...the utter absurdity of this comment is just breathtaking.

First, you haven't (and you will not) "refute" sh!t, my friend. You can't "refute" anything simply by saying "I refute!". This is not Congress and you do not have a "veto". That's not how INTELLIGENT people engage in debate. You refute by presenting an opposing arguments, facts, stats, research,, data, etc. etc. No one gives a rat's butt's worth of credibility to your baseless, fact-free, FEELINGS and utterly ignorant OPINIONS,

@NatMorton.

Next...."so what"?? What kind of dumb-arsed argument is that? So what if tax cuts for the wealthy are destructive to the economy and the prosperity of the entire middle class in that economy? So what????

That's just MORONICALLY stupid of you to admit. But, at the same time, it's also a rare moment of unvarnished HONESTY from pseudo-intellectuals who pretend to be "fiscal conservatives".

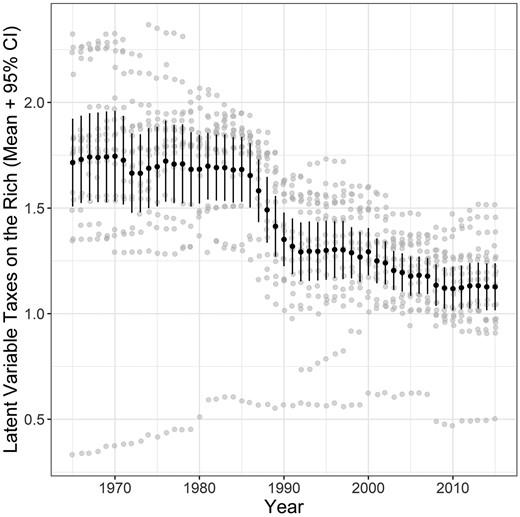

The entire Supply-Side Economic Experiment is a well-documented, thoroughly proven FAILURE. There are, at this point, virtually no credible economists still arguing on behalf of it's "trickle-down" theories. That debate, to whatever degree it ever existed as an honest, intellectual question......is over.

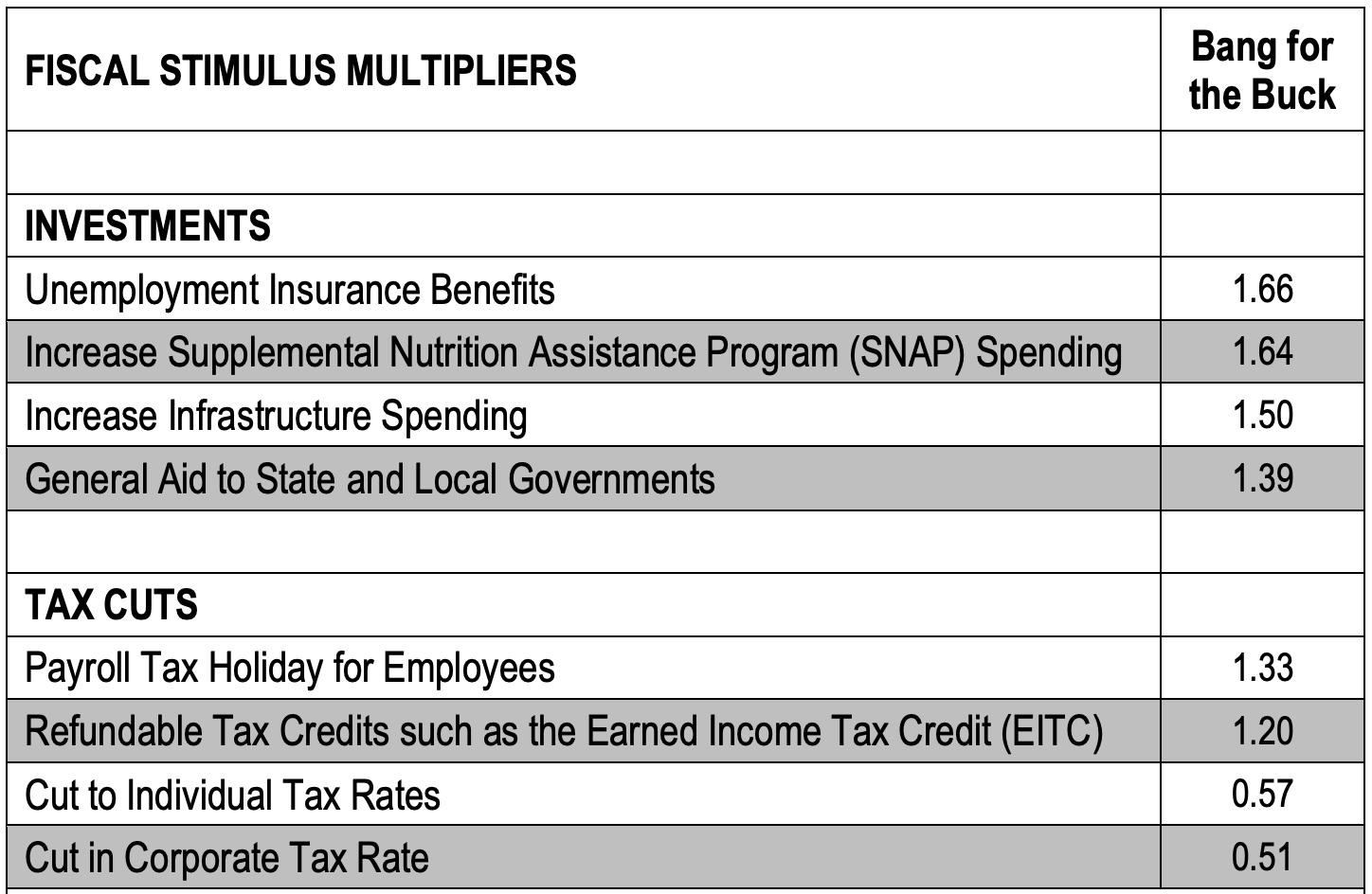

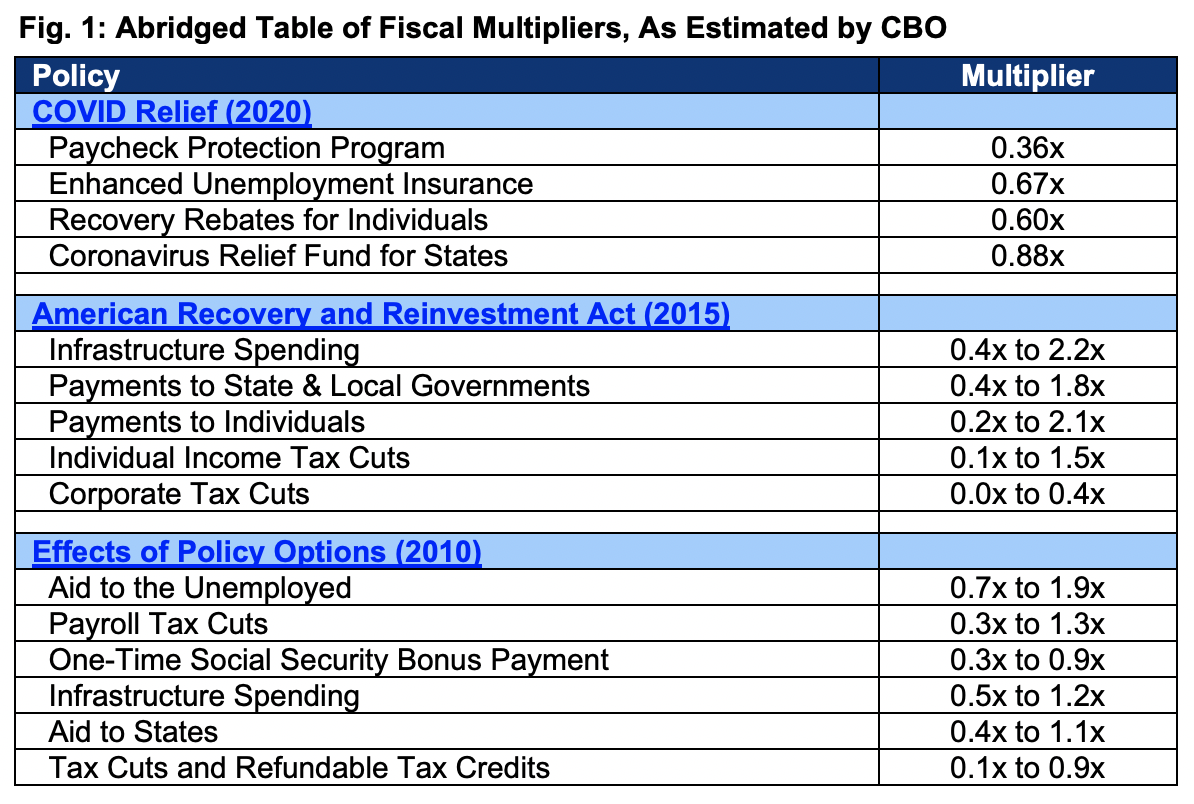

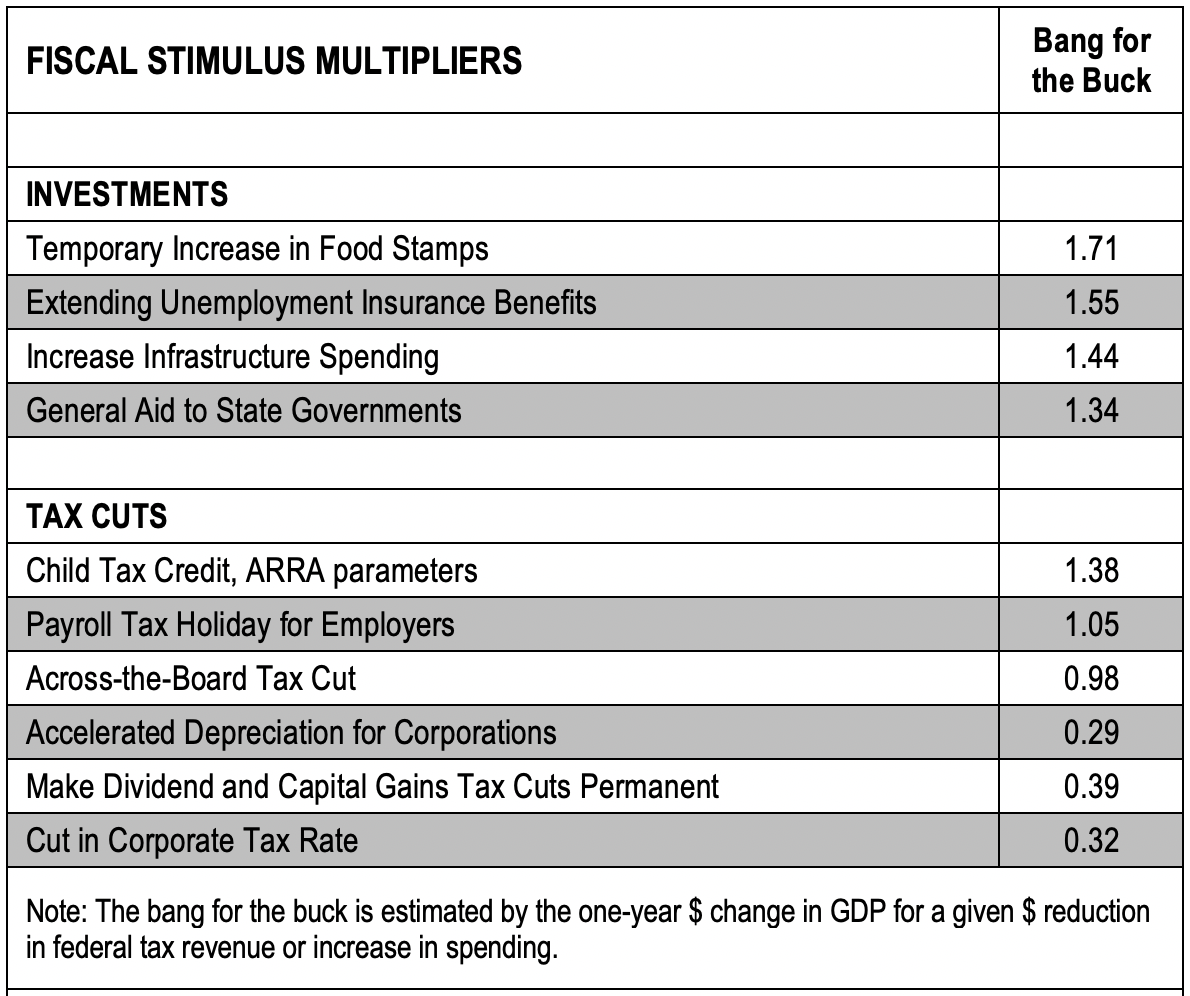

Study after Study after Study after Study.....has PROVEN, beyond any doubt, that tax cuts (especially the high-income and corporate variety) are LITERALLY the WORST FORM of economic stimulus there is. That is a FACT:

----------------------

------------

So again, the debate about Supply-Side/Reaganomics and Tax Cuts as economic stimulus is OVER.

It was always based upon a lie. Tax Cuts do NOT "pay for themselves" and are the WORST form fiscal stimulus there is. In FACT, most forms of tax cuts are COUNTERPRODUCTIVE to a recovering economy.

Words of ignorance that ONLY come from folk who do not value American-styled democracy (much less "individual liberty").

IGNORANT COMMENT.

Period.