- Joined

- Dec 20, 2009

- Messages

- 75,666

- Reaction score

- 39,922

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

From that rabid right-wing propaganda outlet.....er... Daily Beast.

A point I've raised here regularly. If you want a European-style social welfare state, you have to pay for it like they do - by taxing the Bejezus out of the middle class.

The Democrats’ incoming House majority—and its Senate caucus of presidential wannabes—are about to face fiscal reality. When confronted with how to pay for their extraordinarily expensive policy agenda, the answer of liberal lawmakers, analysts, and advocates is nearly always the same: tax the rich....

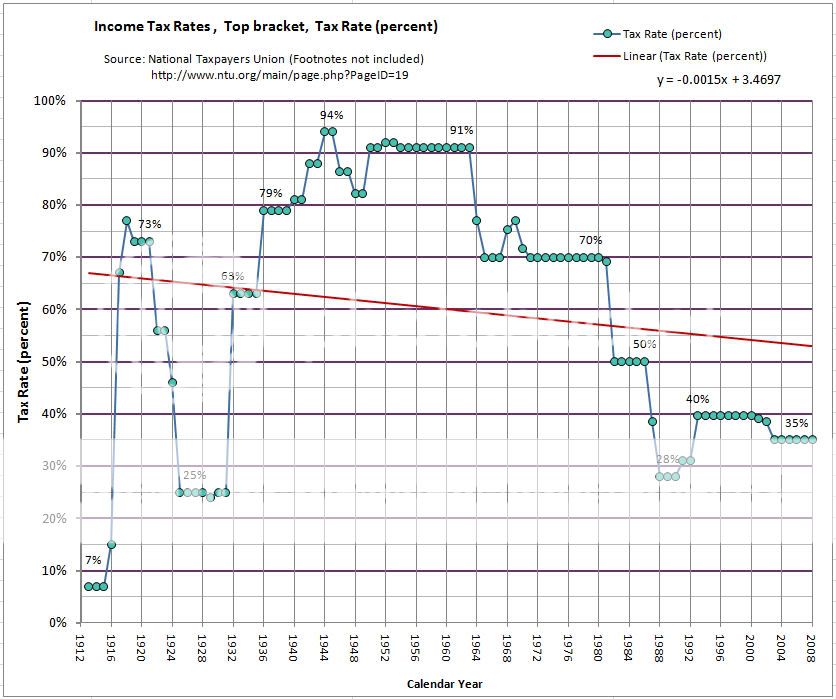

Even if the 2017 tax cuts and 2018 defense spending hikes expire, the CBO projects a baseline budget deficit rising to 5 percent of GDP over the next decade. Additionally, the far-left wish list described above totals 18 percent of GDP. That brings a staggering budget deficit of 23 percent of GDP, or the current equivalent of $4.6 trillion per year. In closing that massive budget gap, tax scores from CBO’s “Budget Options” report show that upper-income tax increases are plausibly limited to one or two percent of GDP.... Imagine 100 percent tax rates on all income earned over the $1 million threshold. That’s politically impossible, but for the sake of argument, imagine it. Even that would add just 5 percent of GDP in revenues—until people quickly stop working at that income. Slightly more realistically, doubling the top two tax brackets, to 70 percent and 74 percent, would raise at best 1.6 percent of GDP, and that’s probably optimistic. Alternatively, the popular liberal Social Security solution of eliminating the payroll tax wage cap of $128,400 would close barely half of the system’s long-term shortfall of 1.5 percent of GDP. It would also bring marginal tax rates (including state taxes) above 60 percent in some states, thus leaving little room for additional income taxes to close the much larger Medicare shortfall or finance new spending...

In reality, spending like Europe requires taxing like Europe. This means, in addition to federal and state income taxes, a value-added tax (VAT)—essentially a national sales tax—that affects all families. CBO data estimates that raising 15 percent of GDP would require imposing an 86 percent VAT rate, or hiking the payroll tax from 15.3 percent to 56.5 percent. No wonder many spenders prefer the “just tax the rich” fairy tale...

A point I've raised here regularly. If you want a European-style social welfare state, you have to pay for it like they do - by taxing the Bejezus out of the middle class.