sep 3, 2014

- Messages

- 20,761

- Reaction score

- 24,176

- Location

- Pacific NW

- Gender

- Male

- Political Leaning

- Liberal

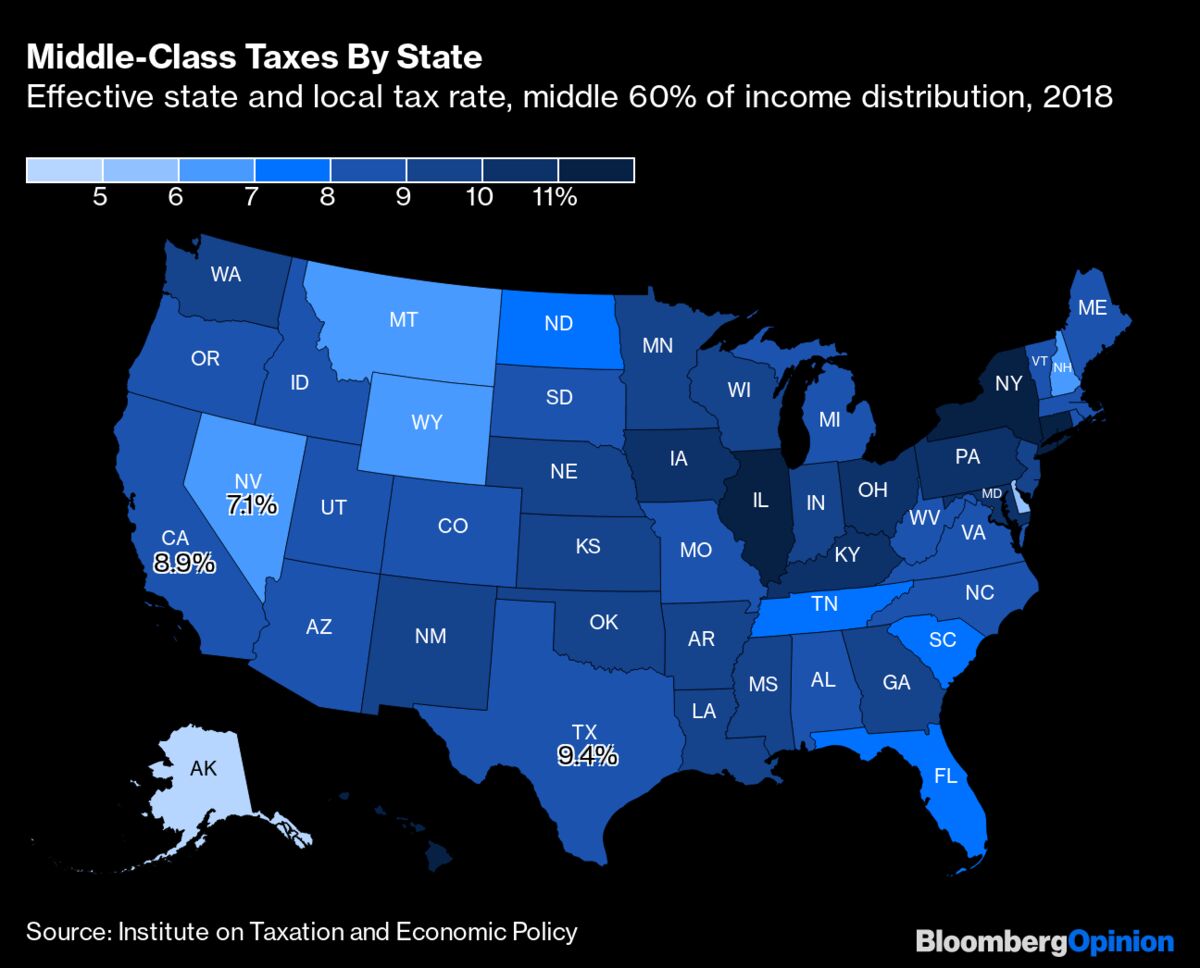

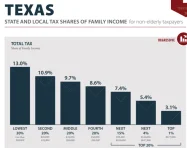

True. Texas has the second most regressive tax system in the US, which means great for the rich, but everyone else pays more.One of the big myths that Republicans like to sell us is that red states necessarily have lower taxes than blue states. The reality of the situation is much murkier

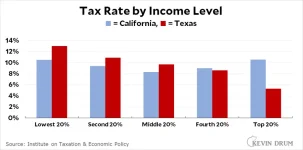

Compare that to, say, radicalmarxistsocialist California:

Combined income, sales, and property tax liabilities fall like this:

Give me California any time.