- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

What I want for my offspring is a country that balances it's budget, guarantees all its citizens adequate shelter/food/medical/dental, a very small peacetime/very large reserve armed forces, no central bank, no government economic intervention, no business/corporate taxation, a VERY simple tax system with no deductions except for charitable contributions and capital losses, identical capital gains/income tax rates, no taxes for the poor and the absolute smallest possible taxes and government that are possible.

You are dreaming. The above is Mission Impossible in a world where market-economies are in competition.

So, you and a couple of hundred families should take the next Private Spaceship journey to a habitable planet and start all over again, because your recipe, in fact, is a good one.

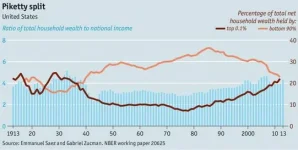

Meanwhile, watch from a larrrrge distance while the global economy implodes on earth, brought down by the mindless exploitation by just 0.001% of the total population of the rest of us.

Because that is the way the earth is heading ...