Trump proposed a 2 trillion dollar infrastructure bill in 2016 and in 2020. At least Biden wants to try to pay for a little of it rather than piling it all on the national debt.

If Trump actually proposed that why did “It’s infrastructure week!” become a running gag line?

What you are referring to wasn't a proposal at all. What team Trump did was sketch in November 2016. I wasn't a plan in any sense of the word. Those that looked at this

sketch of an infrastructure proposal was struck by their almost pathological unwillingness to just do the obvious thing and, you know, build infrastructure. Instead they suggested a complicated scheme that would offer huge tax credits to private investors who would then be rewarded with user fees: build a highway, mainly with taxpayer dollars, then collect all the tolls for yourself.

As writers noted at the time, this scheme wouldn’t work at all for infrastructure spending that can’t be monetized, like repairing levees or cleaning up hazardous waste. And even where it might have been possible to collect user fees, the scheme would offer huge potential for abuse and cronyism (although that might have been a end purpose to those proposing it).

It’s not surprising, then, that infrastructure never happened. But why the Rube Goldberg nature of the proposal, such as it was? Why not just build infrastructure?

The answer, I think, comes down to a blend of ideology and cynical politics.

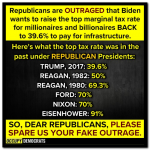

Today’s G.O.P. is the party Ronald Reagan built, a party that always sees government as the problem, not the solution; people who’ve spent decades steeped in that mind-set just can’t wrap their minds around the idea of using government spending, not tax cuts, to solve a problem. For a time, people in Trump’s inner circle, like Steve Bannon, seemed ready to break out of this box. But they couldn’t free their minds — and even if they could have, people like Mitch McConnell would have stood in their way.

Biden's plan is full of detail sheer contrast to the incompetence of the Trump administration, in which almost nobody had any idea how to do policy substance. It tackles the crumbling infrastructure and puts investments that we need in the future, while providing a funding structure.