Back in the day you could count all the toll roads in Texas on one hand. Hardy Toll Road in Houston, Dallas North Tollway, a couple of toll bridges, and that was about it.

Now toll roads are everywhere there, and they're not cheap.

Mansfield is roughly located at the intersection of U.S. 287 and Texas state road 360...that's the closest major freeway interchange, about three miles South of the old township itself.

360 is a main freeway traveling North-South and it divides Dallas and Fort Worth right down the middle of the two cities, pretty much.

It's been mostly unimproved or enhanced since it was first constructed in the 1970's and the part that connects to Mansfield starts about four miles South of Camp Wisdom Road.

It was always little more than two "service roads" built in anticipation of the day the actual 360 freeway gets extended, and it stayed that way until about three years ago when that part became a toll road.

Until recently Mansfield was just a little cow town (pop. 25000) known mostly for being the place where "Black Like Me" author John Howard Griffin got burned and hung in effigy by the local Klan in 1959.

In the last few years the population has more than doubled as developers built out the surrounding area with sprawling HOA bedroom communities.

The state "rewarded" all that growth by making the new portion of 360 into a toll road, but only the portion South of Interstate 20.

Of course once you get North of I-20, then the fun really starts because everything North of the I-20 is a parking lot sunrise to sundown, especially in the summer. (Six Flags traffic!)

It is not surprising for a journey from DFW Airport to Mansfield to take almost an hour, a distance of about twenty miles, the last seven of which will cost you $2.50, or $1.50 if you have a toll tag.

So it's safe to say that freeway traffic isn't any better than it is in Los Angeles.

But a lot of that is due to the fact that once freeways get built down there, that's it, they're pretty much the way they're going to stay unless they get turned into a toll road.

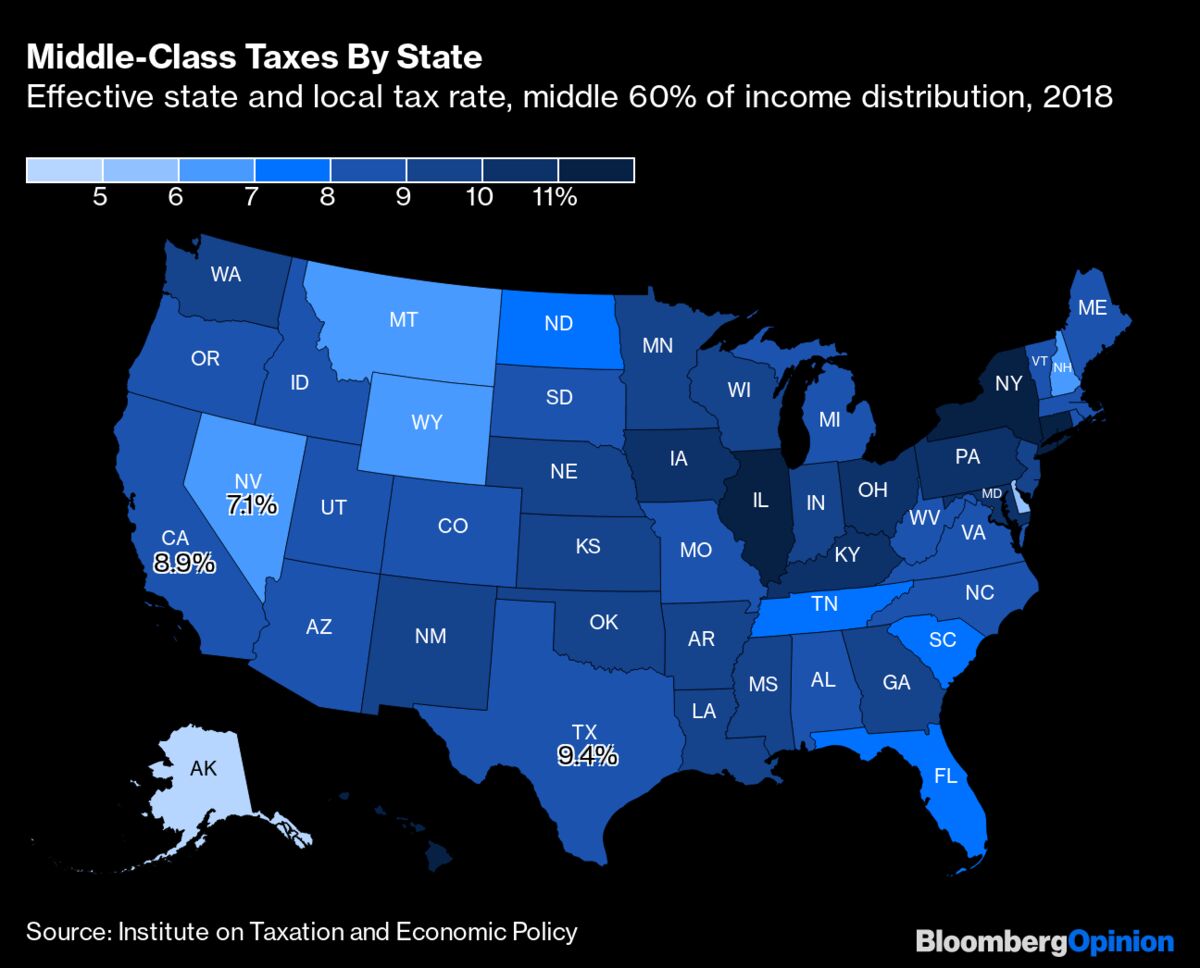

www.bloombergquint.com

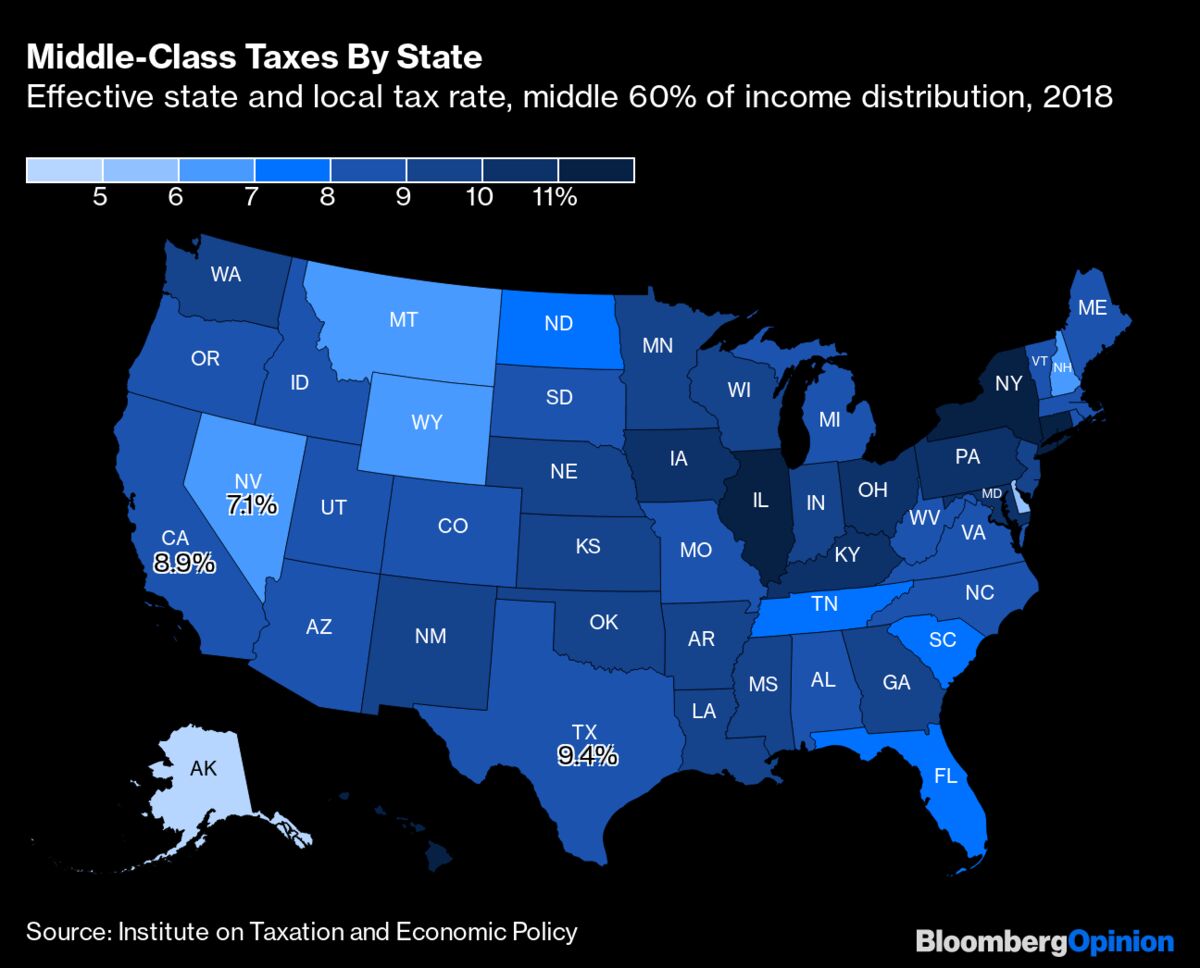

www.bloombergquint.com