The sum and total of the Republican platform these days is MORE TAX CUTS FOR THE RICH! After all, they have to pay back those people who contribute to their campaign coffers. But here’s what those tax cuts for the wealthy elite actually do :

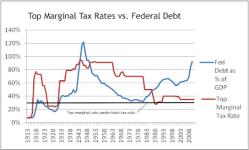

-Spike the annual deficit and the long-term debt (that’s shat happened after every one of those tax cuts)

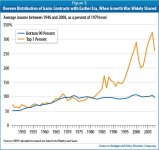

-Increase the economic inequality between the wealthy elite and the rest of us

You don’t have to believe me:

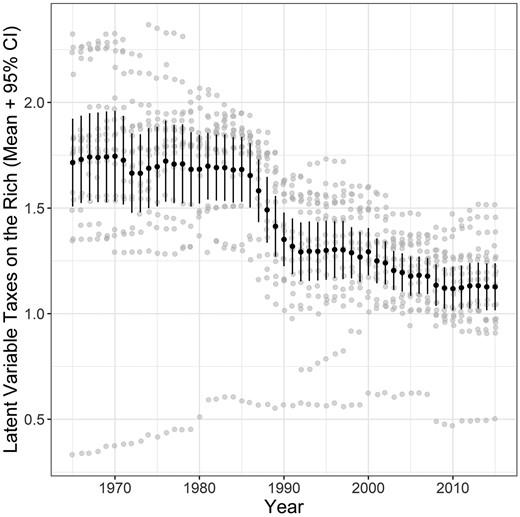

“The results suggest that

tax reforms do not lead to higher economic growth. The effect size of major tax cuts for the rich on real GDP per capita is close to zero and statistically insignificant. Major tax cuts for the rich do not lead to higher growth in either the short or medium run.”

Abstract . The last 50 years has seen a dramatic decline in taxes on the rich across the advanced democracies. There is still fervent debate in both political a

academic.oup.com

One of the reasons that the right wing economic propagandists give for the tax cuts for the rich is that it “frees up in estment money”. Actually, there was no need to do this. There has been plenty of investment money available since at least the mid-90s (except, of course, during the Great Recession), and what it actually does is to result in TOO MUCH investment money so that it goes looking for risky investments such as mortgage derivatives, or hedge funds that buy up perfectly good companies, fire a bunch of employees, sell off assets, and leave ruin and unemployment in its wake.

Know how to increase investment money? Give tax cuts to the masses. They will then use that money to invest in PRODUCTS, and those companies can then use their profits to increase infrastructure and employment.

In fact, every single one of those tax cuts should have been given TOTALLY to the masses. We have seen time and again that trickle-down doesn’t work, but we know that trickle up does. If people have money, they are going to spend it.

academic.oup.com