HumblePi

DP Veteran

- Joined

- Sep 3, 2018

- Messages

- 26,336

- Reaction score

- 18,862

- Gender

- Undisclosed

- Political Leaning

- Liberal

https://www.cnbc.com/2018/10/10/technical-analysts-theres-more-pain-to-come-for-stocks.html

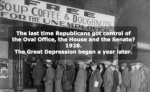

Today, the stock market had one of it's biggest selloffs since last February. The Dow Jones finished at -817.22 or 3.09% and the NASDAQ -315.97 or 4.08% of total market value.

The selloff came on fears of rising interest rates. In the past year with a robust economy and a stock market rising to record levels, Trump took the credit for it - saying that it's a function of his policies. Will he take the blame for the severe losses on Wall Street today? I don't think so.

Everyone knew that a huge bubble in the economy was forming and it would burst sooner or later.

https://www.cnbc.com/2018/06/19/jim-mellon-market-sell-off-in-us-stocks-start-of-major-correction.html

"The trade war worries are "certainly having an effect on the market, but the market is reacting because it's already far too expensive," Mellon said. "The U.S. is selling at 32 times cyclically adjusted price-to-earnings (PE) ratio, which is an all-time high. Surely it's time for a major correction anyway."

Mellon is not alone in suggesting that today's stock market is the most overvalued on record — more so than in 1929, 2000 and 2007.

Today, the stock market had one of it's biggest selloffs since last February. The Dow Jones finished at -817.22 or 3.09% and the NASDAQ -315.97 or 4.08% of total market value.

The selloff came on fears of rising interest rates. In the past year with a robust economy and a stock market rising to record levels, Trump took the credit for it - saying that it's a function of his policies. Will he take the blame for the severe losses on Wall Street today? I don't think so.

Everyone knew that a huge bubble in the economy was forming and it would burst sooner or later.

https://www.cnbc.com/2018/06/19/jim-mellon-market-sell-off-in-us-stocks-start-of-major-correction.html

"The trade war worries are "certainly having an effect on the market, but the market is reacting because it's already far too expensive," Mellon said. "The U.S. is selling at 32 times cyclically adjusted price-to-earnings (PE) ratio, which is an all-time high. Surely it's time for a major correction anyway."

Mellon is not alone in suggesting that today's stock market is the most overvalued on record — more so than in 1929, 2000 and 2007.