Except, the GOP is how conservatives express their political will and promote the policy goals they want to achieve and I have never seen these so-called ''true conservatives'' do anything to change the GOP or promote any sort of systemic change to achieve their aim of debt reduction.

Simple question, why weren't there tea party protests during the George W. Bush or Trump years? Seems like something like the Tea Party is only a big deal when a Democrat is in the White House.

Hey, if you are fine with cutting military spending, getting rid of upper-class tax cuts, and delaying a border wall until the debt is reduced at least makes you consistent on this issue.-, which is more than

Doesnt change the fact that this is all a farce and a shell game.

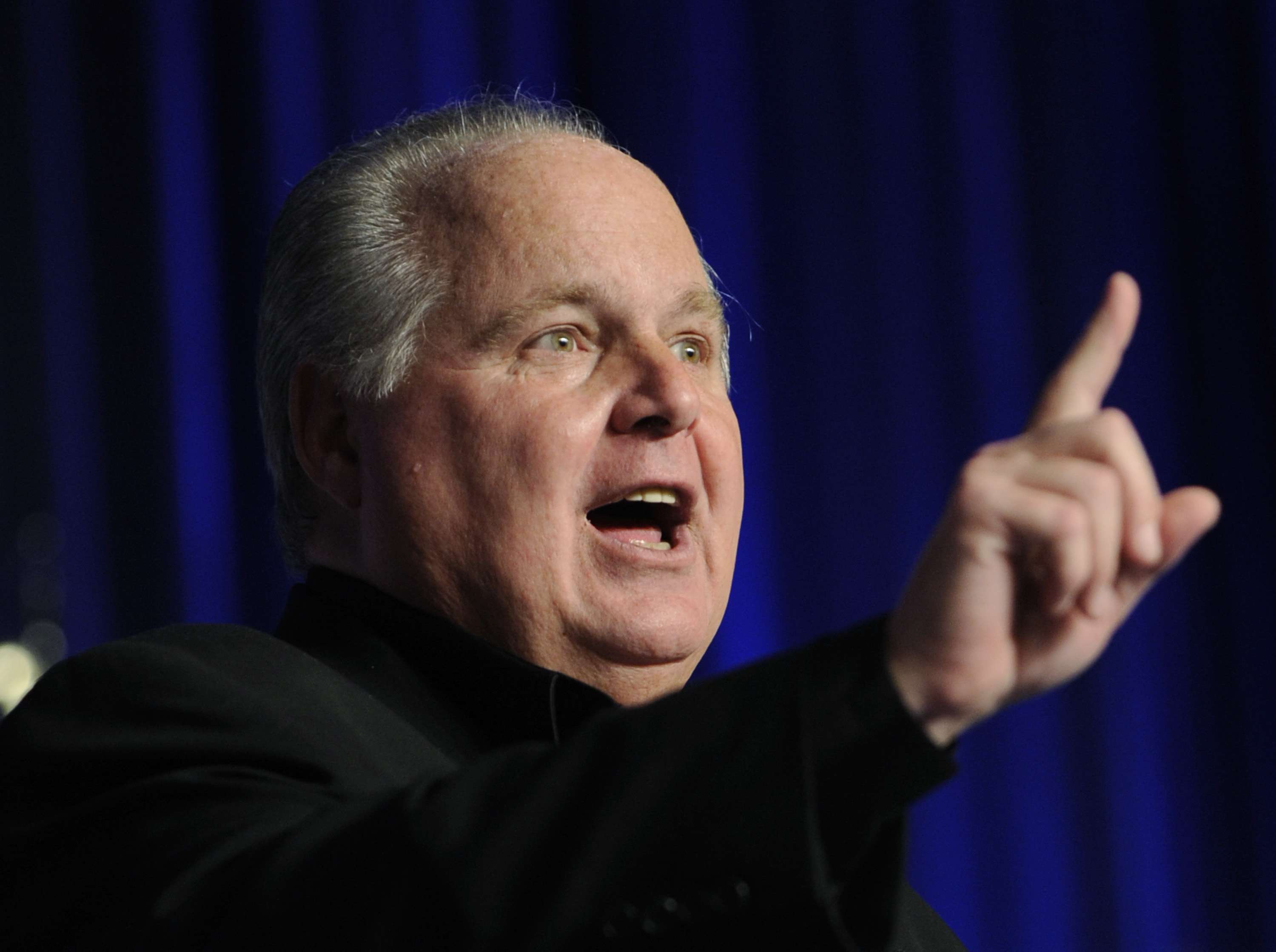

Everyone from Dick Cheney to Rush Limbaugh has admitted this is a con game:

Now he tells us.

www.theatlantic.com

Rightwing icon and firebrand radio host Rush Limbaugh once cared about reining in the federal deficit and the national debt, but not anymore. On his radio

reason.com

Trump had a Republican Congress for 2 years, George W. Bush had one for 4 years, and neither of them reduced the debt.

I think the GOP intentionally increases the debt through tax cuts and military spending and then uses the large debt they created to justify cuts in social spending. The GOP will always be fine with spending for giveaways to defense contractors and other rich elites they hang out with on golf courses.