- Joined

- Aug 10, 2013

- Messages

- 20,231

- Reaction score

- 21,631

- Location

- Cambridge, MA

- Gender

- Male

- Political Leaning

- Slightly Liberal

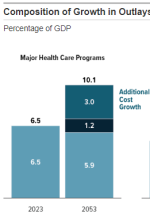

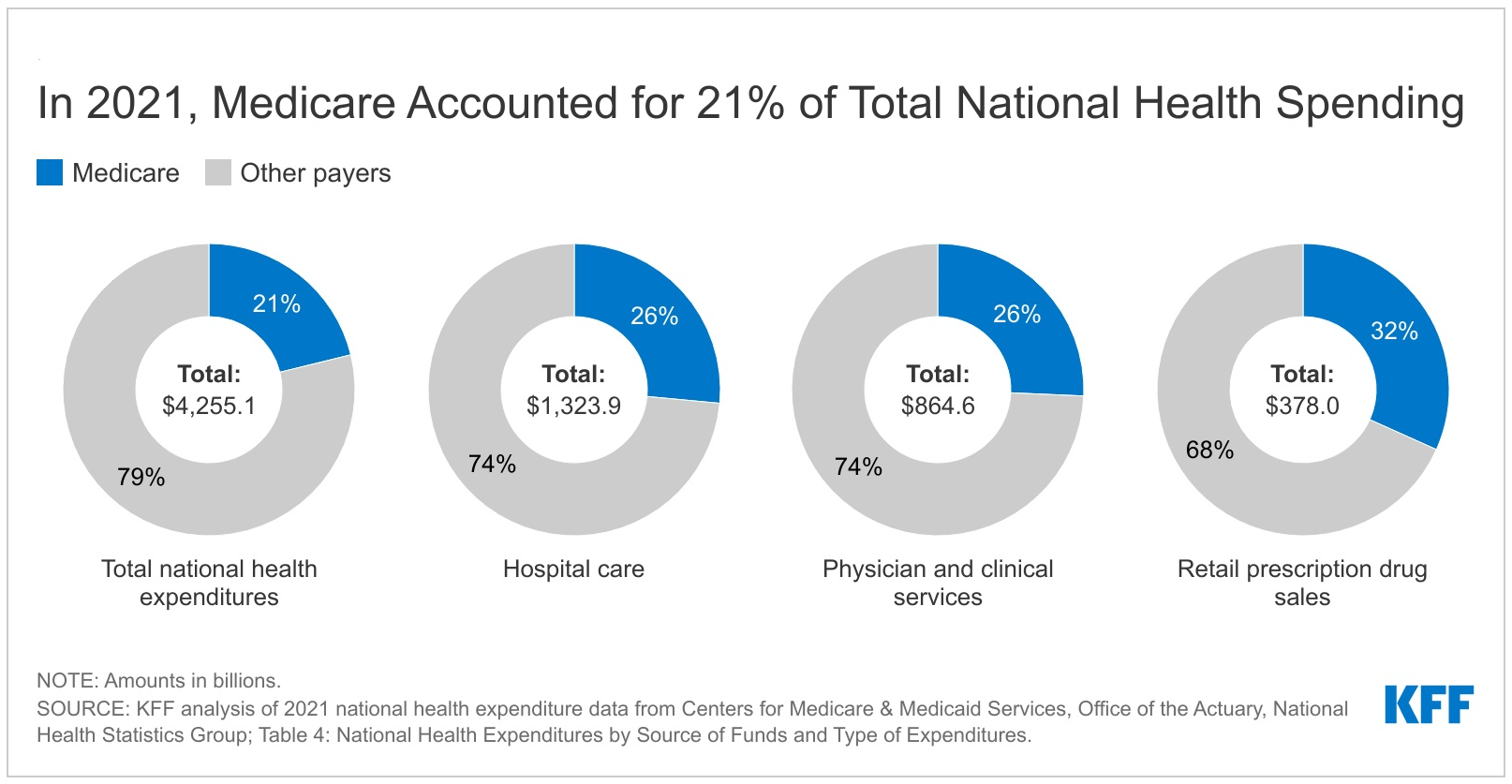

When it comes to long-term federal spending obligations and the debt picture, Medicare has always been the story. And the spectacular savings (cumulative trillions of dollars so far) in Medicare savings that have been achieved since the Affordable Care Act passed in 2010 are also a key part of that story.

debatepolitics.com

debatepolitics.com

Some of the savings in that law came from fixes to the way payments to insurers participating in Medicare Advantage, the privatized part of the program, are determined. Those payments were significantly inflated back when the ACA passed, with private insurers being paid ~18% more than traditional Medicare paid for the same care. Even as the ACA reduced those overpayments, enrollment in Medicare Advantage has grown (contrary to conservatives' predictions a decade ago). When the ACA passed, 26% of Medicare beneficiaries were in Medicare Advantage; this year 52% are.

With a majority of beneficiaries now enrolling in those private plans, it raises the stakes on the fact that, whack-a-mole-style, those insurers have again been finding ways to game the system to inflate their payments. And that's generating some tension between some of the commissioners of MedPAC, the group of experts convened by Congress to serve as its advisory body on Medicare payment policies.

MedPAC Report on Medicare Advantage Growth, High Costs Generates Kerfuffle

Hard to see how we tackle spending and debt--and build on the impressive savings that have been achieved to date--without again addressing the extra payments that Medicare Advantage insurers are getting from the taxpayers.

A Huge Threat to the U.S. Budget Has Receded. And No One Is Sure Why.

Well, I'm pretty sure why, but I guess others are still wondering what odd thing happened in 2010 to make both Medicare and the entire American health care system more sustainable. Anyway, the New York Times clues in today on "the most important thing that has happened to the federal budget in...

debatepolitics.com

debatepolitics.com

Some of the savings in that law came from fixes to the way payments to insurers participating in Medicare Advantage, the privatized part of the program, are determined. Those payments were significantly inflated back when the ACA passed, with private insurers being paid ~18% more than traditional Medicare paid for the same care. Even as the ACA reduced those overpayments, enrollment in Medicare Advantage has grown (contrary to conservatives' predictions a decade ago). When the ACA passed, 26% of Medicare beneficiaries were in Medicare Advantage; this year 52% are.

With a majority of beneficiaries now enrolling in those private plans, it raises the stakes on the fact that, whack-a-mole-style, those insurers have again been finding ways to game the system to inflate their payments. And that's generating some tension between some of the commissioners of MedPAC, the group of experts convened by Congress to serve as its advisory body on Medicare payment policies.

MedPAC Report on Medicare Advantage Growth, High Costs Generates Kerfuffle

A Medicare Payment Advisory Commission (MedPAC) meeting turned unusually contentious Friday as one member, Brian Miller, MD, MPH, of Johns Hopkins University in Baltimore, accused panel leadership of issuing a negative status report opens in a new tab or window on Medicare Advantage (MA) plans' market dominance, saying it had been "hijacked for partisan political aims to justify a rate cut to Medicare Advantage plans."

The subject of his ire was a slide presentation that is posted for the public -- and a lengthy report that only commissioners can read -- highlighting growing concerns with the rapidly increasing amounts of Medicare funds now flowing to MA plans. The slides showed that MA plan "coding intensity" and "favorable selection" increased spending to MA plans -- $82 billion in 2023 alone -- above what Medicare paid for care to fee-for-service beneficiaries.

The analysis detailed the numerous ways that MA plans generate higher revenue, including enrolling people who are relatively healthy, known as favorable selection. They then vigorously scan patients' medical histories and charts to code for health factors that generate higher per-capita payments, known as coding intensity, often spending less on services. Coding intensity is also the difference between a risk score that a beneficiary would receive in an MA plan versus in fee-for-service.

The report said that coding intensity has increased over the years, with many of the biggest MA plans appearing to do the most. It also noted that a few plans now dominate the MA plan market, and that three companies -- UnitedHealthcare, Humana, and CVS Health -- enrolled 58% of all MA enrollees in 2023.

Hard to see how we tackle spending and debt--and build on the impressive savings that have been achieved to date--without again addressing the extra payments that Medicare Advantage insurers are getting from the taxpayers.