-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

History of US tax-rates since their inception

- Thread starter Lafayette

- Start date

- Joined

- Jun 18, 2016

- Messages

- 22,220

- Reaction score

- 7,948

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Yeah. Lowest ever corp tax rates under Rep admin. Then we went into the Great Depression. Dems had to pull the country out, just as with the Great Recession. Trump gives large corps a tax giveaway plan, leaving the avg American the crumbs from that pie of our national treasure. Then an economic calamity from the COVID pandemic is turned into a disaster by Trump and the Rep Congress, supported by the Trump cult. Good luck Biden and Dems raising back the corp tax rates to anywhere near what is was before, when they were making record-breaking after-tax profit under Obama, if Rep control the Sen or a Dem Sen or 2 vote Rep, which is way more likely than the other way around, historically.

- Joined

- Jan 22, 2019

- Messages

- 17,149

- Reaction score

- 6,827

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

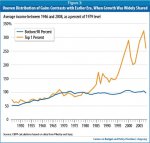

The Graphs shows that the low tax rate, led right into the Great Depression..... and the Chart also shows, that under Ronald Reagan, things in the U.S. has seen the nation struggling with debt, crazy interest rates and Outsourcing.

The last time they were lower than today was in the 1920s ...

American people don't understand "Taxes"... and many blind themselves to what "taxes invest in".... public and private, and how many business rely on grants, contracts and other program benefits that are funded by tax dollars.

The chart shows that between 1952 and 1963 - America was prospering with stability and progressive steps. Only After Civil Rights Act Passed, did the Tax Rate Start to drop, because so many people, did not want to see any tax supported programs to help Minorities and Women, the easiest way to slow down the progress of minorities and women, is to cut into the Federal Tax Resources by Reducing the Taxes Collected.

What we see as a result is "$27,400,000,000,000 DEBT and $155,060,000,000,000 UNFUNDED OBLIGATION - this won't go down without Taxes Going Up... and when Taxes goes up and Tax money is invested to take care of unfunded obligation, doing so will create jobs, and industry to address those unfunded obligation and that will increase employment, as well as re-start business growth. To do so will also, slow the growth of the Debt level, and once in place will began to reduce the Debt... That means American will earn more, be able to save more and in doing so will build a more stable economy for All America.

We have massive Rebuilding that is NECESSARY, and EVERY City in The Nation has high volumes of "Industrial and Business Blight" that must be torn down, removed and the site cleaned up, to 'Re-claim" that land-space. Government Investment has always been the platform that has spurred Business Growth, most people have no idea that the company they work for is more than likely in constant pursuit of government grants, government contracts and other government provided provisions.

With 320,000,000 people, there is no going backwards, because life progresses forward, and in this age of information and technology, it is going to take massive government investments to meet the 21st Century. Homes that were built in the 1930's through the 1970's will require mass rebuilding of some and massive modification of others. Even homes built in the 1990's is now 30 yrs Old.... and many need maintenance and some need modification and some of the lower quality ones need to be torn down and rebuilt. This is massive for jobs, because the attributes and contents of those home products must be manufactured.

This same paradigm holds true for Business of Many Many Types...

We have every form of Infrastructure that must be rebuilt, upgrades and some completely replaced with 21st Century Modeling. Many cities and towns have water systems and sewer system that are more than 80- 90 -100 yrs old - Electrical Grid has to be improved, and in many areas vaults, channels and conduit must be laid to bury electrical cables. 'all this is massive volume of jobs" and some of those jobs won't stop once this is built, because everything built has to be maintained.

Solar and Battery Technology is not going to vanish, it will improve, there is no longer the need for a single source of energy via electric wires on wooden poles, that get knocked down in weather conditions.

Americans need to learn what "Taxes Actually Achieve"... and stop bitching about paying taxes. countries with bad tax policy of low taxes are what we call "3rd World, and 4th World - because without the taxes and the government investing those taxes in the nation, they don't get quality roads, they don't get quality infrastructure of any significance, (except in the wealthy areas), and business does not grow to pay a living wage, which means the taxes they do collect is lower in amount that makes it difficult for them to dig their way out of the hole and get on level ground, so they can built their systems across the landscape.

Ignorance, taking things for granted and greed is always within "the type people" who cry and whine about paying taxes, and they continue to be those who cheat society and nation. The well to do and wealthy, whine the most, because they can no longer just direct working peoples tax money to build up their communities only; and they resent their tax money helping build up all communities, but they had no problem leeching off the average tax payer to build their areas to high standards.

Last edited:

- Joined

- Jun 6, 2020

- Messages

- 12,804

- Reaction score

- 10,259

- Location

- UK

- Gender

- Male

- Political Leaning

- Undisclosed

Even at such high tax rates wealthy people still existed and managed to find the motivation to work even in the 50's.

It shows just how silly the Republican mantra that high tax will destroy the economy really is.

It shows just how silly the Republican mantra that high tax will destroy the economy really is.

- Joined

- Sep 24, 2011

- Messages

- 38,332

- Reaction score

- 44,403

- Location

- Atlanta

- Gender

- Male

- Political Leaning

- Independent

Revisiting this subject means revisiting the mountain of stupidity in the current tax code, it is not just the tax rate that needs to be reviewed but all the politically given means for one to reduce their tax liability.

Our tax code is a joke, an awful joke.

Our tax code is a joke, an awful joke.

Yeah. Lowest ever corp tax rates under Rep admin. Then we went into the Great Depression. Dems had to pull the country out, just as with the Great Recession. Trump gives large corps a tax giveaway plan, leaving the avg American the crumbs from that pie of our national treasure. Then an economic calamity from the COVID pandemic is turned into a disaster by Trump and the Rep Congress, supported by the Trump cult. Good luck Biden and Dems raising back the corp tax rates to anywhere near what is was before, when they were making record-breaking after-tax profit under Obama, if Rep control the Sen or a Dem Sen or 2 vote Rep, which is way more likely than the other way around, historically.

We should have already had the depression and correction after bush's worldwide economic disaster but the fed rescued the wall street banks. All the conditions that caused it are still there. We are just kicking the can down the road. Wall Street and the 1%ers are making record profits because of the fed while the middle/working class, the real economy,, suffers

- Joined

- Jan 22, 2019

- Messages

- 17,149

- Reaction score

- 6,827

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Continued from Post #3

When Tax Rates were higher, BUSINESS PROSPERED ACROSS THIS NATION... Companies Paid Progressive Wage, Provided Union Benefits INCLUDING funded Pension Plans. Now, with ACA, those same companies can return to providing quality medical at affordable rates, because they can register more people which reduces the unit cost of individual insurance cost.

America is truly in need of "In-depth Civics Education" that include deeper educational information on how Governance and Taxation functions. Sadly, we are still in a society that many people still struggle with "financial understanding". There are people this very day, who have a challenge with balancing a check book. There are people who think themselves to be investors who don't understand the "instruments of investment".

Many people have no idea what a Municipal Bond means to their community growth and development, and its time Cities Teach People about Municipal Bonds, including tax exempt bonds... because the taxes they do not pay on their gains from tax exempt bonds, become income that is spent back into the communities they live, it supports business creation, and the vast expanse of programming.

If people go and look in their city, at the once upon a time "Community Centers" that were connected to Churches and Those that were stand alone community centers, they will find those things existed because people had income, business were robust and invested in the community and people invested in the programming.

America can rebuild its Industry... but a New Industrial Model... not trying to recreate the past, but building a Newer Improved Modeling. When people are lesser educated, a society suffers and American Democracy was designed for Educated People. Our Public Schools helped America Grow. They need to be "Updated" in how they teach and what they teach.

People today, want to be "thinkers", they no longer want to be trained just to be "routine assembly line workers" who needed no more than an 8th grade understanding and in some industries people only needed a 4th grade education for the more manual labor type jobs. That system is "Old"... it does not work in today's society.

Technology today... is not as concerned about the "fictional labeling of Degrees", because its not like before, when People achieved a Bachelor's degree, their course of study was focused on the profession they aspired to. Now... its just a matter of amassing credits based on a "business model" the university became, instead of a career and profession education and training institution. Many people who have Master's Degree today, have done little other than pay money to accumulate "credits" to be given a "get a job certificate".

We allowed this escalation, where University as a "business model" saw a means to "fleece the former Bachelor Degree Graduates"... Its not like before, when people who earned a Master's Degree earned it by "dedicated focus" to the career track or the profession. We have people today, running around talking about they have 2-3-4 Master's Degree... and what we find is a "idiot" who was a professional credit accumulator as a professional student".... who results to have little specific practical expertise. Many have no idea what they want to be!!!!

When Tax Rates were higher, BUSINESS PROSPERED ACROSS THIS NATION... Companies Paid Progressive Wage, Provided Union Benefits INCLUDING funded Pension Plans. Now, with ACA, those same companies can return to providing quality medical at affordable rates, because they can register more people which reduces the unit cost of individual insurance cost.

America is truly in need of "In-depth Civics Education" that include deeper educational information on how Governance and Taxation functions. Sadly, we are still in a society that many people still struggle with "financial understanding". There are people this very day, who have a challenge with balancing a check book. There are people who think themselves to be investors who don't understand the "instruments of investment".

Many people have no idea what a Municipal Bond means to their community growth and development, and its time Cities Teach People about Municipal Bonds, including tax exempt bonds... because the taxes they do not pay on their gains from tax exempt bonds, become income that is spent back into the communities they live, it supports business creation, and the vast expanse of programming.

If people go and look in their city, at the once upon a time "Community Centers" that were connected to Churches and Those that were stand alone community centers, they will find those things existed because people had income, business were robust and invested in the community and people invested in the programming.

America can rebuild its Industry... but a New Industrial Model... not trying to recreate the past, but building a Newer Improved Modeling. When people are lesser educated, a society suffers and American Democracy was designed for Educated People. Our Public Schools helped America Grow. They need to be "Updated" in how they teach and what they teach.

People today, want to be "thinkers", they no longer want to be trained just to be "routine assembly line workers" who needed no more than an 8th grade understanding and in some industries people only needed a 4th grade education for the more manual labor type jobs. That system is "Old"... it does not work in today's society.

Technology today... is not as concerned about the "fictional labeling of Degrees", because its not like before, when People achieved a Bachelor's degree, their course of study was focused on the profession they aspired to. Now... its just a matter of amassing credits based on a "business model" the university became, instead of a career and profession education and training institution. Many people who have Master's Degree today, have done little other than pay money to accumulate "credits" to be given a "get a job certificate".

We allowed this escalation, where University as a "business model" saw a means to "fleece the former Bachelor Degree Graduates"... Its not like before, when people who earned a Master's Degree earned it by "dedicated focus" to the career track or the profession. We have people today, running around talking about they have 2-3-4 Master's Degree... and what we find is a "idiot" who was a professional credit accumulator as a professional student".... who results to have little specific practical expertise. Many have no idea what they want to be!!!!

- Joined

- Jan 22, 2019

- Messages

- 17,149

- Reaction score

- 6,827

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Continued from Post #7

The point of principle behind selecting a Major and selecting a Minor... the Minor was to compliment and support the Major. example, a Science Degree that had a Minor in Mathematics ... became a very good "Scientist" because they had the under level of knowing how to use mathematics within their science applications.

We end up with people who have an "English Literature Degree" sitting in position as "Industrial Managers", who have absolutely no training or education in mechanical, technical and operational systems. All they are good for is... "correcting grammar on letters they write" or "the policy that someone else wrote". Thier Education does not match with their Job Classification. This is systemic... and since America began pushing the Master's Degree and the MBA... we've seen nothing but Corporate and Industrial FAILURE... where they became so "degree obsessed" they have many places that are even stupid enough to require a Masters degree for an Administrative Assistant Position, that might pay $28-32k a year. When ones needs basically no more than a high school diploma to do that work. This is how University was complicit in selling this delusion of Human Resource Organizations. Because they knew they "under educated these people' and to try and save themselves from exposure, they promoted this silliness.

Tech Companies have figured it out... They'd rather have a "self taught" person with self developed skills who have a passion for the profession, than a script trained "unit collector of college unit credits", who was trained, not to "be critical thinkers" ... but simply "follow instructions without question or thought".

There are professions where people "actually MUST focus on the profession and learn the knowledge of within and of the profession"... other than that, we have a mass of people "riding a degree label" who have been under-educated and placed in position they do not have the specific skill training and educational professional trained focused to understand the responsibility of the position they have been placed.

(We all know some of such people).... many were trained to expect high pay... based solely on having the "degree" as their "get a job certificate"... and unless we change that paradigm... we will see more dysfunction and more failure in business, and industry.

Some are able to transition and learn... where others ride the degree then the title.... and we suffer as a nation as a result.

The College Cheating Scandal, has exposed that "some" well to do and wealthy people "bought their kids way into university' and "bought their way out'.... and these people got decision making jobs through their parents network of association, of companies their parents may have invested in and had a relationship of some nature either direct or indirect.

(some of us have worked in arena's of environment with some of these people)

The point of principle behind selecting a Major and selecting a Minor... the Minor was to compliment and support the Major. example, a Science Degree that had a Minor in Mathematics ... became a very good "Scientist" because they had the under level of knowing how to use mathematics within their science applications.

We end up with people who have an "English Literature Degree" sitting in position as "Industrial Managers", who have absolutely no training or education in mechanical, technical and operational systems. All they are good for is... "correcting grammar on letters they write" or "the policy that someone else wrote". Thier Education does not match with their Job Classification. This is systemic... and since America began pushing the Master's Degree and the MBA... we've seen nothing but Corporate and Industrial FAILURE... where they became so "degree obsessed" they have many places that are even stupid enough to require a Masters degree for an Administrative Assistant Position, that might pay $28-32k a year. When ones needs basically no more than a high school diploma to do that work. This is how University was complicit in selling this delusion of Human Resource Organizations. Because they knew they "under educated these people' and to try and save themselves from exposure, they promoted this silliness.

Tech Companies have figured it out... They'd rather have a "self taught" person with self developed skills who have a passion for the profession, than a script trained "unit collector of college unit credits", who was trained, not to "be critical thinkers" ... but simply "follow instructions without question or thought".

There are professions where people "actually MUST focus on the profession and learn the knowledge of within and of the profession"... other than that, we have a mass of people "riding a degree label" who have been under-educated and placed in position they do not have the specific skill training and educational professional trained focused to understand the responsibility of the position they have been placed.

(We all know some of such people).... many were trained to expect high pay... based solely on having the "degree" as their "get a job certificate"... and unless we change that paradigm... we will see more dysfunction and more failure in business, and industry.

Some are able to transition and learn... where others ride the degree then the title.... and we suffer as a nation as a result.

The College Cheating Scandal, has exposed that "some" well to do and wealthy people "bought their kids way into university' and "bought their way out'.... and these people got decision making jobs through their parents network of association, of companies their parents may have invested in and had a relationship of some nature either direct or indirect.

(some of us have worked in arena's of environment with some of these people)

Pretty obvious what the effect of the Reagan tax cuts were from the graphs below.

Before Reagan the wealthy business owners knew that any income over $215,000 ($680,000 adjusted for inflation 2020) would be taxed a a 70% rate. They could either pay it in taxes or invest it in their business or workers. Made it a lot easier to give raises. If you notice from the table below a rising tide raised all boats.

Now after Reagan's tax cuts those wealthy business owners realized they could keep it all and they did.

Before Reagan the wealthy business owners knew that any income over $215,000 ($680,000 adjusted for inflation 2020) would be taxed a a 70% rate. They could either pay it in taxes or invest it in their business or workers. Made it a lot easier to give raises. If you notice from the table below a rising tide raised all boats.

Now after Reagan's tax cuts those wealthy business owners realized they could keep it all and they did.

- Joined

- May 22, 2012

- Messages

- 104,398

- Reaction score

- 67,588

- Location

- Uhland, Texas

- Gender

- Male

- Political Leaning

- Libertarian

Revisiting this subject means revisiting the mountain of stupidity in the current tax code, it is not just the tax rate that needs to be reviewed but all the politically given means for one to reduce their tax liability.

Our tax code is a joke, an awful joke.

The saddest part is that the screwed up federal “budgeting” process results in a congressional re-election rate of over 90% - thus is very unlikely to be changed.

- Joined

- Jan 22, 2019

- Messages

- 17,149

- Reaction score

- 6,827

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

The saddest part is that the screwed up federal “budgeting” process results in a congressional re-election rate of over 90% - thus is very unlikely to be changed.

There are means to deal with Pro-rated deductions, based on "Re-Investment" and Re-Investment must be made with long term intentions by signed contract with Municipalities, Country and State.... "0" deduction for Corporate Jets (if they fly on one, they get to deduce no more than the cost of a First Class or Business Class Commercial Ticket Price that of offered under Corporate Rates"), "0" deduction for Corporate Retreats, and "0" deduction for Corporate Perks of Any Kind.... except, for "Medical Coverage" Provided they join the EXACT SAME MEDICAL PROGRAM they provide to Employees.

We can stop the "bullshit"... and we can require "solid profit statements" based on actual sales and actual production", none of this "projected mess", so they can't claim a profit loss and deduct it as a tax credit.

Set cast in stone "Penalty" for any "Offshore Hiding of Money", and "Any Offshore Operations" must submit "actual sales and production profits"...

They have fleeced the nation and the people "too long". There will be "0" DEDUCTION for anything related to Moving a Business Offshore. The tax rate for Offshore Operations, should have a 2-3.5% tax surcharge... and Congress can limit the % of the Industries Production that can be performed Offshore, above that % is hit with another 10% Excess Outsourcing Surcharge. The same is true for Non Owned Production Plants, that ship in to America Imported Production Part, "they have an allowance to buy 25% within a 1% tax surcharge on such parts for production from Offshore Production Plants.

Other Countries "will follow suit"... and this will help "All Nations" Re-Industrialize to Rebuild Their Own Economies and put their people to work. This will boost "International Trade" because nations people can buy from other nations, and industry can buy from Other Nations and Neither Nations Economies Suffer as a result, because their business and industry and their people have income to do so.

American Imperialism "needs to be on its death bed"...

When Natural Resources used by companies is bought through a "National Exchange".. we then won't have private companies playing games that start Wars.. for the sake of jockeying for playing one side against another for a lower rate... because that has cost us "$Trillions in Warfare Acts and Antics".

The Time of Change is upon us.... and it is also a reality that is being faced by Nations Around The Globe.

- Joined

- Jan 20, 2014

- Messages

- 51,768

- Reaction score

- 14,180

- Gender

- Male

- Political Leaning

- Very Conservative

Democrats extended the Great Depression by over a decade.Yeah. Lowest ever corp tax rates under Rep admin. Then we went into the Great Depression. Dems had to pull the country out, just as with the Great Recession. Trump gives large corps a tax giveaway plan, leaving the avg American the crumbs from that pie of our national treasure. Then an economic calamity from the COVID pandemic is turned into a disaster by Trump and the Rep Congress, supported by the Trump cult. Good luck Biden and Dems raising back the corp tax rates to anywhere near what is was before, when they were making record-breaking after-tax profit under Obama, if Rep control the Sen or a Dem Sen or 2 vote Rep, which is way more likely than the other way around, historically.

Democrats extended the Great Depression by over a decade.

Hoover was doing a hell of a job

- Joined

- Jan 20, 2014

- Messages

- 51,768

- Reaction score

- 14,180

- Gender

- Male

- Political Leaning

- Very Conservative

Hoover was simply Roosevelt-lite.Hoover was doing a hell of a job

- Joined

- Jan 22, 2019

- Messages

- 17,149

- Reaction score

- 6,827

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

GOING FORWARD....

As American people become more aware (Democracy Respecting People), They will come to understand the dynamics as I've written and as the graph shows, that it is necessary to increase the tax rate. It won't happen in the first Year of the Biden Administration, but if people are focused and if people understand, after the Mid-Term, and Democrats can strengthen the House and Senate with Majority. Then they can move faster to increase the rates and revamp the tax code, where we can then move even faster in how the government tax resources help to rebuild America stronger than ever before.

It's evident at least in this site, that those who use the word Conservative, do not understand, and they are not up to speed to engage any expanded level of intellectual critical thinking. They still think their one liner slap stick punditry is their go to mentality. They can't get beyond the history of being groomed to void out the ability to think critically, and they can't get beyond worshiping the wealthy.

It's as MLK said...

As long as they can be deluded to think their white skin is their salvation, they will defeat themselves for the sake of seeking to cling to that delusion. We watched 72 million of them back attacks on American Democracy... and they are a detriment to themselves and don't know it, and they are a detriment to America's Growth and Development and they are a defeatist motivated group to sustain and promote inequity, because they'd rather suffer and struggle than see minorities and women in general have the uplift and parity in economics with that concepts they have been taught that no one should have economic parity with white men.

They have no concern that they damage their own daughters, and the working poor damage their own sons, because their sons and daughters will be trapped in the same inequity, they hope to thrust upon blacks, women in general and immigrants Americans.

What we will see is prospering in the ranks of the Democracy Loving sectors of Liberal minded equality respecting Americas, and the Right Wing Conservatives will bury themselves in more debt and wrap their minds in anguish.... in their cult devoted mentality to self defeatism. While lusting for an authoritarian with a vain hope that such type will give them something. (It has not happened since the inception of America, and they simply don't get it)... The Fascist Authoritarians have no regard or concern for uplifting these people, because they are more useful to them to use them as "street level contention makers" to create that drama while the wealthy push plutocracy agenda, to have more power over the people by the use of money gathering.

These same type will be glad to gain benefits from what Democrats Promote, but they can't wrap their heads around the fact that Right Wing Republicanism will strip them of it, the minute they get a position of power to do so.

The Bright Side, is the young people of Democracy Loving Liberal Mindsets will continue learning, and continue to push and change the system to be respectful of "All" American People.... as they transition into position where they have the authority to make change, they will make the changes that benefit "All" of society.

This stuff is not hard to see, grasp and understand, because the world "Always" moves forward... its not a smooth paved pathway, but nevertheless, forward is as forward as a ticking clock....

America will step forward with changes in the educational system...it simply has no choice. The young of today are far more intellectual equipped than any generation of the past. The systems of the 1940's-1960's designs and curriculum are outdated, it can't keep up with the student populations mental capabilities; therefore; the forward progressive change is inevitable. First and Second, Third and Fourth graders can now use 'digital technology' and many are more adept than some of the older people who fought against technology. They don't know about the old ways, nor do they care, because technology moves forward and they have the determination to keep up....

Drive down any street and look at kids in any car, "their heads are focused on their digital units".... their minds are training to look at potential and pursue it.

They know early in their lives how to deal with multiple variable elements and they understand the multi-dimensional inter-relations of those variables. they don't just look for the bottom line, they pursue to understand what is the underlying elements that support that line. which means they look at the history, so when they make changes they do so, "to improve and to advance"

As American people become more aware (Democracy Respecting People), They will come to understand the dynamics as I've written and as the graph shows, that it is necessary to increase the tax rate. It won't happen in the first Year of the Biden Administration, but if people are focused and if people understand, after the Mid-Term, and Democrats can strengthen the House and Senate with Majority. Then they can move faster to increase the rates and revamp the tax code, where we can then move even faster in how the government tax resources help to rebuild America stronger than ever before.

It's evident at least in this site, that those who use the word Conservative, do not understand, and they are not up to speed to engage any expanded level of intellectual critical thinking. They still think their one liner slap stick punditry is their go to mentality. They can't get beyond the history of being groomed to void out the ability to think critically, and they can't get beyond worshiping the wealthy.

It's as MLK said...

As long as they can be deluded to think their white skin is their salvation, they will defeat themselves for the sake of seeking to cling to that delusion. We watched 72 million of them back attacks on American Democracy... and they are a detriment to themselves and don't know it, and they are a detriment to America's Growth and Development and they are a defeatist motivated group to sustain and promote inequity, because they'd rather suffer and struggle than see minorities and women in general have the uplift and parity in economics with that concepts they have been taught that no one should have economic parity with white men.

They have no concern that they damage their own daughters, and the working poor damage their own sons, because their sons and daughters will be trapped in the same inequity, they hope to thrust upon blacks, women in general and immigrants Americans.

What we will see is prospering in the ranks of the Democracy Loving sectors of Liberal minded equality respecting Americas, and the Right Wing Conservatives will bury themselves in more debt and wrap their minds in anguish.... in their cult devoted mentality to self defeatism. While lusting for an authoritarian with a vain hope that such type will give them something. (It has not happened since the inception of America, and they simply don't get it)... The Fascist Authoritarians have no regard or concern for uplifting these people, because they are more useful to them to use them as "street level contention makers" to create that drama while the wealthy push plutocracy agenda, to have more power over the people by the use of money gathering.

These same type will be glad to gain benefits from what Democrats Promote, but they can't wrap their heads around the fact that Right Wing Republicanism will strip them of it, the minute they get a position of power to do so.

The Bright Side, is the young people of Democracy Loving Liberal Mindsets will continue learning, and continue to push and change the system to be respectful of "All" American People.... as they transition into position where they have the authority to make change, they will make the changes that benefit "All" of society.

This stuff is not hard to see, grasp and understand, because the world "Always" moves forward... its not a smooth paved pathway, but nevertheless, forward is as forward as a ticking clock....

America will step forward with changes in the educational system...it simply has no choice. The young of today are far more intellectual equipped than any generation of the past. The systems of the 1940's-1960's designs and curriculum are outdated, it can't keep up with the student populations mental capabilities; therefore; the forward progressive change is inevitable. First and Second, Third and Fourth graders can now use 'digital technology' and many are more adept than some of the older people who fought against technology. They don't know about the old ways, nor do they care, because technology moves forward and they have the determination to keep up....

Drive down any street and look at kids in any car, "their heads are focused on their digital units".... their minds are training to look at potential and pursue it.

They know early in their lives how to deal with multiple variable elements and they understand the multi-dimensional inter-relations of those variables. they don't just look for the bottom line, they pursue to understand what is the underlying elements that support that line. which means they look at the history, so when they make changes they do so, "to improve and to advance"

- Joined

- Jun 18, 2016

- Messages

- 22,220

- Reaction score

- 7,948

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

The Graphs shows that the low tax rate, led right into the Great Depression..... and the Chart also shows, that under Ronald Reagan, things in the U.S. has seen the nation struggling with debt, crazy interest rates and Outsourcing.

American people don't understand "Taxes"... and many blind themselves to what "taxes invest in".... public and private, and how many business rely on grants, contracts and other program benefits that are funded by tax dollars.

The chart shows that between 1952 and 1963 - America was prospering with stability and progressive steps. Only After Civil Rights Act Passed, did the Tax Rate Start to drop, because so many people, did not want to see any tax supported programs to help Minorities and Women, the easiest way to slow down the progress of minorities and women, is to cut into the Federal Tax Resources by Reducing the Taxes Collected.

What we see as a result is "$27,400,000,000,000 DEBT and $155,060,000,000,000 UNFUNDED OBLIGATION - this won't go down without Taxes Going Up... and when Taxes goes up and Tax money is invested to take care of unfunded obligation, doing so will create jobs, and industry to address those unfunded obligation and that will increase employment, as well as re-start business growth. To do so will also, slow the growth of the Debt level, and once in place will began to reduce the Debt... That means American will earn more, be able to save more and in doing so will build a more stable economy for All America.

We have massive Rebuilding that is NECESSARY, and EVERY City in The Nation has high volumes of "Industrial and Business Blight" that must be torn down, removed and the site cleaned up, to 'Re-claim" that land-space. Government Investment has always been the platform that has spurred Business Growth, most people have no idea that the company they work for is more than likely in constant pursuit of government grants, government contracts and other government provided provisions.

With 320,000,000 people, there is no going backwards, because life progresses forward, and in this age of information and technology, it is going to take massive government investments to meet the 21st Century. Homes that were built in the 1930's through the 1970's will require mass rebuilding of some and massive modification of others. Even homes built in the 1990's is now 30 yrs Old.... and many need maintenance and some need modification and some of the lower quality ones need to be torn down and rebuilt. This is massive for jobs, because the attributes and contents of those home products must be manufactured.

This same paradigm holds true for Business of Many Many Types...

We have every form of Infrastructure that must be rebuilt, upgrades and some completely replaced with 21st Century Modeling. Many cities and towns have water systems and sewer system that are more than 80- 90 -100 yrs old - Electrical Grid has to be improved, and in many areas vaults, channels and conduit must be laid to bury electrical cables. 'all this is massive volume of jobs" and some of those jobs won't stop once this is built, because everything built has to be maintained.

Solar and Battery Technology is not going to vanish, it will improve, there is no longer the need for a single source of energy via electric wires on wooden poles, that get knocked down in weather conditions.

Americans need to learn what "Taxes Actually Achieve"... and stop bitching about paying taxes. countries with bad tax policy of low taxes are what we call "3rd World, and 4th World - because without the taxes and the government investing those taxes in the nation, they don't get quality roads, they don't get quality infrastructure of any significance, (except in the wealthy areas), and business does not grow to pay a living wage, which means the taxes they do collect is lower in amount that makes it difficult for them to dig their way out of the hole and get on level ground, so they can built their systems across the landscape.

Ignorance, taking things for granted and greed is always within "the type people" who cry and whine about paying taxes, and they continue to be those who cheat society and nation. The well to do and wealthy, whine the most, because they can no longer just direct working peoples tax money to build up their communities only; and they resent their tax money helping build up all communities, but they had no problem leeching off the average tax payer to build their areas to high standards.

Socialized business cost and privatized profit.

- Joined

- Sep 24, 2011

- Messages

- 38,332

- Reaction score

- 44,403

- Location

- Atlanta

- Gender

- Male

- Political Leaning

- Independent

The saddest part is that the screwed up federal “budgeting” process results in a congressional re-election rate of over 90% - thus is very unlikely to be changed.

It is easy to argue that fiscal policy these days, both spending and taxation reasoning, is all about political protectionism. You could say the ultimate example of trading treasury promises for votes. Democrats buy the voter one way, Republicans do so in other ways.

But what suffers is economic reasoning, perhaps a close second being any sense of fiscal responsibility.

- Joined

- Jan 22, 2019

- Messages

- 17,149

- Reaction score

- 6,827

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

I can write freely and there is no concerns about any right wing conservative spin, and certainly none for their deflection and diversions gaming, because generally as we've seen... anything over three lines of text, they find great challenge. Any elements that deals with multiple-variables they get confounded, and when multi-dimensions are inter-related they get anguished, because they have groomed themselves to resist change, and deny the inter-connections.

They don't understand a basic concept that... in All "Simplicity"... it is built upon and with great complexity of multi variant elements and inter-relations with multi-dimensional factors. They are prone without question to "take things for granted"... and they will "confound themselves with attempts to stagnate and regress something" until they become entangled in their own self created discombobulations.

I've watched this mentality and trend of "attack what they don't understand" in this site since joining it, any time subject matter goes into details about "anything"... they first attack, they deny, they sling out their one liner attempts to put down, and then when all fails they go into complaining about grammar, and when that fails they attack the writer, when that fails... they exit the thread.

One can go back over countless threads and this cycle repeats itself.

So, for those who want to talk about "Taxes" and do so with broad reaching understanding, join me in the discussion and join in the proactive discussion of understanding how it advances America and Uplifts American People... to pay into the system of taxation, and understand that the benefits are far greater than many consider to consider. Those who can't do that... may well benefit themselves to choose "silence".

Those willing to learn... "will learn"... and in their learning, they will contribute positively based on what they have learned, what they have researched to understand and they will have confidence in their ability to be a contributor to the subject materials to expand the understandings of the positive elements of taxation and how it advances a nation and its people, while it improves overall society for "all".

People who invest to understand The Preamble, its origin, as the origin, scope, purpose and function... will come to know the Constitution's origin, purpose and function is based within and upon The Preamble. (The origin of The Preamble, came from the values and principles laid out in The Declaration of Independence).

They don't understand a basic concept that... in All "Simplicity"... it is built upon and with great complexity of multi variant elements and inter-relations with multi-dimensional factors. They are prone without question to "take things for granted"... and they will "confound themselves with attempts to stagnate and regress something" until they become entangled in their own self created discombobulations.

I've watched this mentality and trend of "attack what they don't understand" in this site since joining it, any time subject matter goes into details about "anything"... they first attack, they deny, they sling out their one liner attempts to put down, and then when all fails they go into complaining about grammar, and when that fails they attack the writer, when that fails... they exit the thread.

One can go back over countless threads and this cycle repeats itself.

So, for those who want to talk about "Taxes" and do so with broad reaching understanding, join me in the discussion and join in the proactive discussion of understanding how it advances America and Uplifts American People... to pay into the system of taxation, and understand that the benefits are far greater than many consider to consider. Those who can't do that... may well benefit themselves to choose "silence".

Those willing to learn... "will learn"... and in their learning, they will contribute positively based on what they have learned, what they have researched to understand and they will have confidence in their ability to be a contributor to the subject materials to expand the understandings of the positive elements of taxation and how it advances a nation and its people, while it improves overall society for "all".

People who invest to understand The Preamble, its origin, as the origin, scope, purpose and function... will come to know the Constitution's origin, purpose and function is based within and upon The Preamble. (The origin of The Preamble, came from the values and principles laid out in The Declaration of Independence).

(("The Preamble is not a source of power for any department of the Federal Government,1

The Supreme Court

has often referred to it "as evidence" of the origin, scope, and purpose of "The Constitution."))

The Supreme Court

has often referred to it "as evidence" of the origin, scope, and purpose of "The Constitution."))

Last edited:

- Joined

- Jun 16, 2019

- Messages

- 39,610

- Reaction score

- 38,157

- Location

- Tucson

- Gender

- Male

- Political Leaning

- Other

Democrats extended the Great Depression by over a decade.

This is raw bull**** and you should feel bad for lying.

- Joined

- Nov 11, 2011

- Messages

- 9,361

- Reaction score

- 3,238

- Gender

- Undisclosed

- Political Leaning

- Libertarian

I'm not sure you know how graphs work. It looks like the last time they were lower than today was the period from 1988-2012.

The last time they were lower than today was in the 1920s ...

- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

I'm not sure you know how graphs work. It looks like the last time they were lower than today was the period from 1988-2012.

Indeed they do.

Why the Replicants wanted to increase the rate for that period is likely due to expansion of national expenditures and they wanted a zero-debt national-budget? Bush assumed the presidency in 1988, and if he wanted to balance-an-expanded-budget by increasing the tax-rate it is then that he should have done it. And not later when he wants to get reelected.

Politics is a curious animal ...

Last edited:

- Joined

- May 17, 2019

- Messages

- 20,649

- Reaction score

- 2,465

- Location

- Idaho

- Gender

- Male

- Political Leaning

- Other

Yeah. Lowest ever corp tax rates under Rep admin. Then we went into the Great Depression. Dems had to pull the country out, just as with the Great Recession. Trump gives large corps a tax giveaway plan, leaving the avg American the crumbs from that pie of our national treasure. Then an economic calamity from the COVID pandemic is turned into a disaster by Trump and the Rep Congress, supported by the Trump cult. Good luck Biden and Dems raising back the corp tax rates to anywhere near what is was before, when they were making record-breaking after-tax profit under Obama, if Rep control the Sen or a Dem Sen or 2 vote Rep, which is way more likely than the other way around, historically.

Lowest ever corp tax rates under Rep admin

Isn't a corporate tax more in line with Democrat socialist Europe a good thing?(LOL)

- Joined

- May 17, 2019

- Messages

- 20,649

- Reaction score

- 2,465

- Location

- Idaho

- Gender

- Male

- Political Leaning

- Other

The last time they were lower than today was in the 1920s ...

Why do ya forget to add more Americans don't even pay a Fed tax as well?

- Joined

- May 17, 2019

- Messages

- 20,649

- Reaction score

- 2,465

- Location

- Idaho

- Gender

- Male

- Political Leaning

- Other

Even at such high tax rates wealthy people still existed and managed to find the motivation to work even in the 50's.

It shows just how silly the Republican mantra that high tax will destroy the economy really is.

Even at such high tax rates wealthy people still existed and managed to find the motivation to work even in the 50's.

But actual tax revenue generated might be a different story?

- Joined

- May 17, 2019

- Messages

- 20,649

- Reaction score

- 2,465

- Location

- Idaho

- Gender

- Male

- Political Leaning

- Other