- Joined

- Jan 28, 2012

- Messages

- 16,386

- Reaction score

- 7,793

- Location

- Where I am now

- Gender

- Male

- Political Leaning

- Independent

'Measure’s longest losing streak since 1979 could keep Fed from raising rates to past levels

The longest slide in worker productivity since the late 1970s is haunting the U.S. economy’s long-term prospects, a force that could prompt Federal Reserve officials to keep interest rates low for years to come.

Nonfarm business productivity—the goods and services produced each hour by American workers—decreased at a 0.5% seasonally adjusted annual rate in the second quarter as hours worked increased faster than output, the Labor Department said Tuesday.

It was the third consecutive quarter of falling productivity, the longest streak since 1979. Productivity in the second quarter was down 0.4% from a year earlier, the first annual decline in three years. That was a further step down from already tepid average annual productivity growth of 1.3% in 2007 through 2015, itself just half the pace seen in 2000 through 2007, and the trend shows little sign of reversing.

“In the short term, it’s hard to be anything other than pessimistic, just because this has been going on for so long now,” said Paul Ashworth, chief U.S. economist at consultancy Capital Economics.

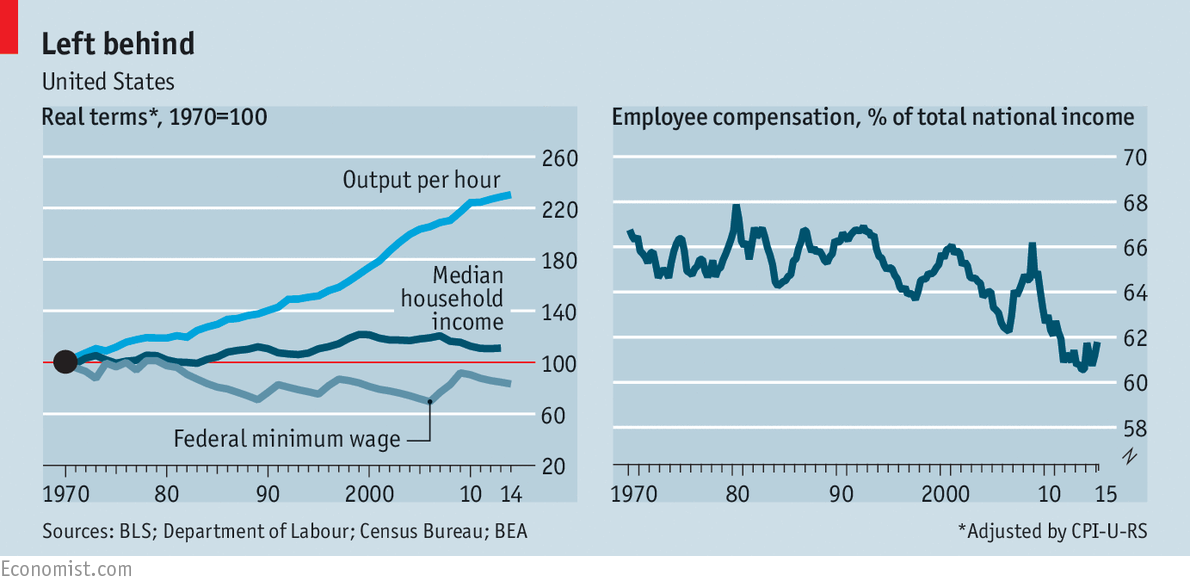

Productivity is a key ingredient in determining future growth in wages, prices and overall economic output. It has slowed dramatically since the information technology-fueled boom of the late 1990s, when strong productivity gains translated into robust growth for household incomes and the overall economy.

The slowdown in recent quarters has likely been reinforced by weak business investment in new equipment, software and facilities that could help boost worker efficiency.

Over time, persistently weak productivity would weigh on American living standards by restraining the economy’s ability to grow quickly and generate higher incomes without stoking too much inflation. Already, some economists say slow productivity may be restraining wage growth.'

Productivity Slump Threatens Economy?s Long-Term Growth - WSJ

Thoughts?

The longest slide in worker productivity since the late 1970s is haunting the U.S. economy’s long-term prospects, a force that could prompt Federal Reserve officials to keep interest rates low for years to come.

Nonfarm business productivity—the goods and services produced each hour by American workers—decreased at a 0.5% seasonally adjusted annual rate in the second quarter as hours worked increased faster than output, the Labor Department said Tuesday.

It was the third consecutive quarter of falling productivity, the longest streak since 1979. Productivity in the second quarter was down 0.4% from a year earlier, the first annual decline in three years. That was a further step down from already tepid average annual productivity growth of 1.3% in 2007 through 2015, itself just half the pace seen in 2000 through 2007, and the trend shows little sign of reversing.

“In the short term, it’s hard to be anything other than pessimistic, just because this has been going on for so long now,” said Paul Ashworth, chief U.S. economist at consultancy Capital Economics.

Productivity is a key ingredient in determining future growth in wages, prices and overall economic output. It has slowed dramatically since the information technology-fueled boom of the late 1990s, when strong productivity gains translated into robust growth for household incomes and the overall economy.

The slowdown in recent quarters has likely been reinforced by weak business investment in new equipment, software and facilities that could help boost worker efficiency.

Over time, persistently weak productivity would weigh on American living standards by restraining the economy’s ability to grow quickly and generate higher incomes without stoking too much inflation. Already, some economists say slow productivity may be restraining wage growth.'

Productivity Slump Threatens Economy?s Long-Term Growth - WSJ

Thoughts?

Last edited: