It’s a mathematical fact that cutting taxes reduces revenue. There is no arguing that. We also have a spending problem, but republicans exacerbate the debt by orders of magnitude more than democrats when they slash revenues while also increasing spending. They’ve been doing it for 40 years and it’s resulted in 23 trillion of debt, and the largest wealth disparity since the 1920’s.

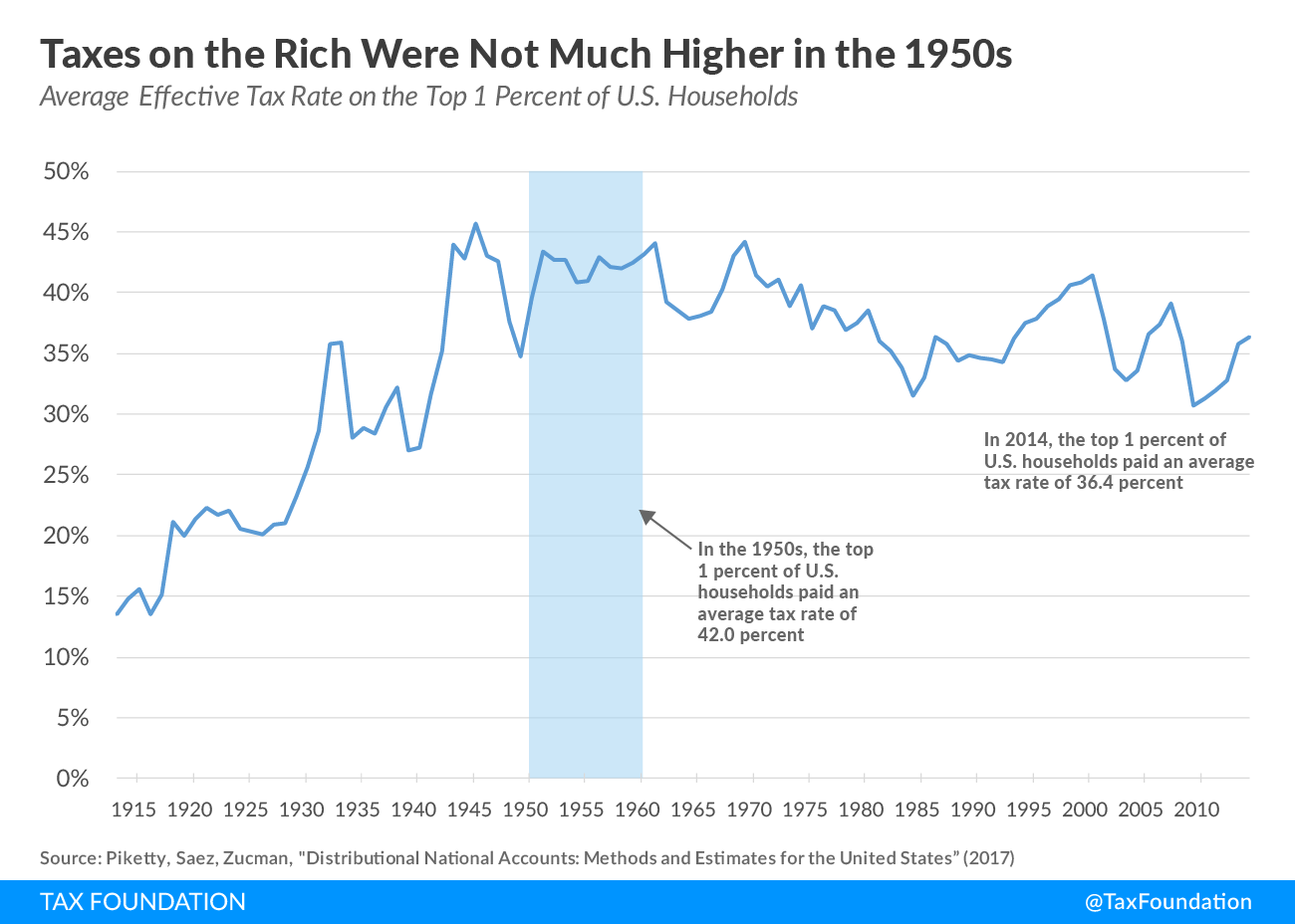

We've not seen a Republican Administration that has not increased the National Debt in 50+ yrs... and then they want to cut taxes. As the Chart in earlier post shows, when Corporate Taxes are Higher "America Prospers", "Business and Industry" is made more stable and growth is done by solid steps; this translates into the lives of the working class is improved in income and living standards upkeep of our overall categories of Infrastructure.

When Republican talk budget, its only because "they only want what they want" and they pack their wants into any bill and in doing so, try to block out what other items that may be within the bills. This "Autocratic" - Attack Something Mentality - Damages society on every level.

We are not going to go back to Jim Crow Systems where tax revenue was spent only of white well to do and white wealthy society. Our tax revenues is to be spent to benefit "All" of American society... without the bias of race and

high income monetary status being a controlling factor in how its spent.

Thank goodness we have a young generation who actually "research and read" and they are exposing the biases in every category from Religion Teaching Ideology of mental manipulations, to Society Economics, on Federal, State, County and City levels. They are exposing the biases in business and industry as it relates to race and gender.

General society is more informed and knowledgeable than any previous time in World and American History.

We watched the madness of Trump take over the Republican System and

go to extremes trying to sustain and reconstitute white nationalism, and the majority of Americans "Reject" it in every aspect. The world

does not go backwards, neither will American society. Working Poor and Poor Whites are finally realizing in many sectors of society, that the old system of Jim Crow Segregationist Ideology, was "damaging to them in ways they never gave attention unto"... it segregated working class and poor whites, to a fixed frame of economic deficiency, and ultimately educational deficiency, all impacting and bringing down the pathways to middle class economic standards, and making it difficult to meet the basis standards of living, let along unable to elevate to middle class higher standards of living.

They are fast learning, that "everything" that was designed to "disenfranchise blacks, and other minorities" was also with design to minimize any progress of working poor and poor whites.

Nothing can stop the advances of "education" where a society become more informed and knowledgeable; there will be a return to educational systems being funded as they were before Ronald Reagan damaged Community Colleges, and State Universities. The attempt of Reagan to slow down the progress of poor whites and minorities, by making educational higher learning accessibility more difficult to get...

has not worked as he planned. In great part, thanks to the 1990's advances in wide spread Internet.

Now, people are becoming more financially literate... and they are driven to learn more about

Civics of American Democracy.... and The Values of The Preamble.... and its meaning for "All" American People.