Thank you very much!

@RedFishBlueFish @Threegoofs for your responses.

Interesting......as to me the term of Strategic Reserves doesn't match the intent.

1) Selling for a net profit is good, but I would figure those net profits would be used exclusively to re buy at a lower price, since its a strategic reserve separate from the General Funds/Expenses.

2) Comingling funds generally is not good... Right? Do as I say not as I do???/

3) This is an SBF ponzi, robbing Peter to pay Paul, you take the profits from here (SPR) to deposit in a general fund thats drowning in debt.

oh well anyways....

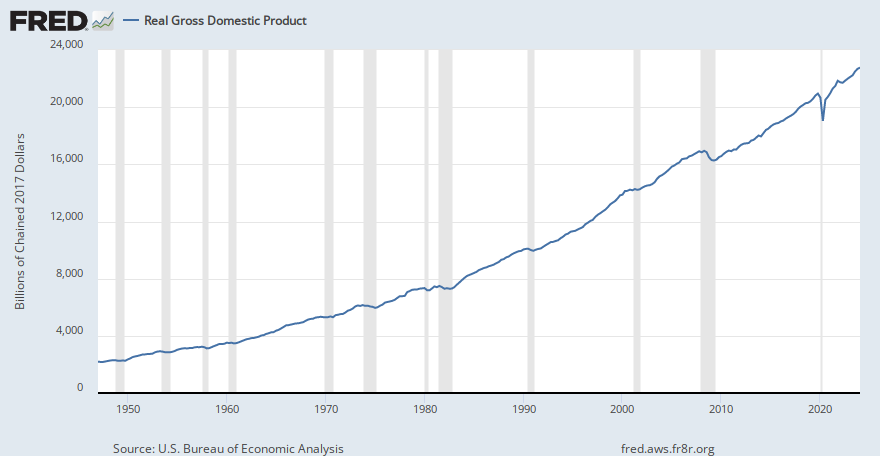

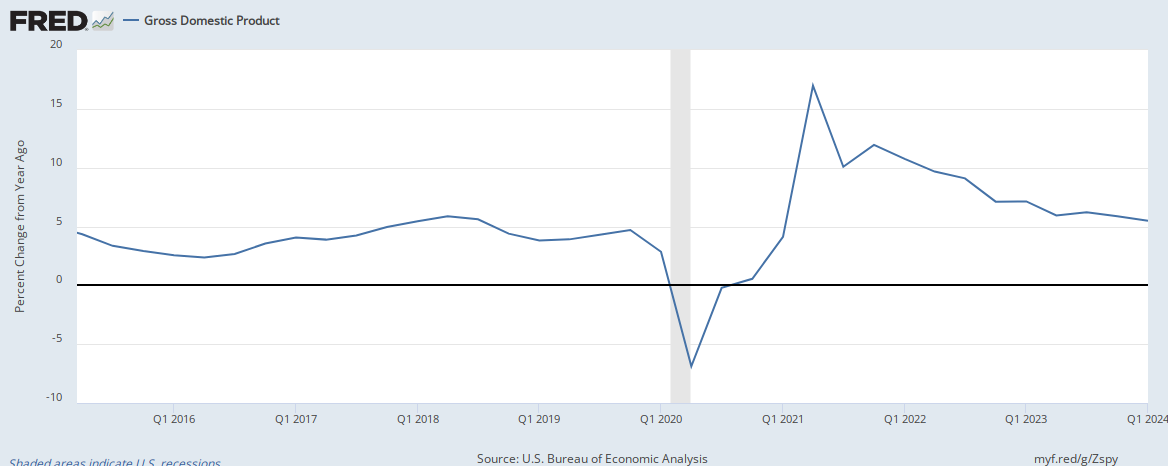

Back on topic... 2.1 GDP growth...... but does that account for 7-9% inflation that means we are net negative of 5-7%? Our growth is negative of the inflation.....is that a win?