No such thing as free lunch goes without saying. Income should guaranteed to low wage earners as a top-up. You play your part instead of cheating on food stamps.

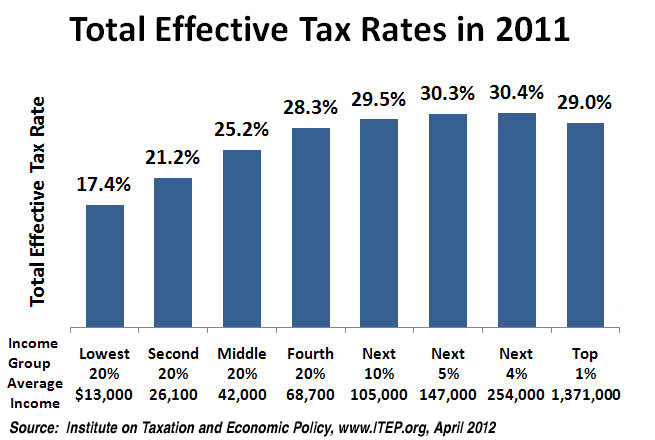

Depends upon what's on the table. It IS a free-lunch, when tax-rates are not progressive, and when flat-rates unfairly tax higher-incomes at lower than progressive rates. (At present the maximum tax is 30% on all income above $105K per year, which is non-sensical.)

Meanwhile the truly-poor - that 15% of our fellow citizens (close to 50 million men, women and children) below the Poverty Threshold - do not even have the protection of a livable minimum wage (if they work) or allocation if they do not.

The argument for a progressive vs a flat-tax rate is well put in this article from Investopedia:

Is a progressive tax more fair than a flat tax?

Excerpt:

A Progressive taxation versus flat taxation inspires ongoing debate, and both have proponents and critics. In the United States, the historical favorite is the progressive tax.

Progressive tax systems have tiered tax rates that charge higher income individuals higher percentages of their income and offer the lowest rates to those with the lowest incomes. Flat tax plans generally assign one tax rate to all taxpayers. No one pays more or less than anyone else under a flat tax system. Both of these systems may be considered "fair" in the sense that they are consistent and apply a rational approach to taxation. They differ, however, in their treatment of wealth, and each system may be called "unfair" according to who benefits or is treated differently.

Supporters of the progressive system claim that higher salaries enable affluent people to pay higher taxes and that this is the fairest system because it lessens the tax burden of the poor. Since the poor have the smallest disposable incomes and spend a higher proportion of their money on basic survival needs, such as housing, this system allows them to keep more of their money. Affluent taxpayers are better able to provide for their physical needs and therefore are charged more. A flat tax would ignore the differences between rich and poor taxpayers. Some argue that flat taxes are unfair for this reason. Progressive taxes, however, treat the rich and poor differently, which is also unfair.

Flat tax has one tax rate. Everyone carries the same responsibility, and no one is unequally burdened, rich or poor. Taxes do not discourage high earners from earning more, and the low tax rate encourages the poor to strive to earn more. This reduces the potential deadweight loss of taxation and encourages good work ethics. This system does, however, risk taking too much money away from the poorest citizens.

Both tax policies have significant advantages and disadvantages that may prevent them from perfect fairness.

Unfortunately, this argument does not take into consideration what is called "collegiality" - meaning the shared responsibility of a collective people. Nobody lives on an island, and on which island, alone, have you seen any millionaire?

We have all a responsibility to the collective society in which we live, and that responsibility manifest itself mostly in taxation. The revenues of which (supposedly) go towards realizing certain objectives as decided by those who represent us to the three elements of national governance (the Executive, Legislative and Judicial).

One would, think of late, that the entire governance mechanism has broke down. And given the political stagnation caused by continued Replicant negation the country goes nowhere in terms of bettering the lives of its citizens. When the Right rises to manifest its will to maintain at any price the status-quo without change, there must be a reason.

And that reason is quite simple. The tax mechanism installed by a besotted Reagan administration is adept at generating enormous wealth for a privileged few. Who have decided, like Plutocrats, that "nothing will change". Everything is just fine for as long as the money-pump services their purposes of self-enrichment.

Is THAT the kind of economic unfairness in which you want your family to live? Not me.

And if you cannot see how the rage of people is being expressed in the exaggerated mutual killing, then you are blinding yourself to the facts. What person, who obtains a fair wage and a life-style worth living would want massacre their fellow citizens.

It's a world turned upside-down, and we cannot blame just the drugs and alcohol - which are the propulsion but not the cause of the disastrous acts committed upon their fellow citizens ...