- Joined

- Feb 14, 2019

- Messages

- 10,882

- Reaction score

- 5,085

- Gender

- Female

- Political Leaning

- Undisclosed

Details please.They'd do it by ruining SS, Medicare, and the social safety nets. They want to do that quite badly.

Details please.They'd do it by ruining SS, Medicare, and the social safety nets. They want to do that quite badly.

Look up Gingrich, Paul Ryan, and "privatization" schemes. Or don't.Details please.

LOL. And we all know the current “White House” offers facts. Gingrich? Paul Ryan? How on earth are THEY going to ruin Medicaid, and Social Security?Look up Gingrich, Paul Ryan, and "privatization" schemes. Or don't.

Here's a recent article from the White House.

FACT SHEET: Extreme House Republican Plan Would Cut Medicare and Social Security While Slashing Taxes for Big Corporations and the Wealthy | The White House

New state-by-state analysis shows how the Republican Study Committee budget would also worsen wait times for seniors who call for assistance with Medicarewww.whitehouse.gov

Have you ever tried Google?LOL. And we all know the current “White House” offers facts. Gingrich? Paul Ryan? How on earth are THEY going to ruin Medicaid, and Social Security?

Absolutely. And you?Have you ever tried Google?

Sure. It's a pretty good search engine. I think that I preferred Lycos before that.Absolutely. And you?

I prefer duck duck go. But to each his own. Enjoy…lolSure. It's a pretty good search engine. I think that I preferred Lycos before that.

I haven't tried that one. I did try Bing, but it didn't really give me a good reason to switch.I prefer duck duck go. But to each his own. Enjoy…lol

Trying various sources is always a good thing. Not wise to rely on any one search engineI haven't tried that one. I did try Bing, but it didn't really give me a good reason to switch.

People say that when they can't refute the correlation.Correlation does not equal causation.

I did not.Didn't you yourself post here that more currency chasing the same, or fewer, amount of goods and services causes inflation?

Notice that you never answered any of my questions. To reason through the problem. You aren't arguing in good faithSorry, but you can't convince me that up is down, that right is left, nor that 2 + 2 = 5.

Price gouging? Bought into that did you?

I never claimed it was across the industry, I specifically pointed out Kroger, who was forced to admit in court to price gouging as part of an FTC investigation into Kroger's merger with another chain.Conventional grocery stores have a profit margin of about 2.2%

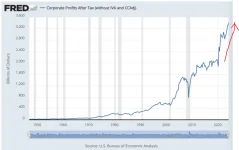

That was a chart from Statista, which get's it's data from the Bureau of Economic Analysis, but here's another chart with the same dataNice uncited chart you got there. What's the source of the data?

Just a fact.This being the preordained conclusion which you were after in the first place.

Look up Gingrich, Paul Ryan, and "privatization" schemes. Or don't.

I disagree.I'll do you one better: I'll run the numbers

It turns out, even the worst-performing post-WWII cohort would have significantly outperformed Social (In)Security, had we allowed them to invest the same monies in simple, easy, basic, index funds.

And it would allow the vast majority of Americans of middle and low income to retire with financial independence.

Mind you, it's too late now - we can't afford the transition. But it would have been a much better system, had we been wise enough to switch over years ago.

With you. Have a great night.with what? The math is the math.

The U.S. national debt is rising by $1 trillion about every 100 days

https://www.cnbc.com/2024/03/01/the...ising-by-1-trillion-about-every-100-days.html

| Date | Total Public Debt Outstanding | Increase from 100 days ago |

|---|---|---|

| 8/22/2022 | $30,740,292,605,227.85 | $356,993,336,348.32 |

| 11/30/2022 | $31,413,322,465,316.30 | $673,029,860,088.45 |

| 3/10/2023 | $31,460,029,554,847.61 | $46,707,089,531.31 |

| 6/20/2023 | $32,105,203,198,332.68 | $645,173,643,485.07 |

| 9/26/2023 | $33,146,408,994,532.36 | $1,041,205,796,199.68 |

| 1/4/2024 | $34,006,270,930,685.56 | $859,861,936,153.20 |

| 4/12/2024 | $34,553,219,625,645.51 | $546,948,694,959.95 |

| 7/22/2024 | $34,950,138,997,139.35 | $396,919,371,493.84 |

| 10/30/2024 | $35,847,012,590,067.17 | $896,873,592,927.82 |

Rule no.1 in sensationalizing is to latch on to outliers and large numbers while ignoring averages, medians, and normal distributions.The data from the Treasury Department says it is less than that...

Average increase every one hundred days: $748,361,878,346.90 (since June 20th 2023)

Date Total Public Debt Outstanding Increase from 100 days ago 8/22/2022 $30,740,292,605,227.85 $356,993,336,348.32 11/30/2022 $31,413,322,465,316.30 $673,029,860,088.45 3/10/2023 $31,460,029,554,847.61 $46,707,089,531.31 6/20/2023 $32,105,203,198,332.68 $645,173,643,485.07 9/26/2023 $33,146,408,994,532.36 $1,041,205,796,199.68 1/4/2024 $34,006,270,930,685.56 $859,861,936,153.20 4/12/2024 $34,553,219,625,645.51 $546,948,694,959.95 7/22/2024 $34,950,138,997,139.35 $396,919,371,493.84 10/30/2024 $35,847,012,590,067.17 $896,873,592,927.82

Average increase every one hundred days: $607,079,257,909.74 (since May 14th 2022)

Of course, but you can do the wrong arithmetic if you don't understand how the variables interact. Math is knowing what arithmetic to do.

Of course, but you can do the wrong arithmetic if you don't understand how the variables interact. Math is knowing what arithmetic to do.

Govt fiscal consolidations - austerity - usually reduce GDP growth rather than debt to GDP ratios even if they reduce nominal debt. Because govt spending is a component of GDP, not something subtracted from it (like household spending is subtracted from household income).

It's the G in GDP = C + I + G+ (X-M).

All money is now circulating IOUs - and really always has been. Money that isn't also debt (someone else's liability) soon becomes worthless. If someone has to be in debt - and someone DOES have to be in debt in order to increase the money supply with population and economic growth - who should it be? Households, firms, or an immortal entity that issues its own currency and can roll over its debt forever?

If we want growth in market economies - that miraculous thing - we must either have some routine form of debt write-off or accept that the big scary number (the national debt!!) will increase forever. Maybe we should just call it something else:

If the govt net spends less into the economy than it taxes out, there are necessarily losers who must either cut consumption (C) or borrow from the banks in order to maintain consumption. And it's always private debt that causes debt crises. Private debt is already ~220% of GDP, i.e. near 2008 levels; far higher than govt debt, and far more likely to cause a(nother) debt crisis.

There's no effort and harm-free way out of a hole like this. We've locked ourselves into an unsustainable path that is going to require cuts we don't want to make, and tax increases we don't want to pass.

You raise a good point, however, that we should seek to do so in ways that harm the economy as little as necessary (though I might prioritize some protection of our more vulnerable seniors in there as well). When we look at how to do that, however, what we find is:

Tax-based deficit reductions tend to have a more negative impact on the economy and less successful track record than spending-based ones. The difference is primarily due to the response of private investment, as business confidence falls to a greater degree and for a much longer duration after tax-based plans.Overall, successful fiscal adjustments primarily cut spending and modestly increase taxes. A rough guideline for an expenditure-based plan is for at least 60 percent of its savings to come from spending cuts and 40 percent or less from revenues....

Looking at 16 OECD countries over a 30-year period, Alberto Alesina and his coauthors found that, on average, spending cuts were associated with mild recessions and in some cases no downturns at all, while almost all fiscal reforms based on tax increases were followed by “prolonged and deep recessions.”In a study of 17 OECD countries over a 30-year period, Norman Gemmell and other academics showed that reducing deficits by raising distortionary taxes, such as income taxes, consistently reduced economic growth, while raising less distortionary taxes, such as consumption taxes, was more growth-enhancing.

I believe Alesina has been largely debunked, but it's somewhat beside the point that austerity generally results in slower GDP growth, rather than smaller debt to GDP ratios (for reasons I pointed out).There's no effort and harm-free way out of a hole like this. We've locked ourselves into an unsustainable path that is going to require cuts we don't want to make, and tax increases we don't want to pass.

You raise a good point, however, that we should seek to do so in ways that harm the economy as little as necessary (though I might prioritize some protection of our more vulnerable seniors in there as well). When we look at how to do that, however, what we find is:

Tax-based deficit reductions tend to have a more negative impact on the economy and less successful track record than spending-based ones. The difference is primarily due to the response of private investment, as business confidence falls to a greater degree and for a much longer duration after tax-based plans.Overall, successful fiscal adjustments primarily cut spending and modestly increase taxes. A rough guideline for an expenditure-based plan is for at least 60 percent of its savings to come from spending cuts and 40 percent or less from revenues....

Looking at 16 OECD countries over a 30-year period, Alberto Alesina and his coauthors found that, on average, spending cuts were associated with mild recessions and in some cases no downturns at all, while almost all fiscal reforms based on tax increases were followed by “prolonged and deep recessions.”In a study of 17 OECD countries over a 30-year period, Norman Gemmell and other academics showed that reducing deficits by raising distortionary taxes, such as income taxes, consistently reduced economic growth, while raising less distortionary taxes, such as consumption taxes, was more growth-enhancing.

Now, the MMT answer (if that is the perspective you are coming from) is that we don't need to reduce the deficit, because we can just print to cover any gap.

The "Let's Just Default On The Debt" is a new one one me; I struggle to imagine anything that would do more immediate harm.

Unfortunately, the "let's just print" creates inflation and, eventually, hyper-inflation (especially when and if we lose global reserve currency status). Argentina tried this, and, the result was a twelve month inflation rate of 276% back in February. To contrast, the American people just went through an inflation experience that peaked at 9.1%, and it may give us back a Trump Presidency. The MMT answer, as I understand it in that case, is to raise taxes to sop up all that money.

The political likelihood of any set of lawmakers surviving (not by reelection. I mean by avoiding being killed by mobs) massive and punishing tax rates on the American populace in the middle of a hyperinflationary event they created, however, is roughly about nil, and, they know that.

No, it's necessarily true in the short, medium or long term. It's an accounting identity, and readily apparent in national sectoral balances:

In the short term that is plausible. We know we are currently headed for a crises in the early-mid 2030s, but, there's a lot of space for private debt to create a problem in the middle.

That's right - largely benign as long as you're not causing runaway inflation - whereas austerity tends to be self-defeating. And what we call things very much matters to which policies get implemented.Respectfully, it doesn't matter if we call it Uncle Sam's Credit Card or Boopster The Rainbow Unicorn. The fiscal impact is the same.

Do you ever get tired of this canard?I'm unaware of anyone who says "Let's Just Default On The Debt".

There are hard limits in the real economy (of production, consumption and employment), beyond which additional net spending risks causing runaway inflation.

whereas austerity tends to be self-defeating.

This is not sustainable.