So you note how inflation is happening. The rich do not cause inflation. Government causes inflation.

So, let's make sure that we're clear here since I don't recall having a conversation w/ you. So let's define inflation.

Inflation is a sustained increase in the general price level of goods and services in an economy, typically measured annually as a percentage, resulting in a reduction in the purchasing power of money. It's driven by factors like excessive demand, increased production costs, or inflationary expectations.

Now, let me try to intercept a possible response before it comes that usually goes something like this.

"Inflation is an increase in the number of dollars, driven by government spending".

First, if you were to respond with this....You'd be presenting a

specific theory of inflation, often associated with the

Monetarist school of economic thought, but it's not the complete or universally accepted definition. It's a potential

cause of inflation, but not the

definition of inflation itself. Further, it's family simple to use the Monetarist equation MV=PQ to disprove this idea, but I digress, we'll get there.

Further, if it were true that more government spending resulted in greater spending by the public, which in turn drove up prices and a decrease in buying power, then you'd simply be wrong. First, it's worth pointing out that wages are the

price of labor, if inflation was really as you claim, then it stands to reason that wages would increase as well (at least in nominal terms), as fast if not faster than in the past relative to prices. Even if you wanted to claim that wages lag behind inflation, we should still see wages rising with inflation over time....That's not been the long term trend. But that's not the case, a greater and greater percent of the population has

less money, not more. How can people will less money cause prices to increase?

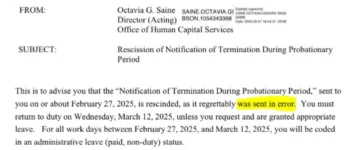

Here is a graph that shows government deficit spending percent change, but I've added GDP, which is an accumulation of all spending and mapped that over CPI.....

If it's easier, here is just government deficit spending over CPI. Not much of a correlation here....

Here is CPI to M1 (the actual supply of money in our accounts) where M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other checkable deposits (OCDs), consisting of negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions.

Zero correlation.

You won't find a correlation to CPI and wages, reserve levels or total federal debt.

:max_bytes(150000):strip_icc()/GettyImages-181192369-87a381d795274d8692be8685770351ab.jpg)