- Joined

- Jun 16, 2020

- Messages

- 7,175

- Reaction score

- 4,542

- Gender

- Male

- Political Leaning

- Moderate

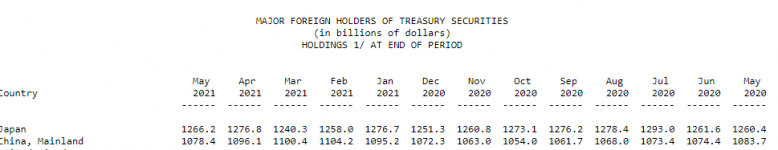

Do you know what China uses as a “reserve” for their currency? Dollars.Yeah, but if they establish themselves as a military top dog people will quickly flock to their debt and buy it like it’s going out of style and abandon ours. Our ability to sell debt is based solely on our military, which is now advertising for sorority chicks with lesbian moms as soldiers

If they dumped our debt, they would make their own currency worthless. The reason why our international finance system is comprised this way is to eliminate war conflicts.

If we could get our ass out of international conflicts such as Afghanistan, Iraq, Syria and now Cuba apparently, we could start actually funding things for the betterment of our people with the government instead of the betterment of the 1% military industrial complex.