- Joined

- Feb 24, 2013

- Messages

- 35,014

- Reaction score

- 19,478

- Gender

- Undisclosed

- Political Leaning

- Conservative

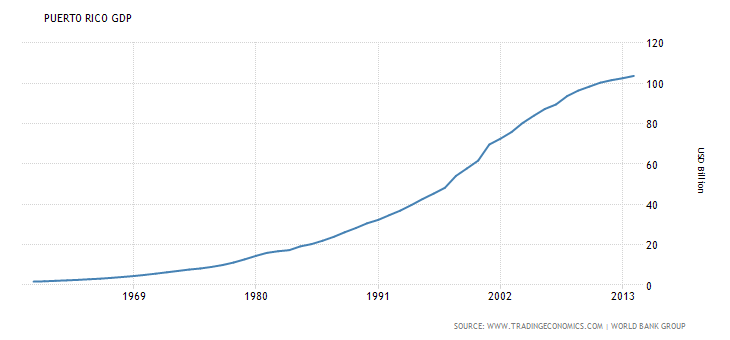

So now you admit that the collapse of manufacturing is a large problem for Puerto Rico, and not the spending.

No, I don't. You don't seem to understand this very well. The SPENDING is entirely the problem. You and Deuce's argument is like a guy jumping from a plane without a parachute and, upon his inevitable demise, you blaming gravity. The problem was entirely foreseeable and Puerto Rico kept blindly spending at levels they could not sustain if the economy went into declined.

It's their fault.

Hell, your idea of "forward planning" requires spending if the government wants to encourage other jobs.

No, no it doesn't. Spending more money is not the only way of diversifying the economy... no shocker you don't seem to know that.

You can also attract new and varying business by favorable tax policies that attract new business and public/private partnerships to promote education in growing industries.