It's not rigging it. It's working the problem of human nature.

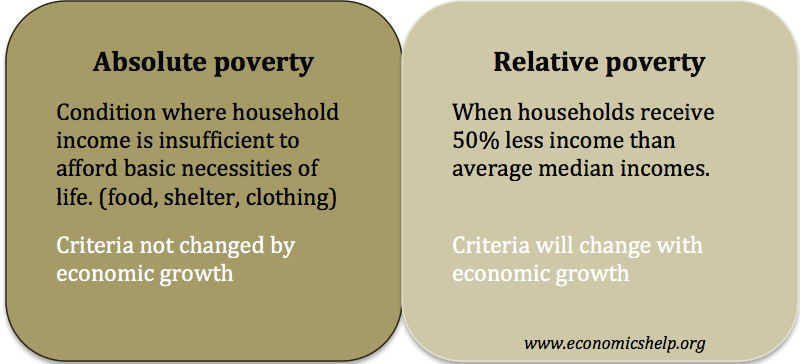

The "problem of human nature"? What is that? I don't think there is such a thing as human nature. It seems to me that people tend to differ quite fundamentally. I suppose one can say that we all need to eat, sleep, hydrate, shelter, and so on, but solving the kinds of problems

those needs create are very clearly not what the wealthy elite and their allies in government are doing. In fact, quite the opposite for a great many people--they're making obtaining the goods that satisfy those needs even harder.

I'm not "basically saying", you have a direct quote.

Thank you for doubling down, though there is no need for you to make my job here any easier. It's easy enough as it is.

This is called a logical leap. "You said you'd go to dinner with me so now rape is justified to get what I want since you didn't put out."

You disagree with the morality you portray here in a strawman matter so then you double down on it by adding a logical leap to the strawman.

Incorrect. I called attention to the moral dimensions of recent (well, recent in generational time) economic trends, and your response was, basically "stuff it! Deal with reality!" Your response was simply to deny that there is a moral dimension that has any import. So, if that is the case, how can you, in any principled manner, halt the logical next step in that evolution? To put the point differently, if the wealthy not only are but should be, in your view (as you seem to have not only stated but confirmed), free to so arrange the economy that it massively benefits them at the expense, the very painful and sometimes lethal expense, of the lower classes, why should not the lower classes be free to simply kill the wealthy? The wealthy are quite free, in your view, to kill them--according to what you've said in this thread, they ought to have that kind of power. So why would it not work the other direction?

I suppose you could pivot to something like the Han Fei, where the word of the powerful (technically, the Emperor) constitutes the moral good. In response, I'd say that the overwhelming majority of people disagree with such moral intuitions, to the point that it looks like your intuitions are simply flawed. The Western equivalent (the

jure divino) was never a fully coherent, nor absolute, doctrine the way the Han Fei was, though if you make that move, it'll be surprising since one of the principles on which this country was founded is precisely a denial of the divine right of kings. So how you could defend a view that there's no moral dimension to how the economy is set up to work is not obvious.

Your counter example--the dinner/rape example--is a

non sequitur. There's no denial, in the dinner/rape example, on the part of the person who said they'd go to dinner that there's a moral dimension to their interactions. My violence example goes through because you denied that there is a moral dimension to economic interactions; if there is not, then you can have no objection to violence.

If the way to acquire wealth were currently by physical battles to the death you might have a point. In fact that model worked to a degree in the past. The reason it fails today is much of the wealth generation is understanding and utilizing more than force. You could twist a million heads off a million people and likely not come up with the talent stack that Elon his circle have.

When people live by the rules you're relying on in this exchange for long enough, it always comes down to physical battles to the death. Now, I might agree that's not the best way to generate wealth, sure--but that's not exactly what we're talking about. We're talking about people getting their share of what wealth there is, which is a different point.

As for the Elon-talent thing...you've spoken truer than you purpos'd. I've known quite a few wealthy elite. What I've found is that by and large they are a bunch of dumbasses; they don't work hard, they don't work smart. They play in a rigged game and its made them incompetent. I can think of a few exceptions, but mostly, nah.