- Joined

- Jun 16, 2019

- Messages

- 56,571

- Reaction score

- 65,465

- Location

- Tucson

- Gender

- Male

- Political Leaning

- Liberal

You mean like our economy shrank in the late 40s?Raise taxes=reduce income.

Do you think the economy should shrink?

You mean like our economy shrank in the late 40s?Raise taxes=reduce income.

Do you think the economy should shrink?

Could you elaborate on this?Eliminating all deductions reduces income to the private sector.

Same as above.So reduce income even more?

When possible.Are you arguing that spending and taxes should be balanced?

Firms have figured a way to bend marginal costs to a point where higher profitability can be achieved without cannibalizing revenue.Balancing the looks at things like capacity utilization, which is the percentage of US total production capacity being used (available resources include manufacturing, mining, and electric and gas utilities). In other words, capacity utilization measures the amount of slack in the economy by looking at how much industries in the U.S. are presently producing and comparing that output to what they could potentially produce if the industrial sector was running at maximum capacity.

View attachment 67538686

So why is there slack in capacity?

Honestly, there are at least 5-6 major categories that could explain it, but the fact remains that unused capacity could be put to some use without increases in inflation as the infrastructure already exists.

IMO, we're too far past that stage of capitalism. It's not McDonald's workers that are being threatened with mechanical / software / AI replacement... it's lawyers, accountants, developers, etc.... How long before a system that harnesses AI is able to provide superior health care diagnostics?One of the issues is skilled labor, so perhaps a way to balance the economy is to spend additional money subsidizing education, especially in the fields that require it.

Government spending is covering up the externality of extreme rent seeking that i brought up earlier. Without deficit spending, people wouldn't have the means to consume the goods and services from which record profits are derived.Overall, the government moves money into and out of the economy, sometimes the economy needs more spending, sometimes less, but looking at the prevailing economic data and, for instance, counter-cyclical spending is a way to use the government's power to balance the economy.

It all depends on who you raise taxes on.You mean like our economy shrank in the late 40s?

You were here all during the Trump Administration and didn't trash the Trump Administration for exploding our national debt.

Total expenditures. Try replying to what you've quoted.

So simply do a bunch of screenshots of where you trashed the Trump administration. Should be easy.

I don't see signatures. I have them turned off. Is this what you're talking about?

View attachment 67539070

Well that wasn't your thread but I at least I give you credit for saying what Trump really is.It is indeed. here is the link to the thread where @Conservative tried to tell me that "I had changed" because he didn't like that I was a critic of the Trump administration, and so I spent several pages just smashing the notion that the Trump administration didn't deserve criticism to pieces.That quote was the end of the debate - @Conservative complaining that I had principles, when I should just listen to what Bill O'Reilly said, instead

But there are plenty of others - this forum, as it so happens, even has a Search function (it's up there in the top right), and you can check for yourself.

Start Immediately after his taking the Presidency, if you like, or skip ahead to me supporting both impeachments, etc., so on, and so forth.

Well that wasn't your thread but I at least I give you credit for saying what Trump really is.

Now you get to vote and see if it's just all talk. If you vote for Trump (while telling us that you didn't) then that post is meaningless.

I can tell you I'm voting for Charlie Daniels but the only person who knows who I vote for is me. The only person that knows who you really vote for is you.How very generous. But, perhaps now you can dispense with the sniping on this question

I'm voting for Mitch Daniels, who remains my short, bald, bonnie prince charlie. I'll be voting for the Constitution Party candidate for Governor, and a mix-mash down ballot.

I can tell you I'm voting for Charlie Daniels but the only person who knows who I vote for is me. The only person that knows who you really vote for is you.

If you vote for Trump (and say you didn't) then your Sig is meaningless.

Politically, you are who you vote for.there are going to be good people who vote for each of the major candidates, and for third party candidates.

Do you not have any of these in your life?

Ah. So, because I'm pro life, I should treat every. single. Democrat voter in my family as though they were a child murderer? Literally hate my brother?Politically, you are who you vote for.

If you vote for Hitler in the morning and then go feed some needy kids in the afternoon then you're still a Hitler voter and you are still approving of him and his evil.

It almost sounds like you're trying to give yourself an "out".

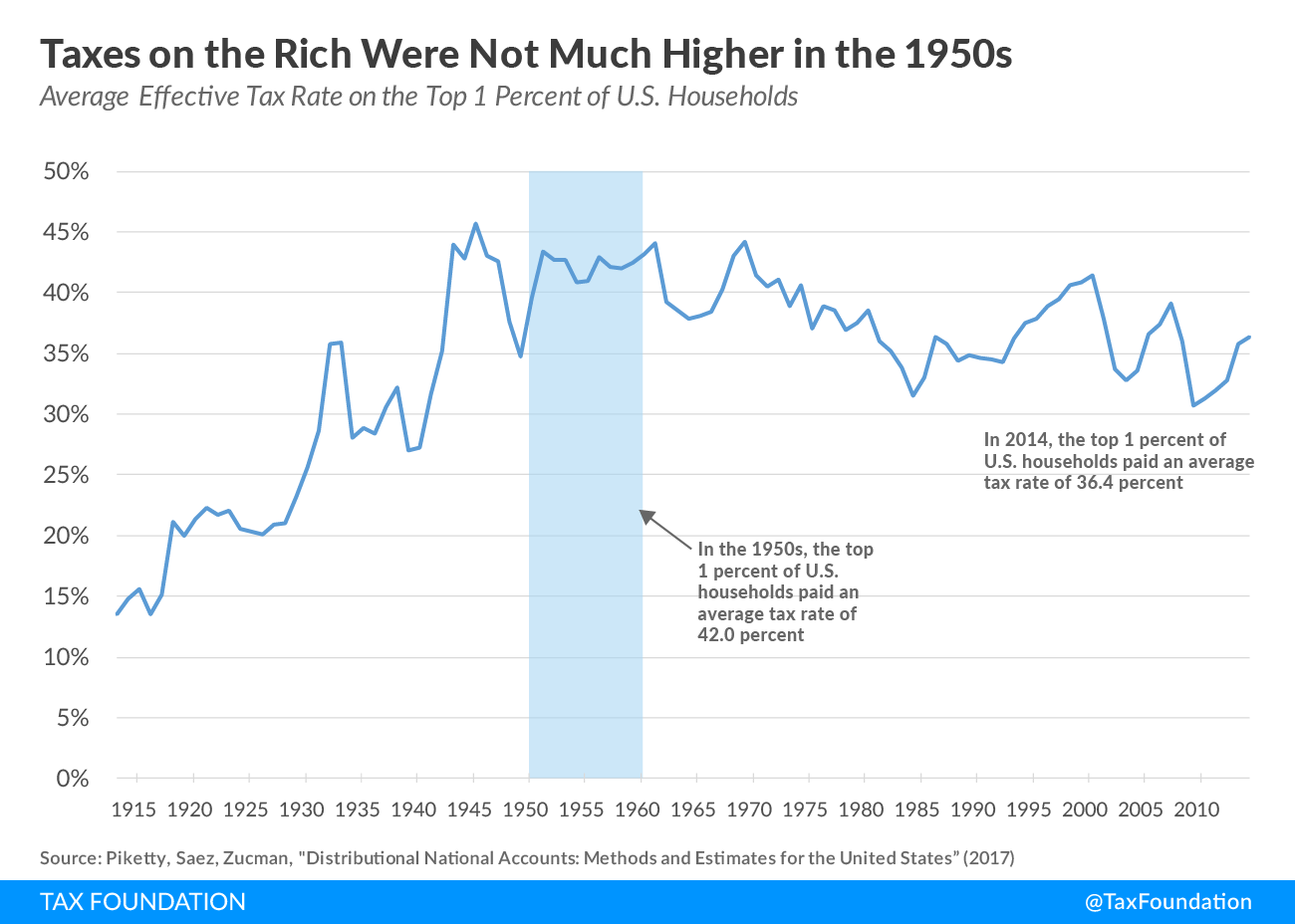

If you are referring to the extremely high marginal rates at the time, it's worth pointing out that the effective rates weren't much higher than today;You mean like our economy shrank in the late 40s?

Yeah, I'm still pondering that question. AI and other types of automation make it possible to create greater output with fewer people. People today are 128% more productive than they were n 1980. In 10 years, automation, like AI and applications like Puppet, Chef and Ansible are automating tasks at a frightening pace. In the next 10 years average output per-person might be 1000% times greater than 1980, which means we will live in a post scarcity world.The next stage of capitalism will incorporate a universal basic income.

Not that I necessarily disagree, but can you give me an example?Government spending is covering up the externality of extreme rent seeking that i brought up earlier.

All other things being equal an increase in taxes removes dollars from the private sector economy. Now, amounts matter, and what we're really talking about here are aggregate numbers. It's like telling someone you added water to the swimming pool, you don't say; I added water to the pool and didn't take any back out. So when I say cut taxes I expect other to understand the implicit assumption that spending is about the same.Could you elaborate on this?

Have there been any period in the recent past you think spending and taxes should have been balanced? If so....To what end?When possible.

Fake reply.Fake news.

I'm still not seeing how you see taxes taking money out of the economy. FY2024 the U.S. government spending put about $6.8 trillion into the economy, about $4.9 trillion was from tax revenue and about $1.8 trillion borrowed and added to the interest bearing debt owed.All other things being equal an increase in taxes removes dollars from the private sector economy. Now, amounts matter, and what we're really talking about here are aggregate numbers. It's like telling someone you added water to the swimming pool, you don't say; I added water to the pool and didn't take any back out. So when I say cut taxes I expect other to understand the implicit assumption that spending is about the same.

So for example, if the government averages a deficit of $500 billion over 10 years (with the low being $300 and the high being $700), the economy adapts itself to that level of income. Government spending or entitlements are added to the private sector economy as income. Incomes are spent and drive demand and business output will attempt to adapt to the demand. If there's a push to reduce the deficit through increases in taxes or reductions in spending, the private sectors income is reduced, dollar for dollar, by the amount the deficit has been reduced. the removal of $900 billon can have a significant effect on demand, expcially if a sizeable portion of that money is earned by the middle class.

So if the government went from a 10 year average of $500 billion in deficit spending and cut spending over the next 3 years to an average of $200, then $900 billion dollars over that three years has been removed from the economy, again, all other things being equal. Most people will try to point out that things aren't equal, but generally fail to point out how.

Now, we can certainly talk about how the COVID, or oil crisis driven by the middle east's significant influence on supply or natural disasters can cause reductions in demand and at any of these points it is wise to look at spending, and in my opinion consider what money is being spent on, but that's a whole other kettle of fish.

So when I say what I say, we have to start out at a high level and drill down to discuss how policy, or private sector banking, imports, exports etc can affect the broad statements that I'm making, but once we establish the truth (or lack of) at the highest level, we can figure out where the disconnect is

So what determines the level of deficit? What are some reasons why it might need to grow over time?

I've posted this part several times, but here it is again....

The US population increases has increased by an average of 293k per month over the last 40 years.

Population

Looking at the census...

The U.S. population in 2020 was 331,449,281.

The 1980 population of 226,545,805.

Here's the breakdown:

Population increase: 104,903,476 people (68 million more working aged people)

Percentage increase: 31.64%

Do you think that we need more money in the economy with 31% more people?

Productivity:

Each worker, thanks to advances mostly in computers, but other tech as well, has made the average worker 128% more productive on a per worker basis when compared to 1980.

So in real terms, we'd take the number of workers and multiply by per-person productivity to get a fair comparison with the year 1980. Today there are 208 million working aged people vs 140 in 1980. So if we use 1980 as the year to compare to today we have 474 million peoples worth of productivity (208 million x the increase in per-person output or 2.28) when comparing today to 1980, so in real terms the economy has an output potential 70% greater today than 40 years ago.

Of course, not all people of working age are working, but that's true in both time periods and I don't want to over complicate this, even if the number in 1980 and 2020 were 5%-10% less, the result would stay largely the same as a percentage).

Do you think that an economy with more people and much greater output potential needs more dollars?

There are three of the biggest reasons that I think the US Government needs to net deficit spend.

To say nothing of how deficit spending is an opportunity to rebalance the share of dollars between the top 10% and the bottom 90% of income and wealth holders. Even with government entitlements and spending the top 10 percent's share of wealth has accelerated significantly.

Have there been any period in the recent past you think spending and taxes should have been balanced? If so....To what end?

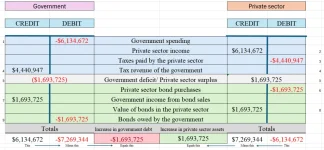

To understand you really need to understand that each component of a transaction has 2 sides.I'm still not seeing how you see taxes taking money out of the economy. FY2024 the U.S. government spending put about $6.8 trillion into the economy, about $4.9 trillion was from tax revenue and about $1.8 trillion borrowed and added to the interest bearing debt owed.

Maybe you could reference what I said. That said, a lack of deficit spending can encourage more borrowing within the private sector. This increases risk and volatility. If the economy falls into recession, repossessions, bankruptcies and foreclosures increase. Properties are purchased by the investor class, the economy inevitably turns and properties are sold for a tidy sum shifting wealth from the bottom 90% to the top 10%. This formula, thanks to technology, is becoming increasingly efficient.Over the past 100 years, how has deficit spending effected the share of dollars between the top 10% and the bottom 90% of income and wealth holders? You seemed to indicate that it has done exactly the opposite.

I agree there are times to increase and decrease spending, but it requires you understand the chart above and agree that the government should act counter-cyclicallyIn most every year spending should, and could easily be made equal to the tax revenue collected, times of a major crisis such as COVID being an exception.

You seem to be including business/corporations while I'm simply talking about taxing the income of private individuals.To understand you really need to understand that each component of a transaction has 2 sides.

So the result looks like this:

View attachment 67539241

1. The government spends into the economy

2. Private sector increases its income

3 The private sector pays taxes, this removes money from the private sector economy

4 The government collects taxes

5 The difference between taxes and spending is calculated and this amount is both the government's deficit and the private sectors net surplus

6. The private sector buys bonds offered by the government

7. The government collects revenue for bond sales

8. The private sector now owns bonds equal to what was spent to purchase them

9. The government owes an amount equal to what the private sector purchased

What most people fail to consider is that bonds sales remove cash, but replace it with a cash asset of the same (higher with interest), thus net fiscal assets in the economy remain the same.

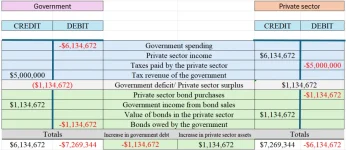

Now, back to the point I made, if in this example, you increase taxes, the increased amount of money, or private sector assets (the green box) decreases....Here, let's try it.....

View attachment 67539242

Increasing taxes reduces money in the economy.

Maybe you could reference what I said. That said, a lack of deficit spending can encourage more borrowing within the private sector. This increases risk and volatility. If the economy falls into recession, repossessions, bankruptcies and foreclosures increase. Properties are purchased by the investor class, the economy inevitably turns and properties are sold for a tidy sum shifting wealth from the bottom 90% to the top 10%. This formula, thanks to technology, is becoming increasingly efficient.

I agree there are times to increase and decrease spending, but it requires you understand the chart above and agree that the government should act counter-cyclically