- Joined

- Apr 28, 2015

- Messages

- 85,668

- Reaction score

- 72,367

- Location

- Third Coast

- Gender

- Male

- Political Leaning

- Liberal

I did a lot of studying of this last year while I was looking for a new house (which I got under the local market rate due to a paperwork issue, but that's another story for another day).

I would say up until October of 20, most of it was driven by migratory patterns of well paid white collar works who wanted to work from home. After Oct, its turning into FOMO and speculation. My dates are not exact of course, but this is based more on my observation.

Three things are going on right now though -

1. Interest rates have gone up but it does not appear to be lowering demand, but this increase JUST happened, so it may take some time to see that decreased demand in the stats

2. Rental costs are way up

2a. Rental costs being up might be what's driving people towards houses, at least according to the pundits

3. Its hard to get the parts needed to build a house

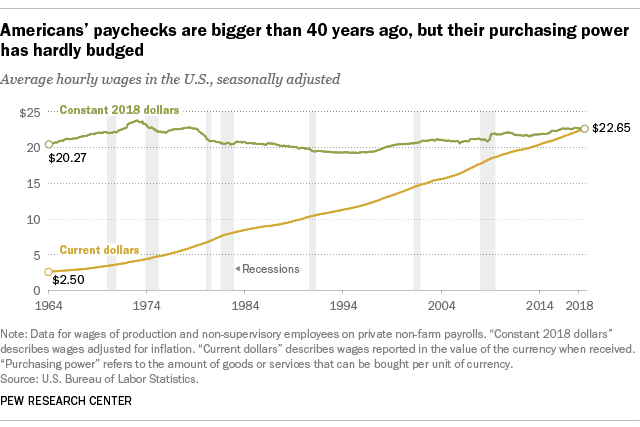

I fear we might see a homelessness crisis soon as rents and mortgages are outpacing people's ability to afford them, now that the flood of work from home people is starting to subside. So my best guess is that the bubble is just now starting for form.

My immediate concern is a 'bubble pop', as we aggressively raise interest rates to try to tame the near runaway inflation we're experiencing.

The economic uncertainty due to the Russia-Ukraine-Europe-NATO situation is also of concern.