Since they removed the individual mandate things have gotten MUCH better. When Obamacare first hit my premiums doubled while my benefits were cut in half.

Obamacare--like the man it's named after--f_cK!ng sux.

The purpose of the individual mandate

is vital in a system reformed to remove financial penalties to become immediately insured with pre-existing conditions. Trump & RWE politicians aligned with him effed the taxpayers by eliminating the individual mandate, a fine for having the financial ability to pay for health insurance coverage but being selfishly unamerican enough not to purchase health insurance coverage until a perceived immediate need for medical treatment!

No individual mandate encourages "free riding" an antisocial, unamerican behavior. With no free riders paying the individual mandate, the increased costs to all insurers of those who don't purchase health insurance coverage until they can take the insurer for thousands in treatment costs while paying only hundreds to the insurers, are passed along to all other purchasers of insurance coverage and to government paying for expanded medicaid coverage!

Facts? Links supported facts?

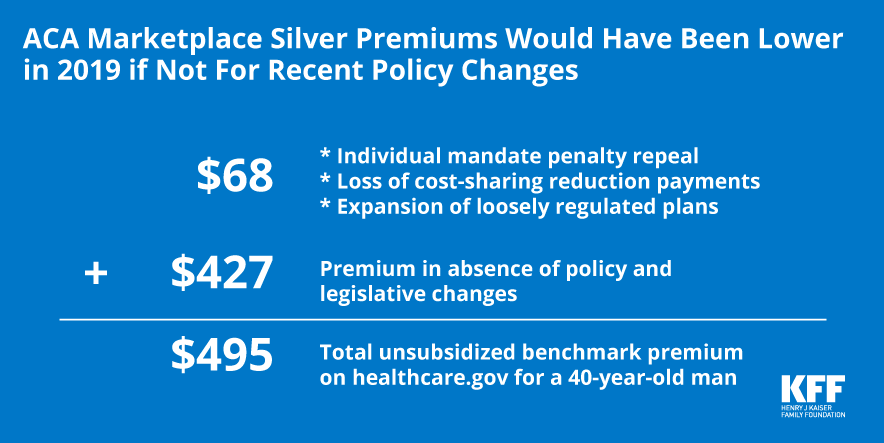

How Repeal of the Individual Mandate and Expansion of Loosely Regulated Plans are Affecting 2019 Premiums

In health insurance systems designed to protect people with pre-existing conditions and guarantee availability of coverage regardless of health status, countervailing measures are also needed to ensure people do not wait until they are sick to sign up for coverage (as doing so would drive up...

www.kff.org

"The Affordable Care Act (ACA) included a variety of "carrots" (e.g., premium tax credits and cost-sharing reductions) and "sticks" (e.g., the individual mandate penalty and limited ..."

en.wikipedia.org

"...The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered.[5][6] The law also enacted a host of delivery system reforms intended to constrain healthcare costs and improve quality. After it went into effect, increases in overall healthcare spending slowed, including premiums for employer-based insurance plans.[7]

The increased coverage was due, roughly equally, to an expansion of Medicaid eligibility and to changes to individual insurance markets. Both received new spending, funded through a combination of new taxes and cuts to Medicare provider rates and Medicare Advantage.

Several Congressional Budget Office reports said that overall these provisions reduced the budget deficit, that repealing ACA would increase the deficit,[8][9] and that the law reduced income inequality by taxing primarily the top 1% to fund roughly $600 in benefits on average to families in the bottom 40% of the income distribution.[10]

The act largely retained the existing structure of Medicare, Medicaid and the employer market, but individual markets were radically overhauled.[1][11] Insurers were made to accept all applicants without charging based on preexisting conditions or demographic status (except age). To combat the resultant adverse selection, the act mandated that individuals buy insurance (or pay a fine/tax) and that insurers cover a list of "essential health benefits".

Before and after enactment the ACA faced strong political opposition, calls for repeal and legal challenges. In National Federation of Independent Business v. Sebelius, the Supreme Court ruled that states could choose not to participate in the law's Medicaid expansion, but upheld the law as a whole.[12] The federal health insurance exchange, HealthCare.gov, faced major technical problems at the beginning of its rollout in 2013. Polls initially found that a plurality of Americans opposed the act, although its individual provisions were generally more popular.[13] By 2017, the law had majority support.[14] President Donald Trump rescinded the federal tax penalty for violating the individual mandate through the Tax Cuts and Jobs Act of 2017, starting in 2019.[15] This raised questions about whether the ACA was still constitutional.[16][17][18] The Supreme Court upheld the ACA a third time in a June 2021 decision.[19] .."