- Joined

- May 22, 2012

- Messages

- 104,405

- Reaction score

- 67,607

- Location

- Uhland, Texas

- Gender

- Male

- Political Leaning

- Libertarian

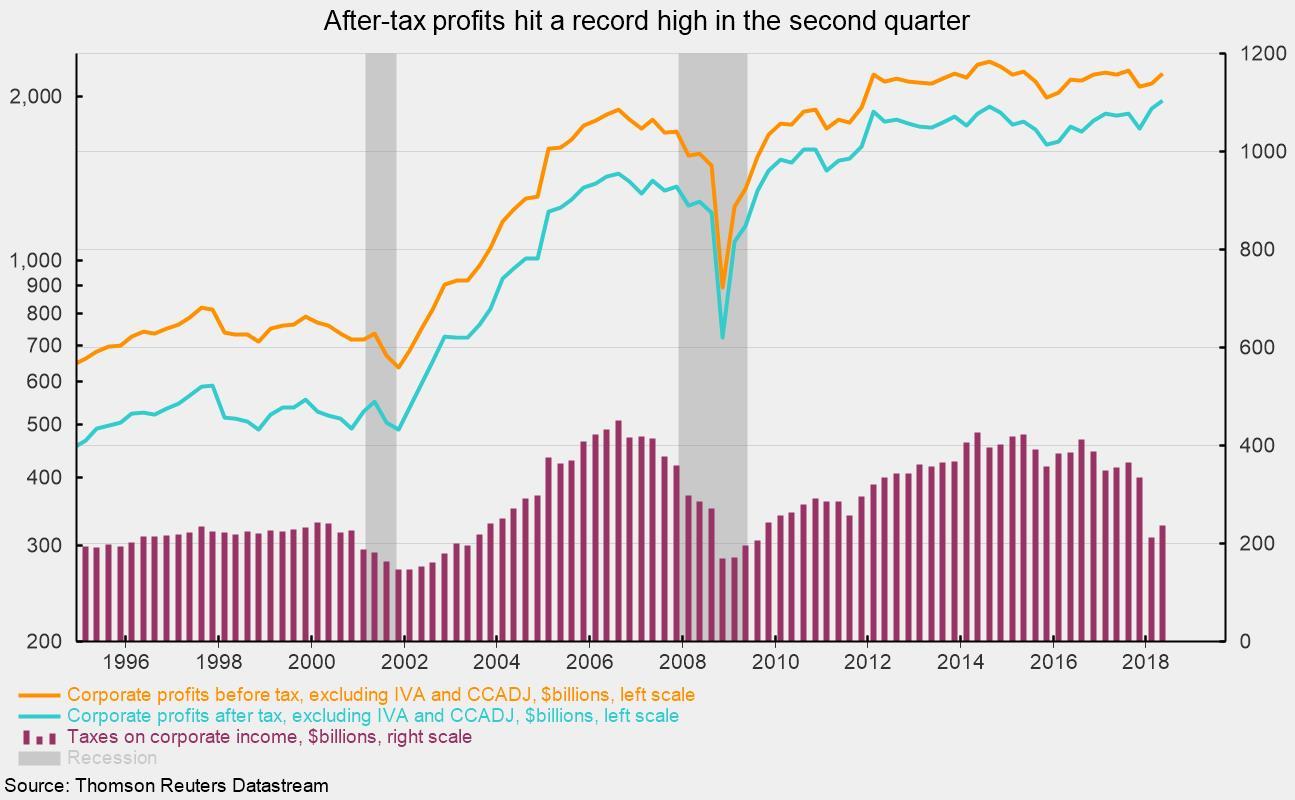

Re: The "Tax The Rich" Delusion on the Left

Thank you. That is an interesting graphic yet when (if ever) were US wages tied to profit levels? The simple truth is that wages are tied to replacement costs - what an employer must offer to attract and retain qualified labor.

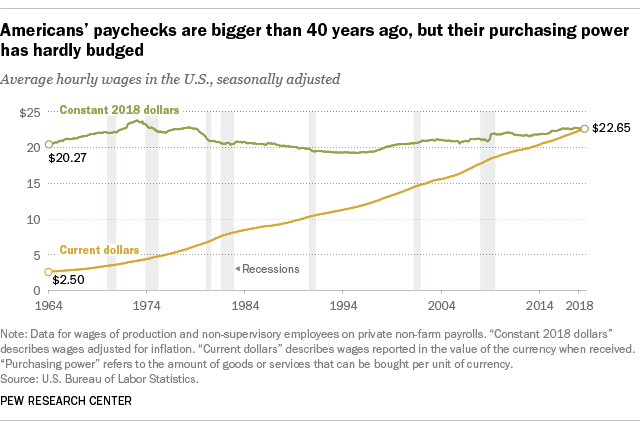

Actually many had to accept lower pay as happens after every recession. How do you think companies have been able to avoid paying for raises for 40 years?

Thank you. That is an interesting graphic yet when (if ever) were US wages tied to profit levels? The simple truth is that wages are tied to replacement costs - what an employer must offer to attract and retain qualified labor.