- Joined

- Dec 20, 2009

- Messages

- 75,703

- Reaction score

- 39,986

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

This is not sustainable.

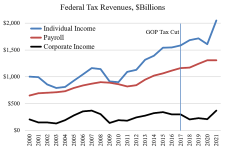

For those who think "Just Raise Taxes" is the solution:

We have had tax rates a lot higher - and didn't collect anywhere close to the % of GDP we need.

The debt load of the U.S. is growing at a quicker clip[url] in recent months, increasing about $1 trillion nearly every 100 days.... U.S. debt, which is the amount of money the federal government borrows to cover operating expenses, now stands at nearly $34.4 billion, as of Wednesday. Bank of America investment strategist Michael Hartnett believes the 100-day pattern will remain intact with the move from $34 trillion to $35 trillion....

Moody’s Investors Service lowered its ratings outlook on the U.S. government to negative from stable in November due to the rising risks of the country’s fiscal strength. “In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,” the agency said. “Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

For those who think "Just Raise Taxes" is the solution:

We have had tax rates a lot higher - and didn't collect anywhere close to the % of GDP we need.