My point had nothing to do with

room for wage increases.

Capital isn't required to pay more for labor simply because they have

room, any more than you should be required to pay more for a loaf of bread just because you have

room in your personal budget.

A business's, industry's, or market's demand for labor, and the availability of a supply of labor sets the price.

Whether or not the business, industry, or market can

afford to pay more isn't a factor.

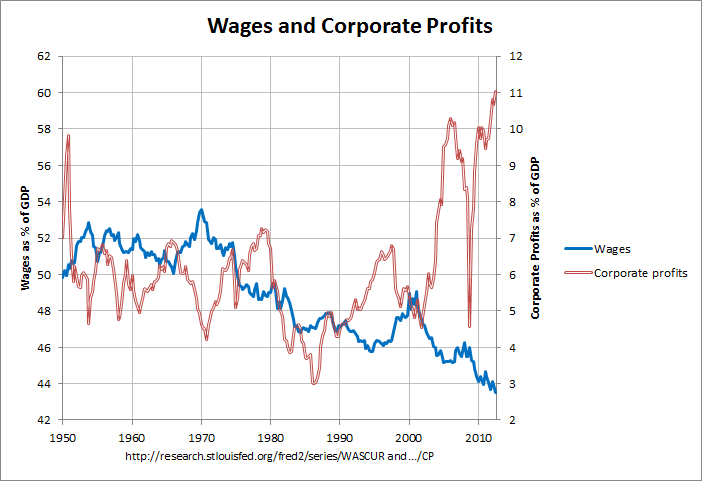

Your diagram only serves to illustrate what I was previously saying.

The reason profits are up and wages are down is because U.S. business is no longer held captive by the U.S. labor market.

If you look at the period between 1950 and about 1975 wages are relatively "flat". They rise and fall and rise and fall but you don't hit a cliff where you see a consistent downward trend until you get to 1975.

That's about the time we started seeing all those goods on American shelves with "Made in Taiwan" and "Made in the Philippines" labels on them (and about the time those "Made in America" labels became popular too).

By the mid 1980s India, China, and a large majority of the South Pacific island nations were in on the deal. By the early 1990s Mexico, Latin and South America came on board. By the late 90s, early 2000s it was Russia and a handful of Easter European nations. The next big growth market (which is not to say that the previously mentioned places have even begun to stop growing) is in Africa.

Two years ago you'd hear folks talking about the BRIC economies (

Brazil,

Russia,

India,

China).

Lately it's become BRICA (

Africa).

This economic cucumber has already become a pickle, and there's no going back to the way things were in the 1950s and 60s.

As I was also saying, while wages are falling in the United States we're seeing a corresponding increase in wages in the developing world.

Here's a diagram I pulled on urban China but if you care to look you can find similar situations in any of the countries I've discussed in both urban and rural areas:

View attachment 67156910

For a long time the people of America lived in relative luxury while the people of the vast majority of the world lived in abject squalor.

That's still largely the case and will be long into the foreseeable future.

But things are becoming a bit more equitable.

That equity comes in large part because of American corporations.

American corporations are spreading prosperity around the globe.

They're certainly getting a good deal in return for their benevolence, as their profitability indicates.

But there's no denying that it is the capital that is creating this change for good in the world whereas if it had been left to labor the

status quo would have been maintained indefinitely.