On Friday, Chinese state media reported that China Credit Trust Co. warned investors that they may not be repaid when one of its wealth management products matures on January 31, the first day of the Year of the Horse.

The Industrial and Commercial Bank of China sold the China Credit Trust product to its customers in inland Shanxi province. This bank, the world’s largest by assets, on Thursday suggested it will not compensate investors, stating in a phone interview with Reuters that “a situation completely does not exist in which ICBC will assume the main responsibility.”..

The Credit Equals Gold product is not the first troubled WMP, as these investments are known, to risk nonpayment, but Chinese officials have always managed to make investors whole. CITIC Trust did that in 2013 on a steel-loan product in Hubei province, and a mysterious third-party guarantee rescued a Hua Xia Bank WMP. An investment marketed by ICBC’s Suzhou branch was similarly repaid.

There has never been a default—other than one of timing—of a WMP, so the Credit Equals Gold product could be the first. If it is, it will edge out the WMP that invested in loans to Liansheng Resources Group, another Shanxi coal miner. Jilin Trust packaged Liansheng’s loans into a wealth management product sold by China Construction Bank , the country’s second-largest lender by assets, to its customers. Liansheng is in bankruptcy, and it looks like the WMP holders will not be repaid in full.

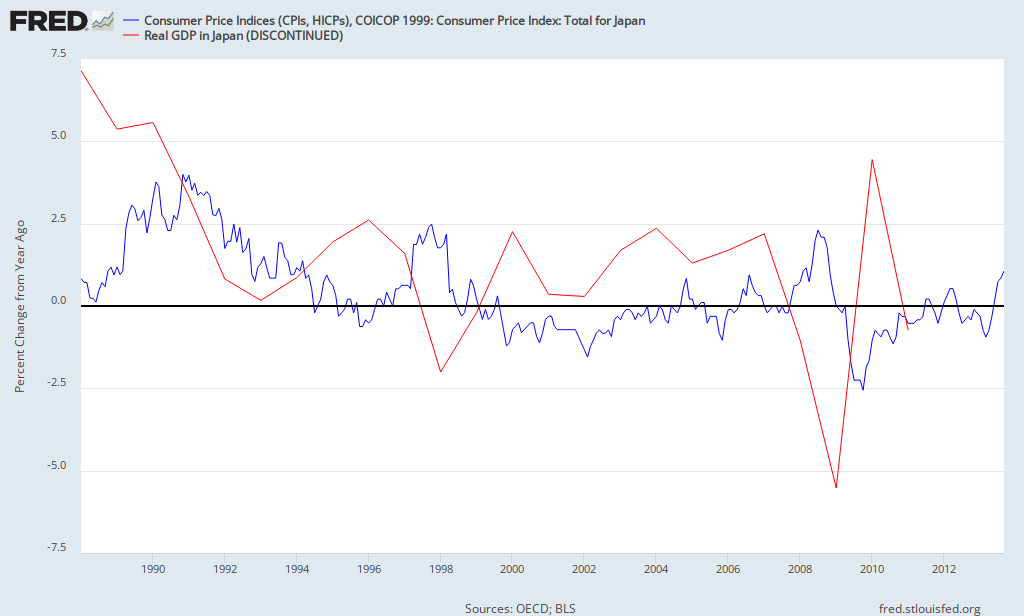

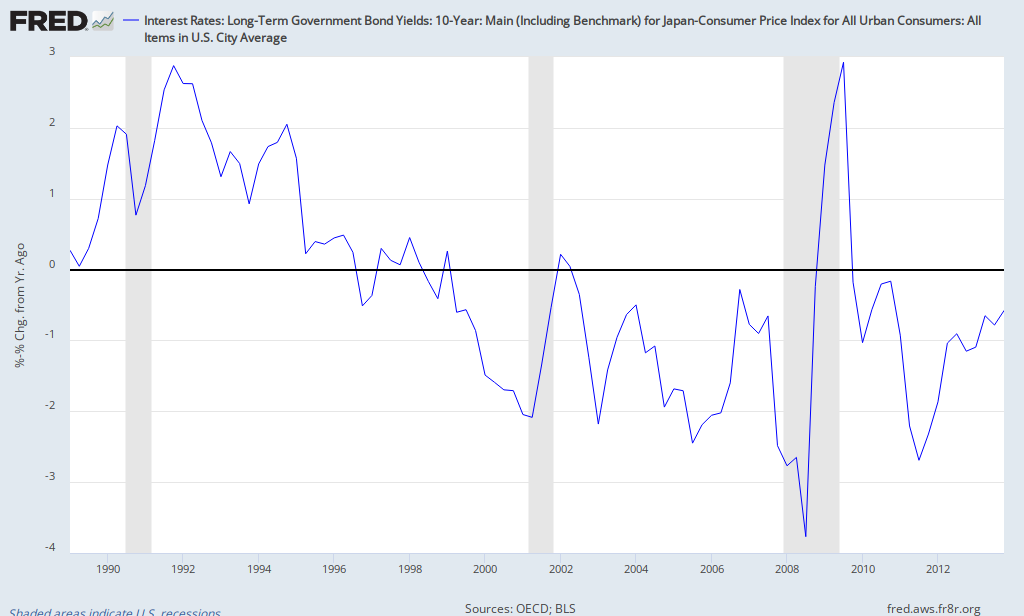

A WMP default, whether relating to Liansheng or Zhenfu, could devastate the Chinese banking system and the larger economy as well. In short, China’s growth since the end of 2008 has been dependent on ultra-loose credit first channeled through state banks, like ICBC and Construction Bank, and then through the WMPs, which permitted the state banks to avoid credit risk. Any disruption in the flow of cash from investors to dodgy borrowers through WMPs would rock China with sky-high interest rates or a precipitous plunge in credit, probably both. The result? The best outcome would be decades of misery, what we saw in Japan after its bubble burst in the early 1990s....

Even if Beijing makes sure there is no default on January 31, we should not feel relief. Just as Zhenfu followed Liansheng, there will be another WMP borrower on the edge of disaster after Zhenfu. And there are many Lianshengs and Zhenfus out there. There may have been 11 trillion yuan in WMPs at the end of last year....