- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

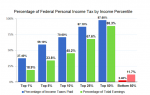

Here is the present Household Income-Distribution chart for the US. The chart is not easy to understand - but this helps - that there are three facts worth noting from that chart:

*6% of all American families earn less than 21K annually!

*The mid-point income for ALL AMERICANS is $49.5K a year.

*The top 10% of families earn salaries beyond (and way beyond) $130K per year.

If there is anything worth noting in that chart (which is not easy to understand), it is that most Americans may not be dirt-poor, but with a median*-income of just less than $50K neither are they "very-well-off".

So, it is up to YOU to decide if that distribution is fair or not - and consider that upper-incomes are no longer taxed at

Note that Median Income means not the average but just half-way up the Income Ladder.

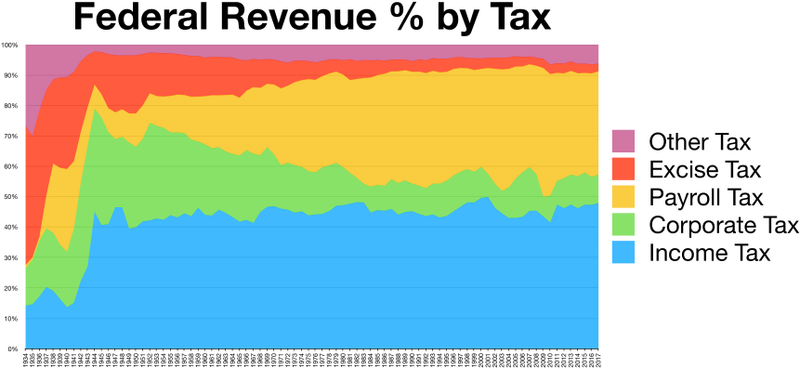

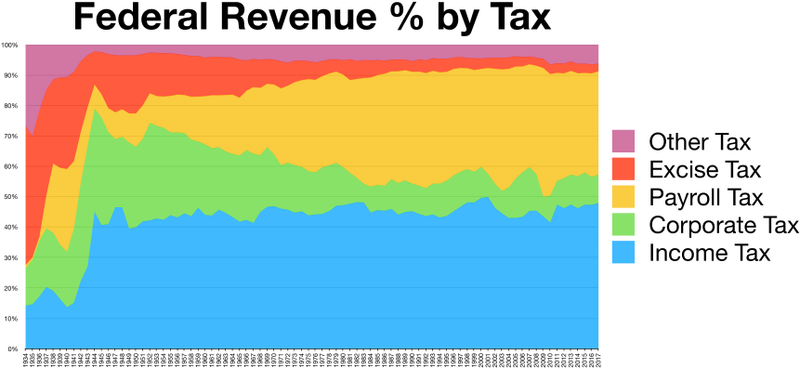

Note further this historical distribution of Federal Income Tax By Type of Tax:

Note that:

*Total Income Taxation has remained fairly constant (at around 45% of Total Revenue) ever since the end of WW2,

*Payroll Taxation has largely supplanted both Corporate- and Excise-Taxation

What do you think about the fairness of that tax-distribution evolution shown above? Why should Corporate Taxation shrink? (To give more of the profits made to Upper Management - that's why!)

*6% of all American families earn less than 21K annually!

*The mid-point income for ALL AMERICANS is $49.5K a year.

*The top 10% of families earn salaries beyond (and way beyond) $130K per year.

If there is anything worth noting in that chart (which is not easy to understand), it is that most Americans may not be dirt-poor, but with a median*-income of just less than $50K neither are they "very-well-off".

So, it is up to YOU to decide if that distribution is fair or not - and consider that upper-incomes are no longer taxed at

Note that Median Income means not the average but just half-way up the Income Ladder.

Note further this historical distribution of Federal Income Tax By Type of Tax:

Note that:

*Total Income Taxation has remained fairly constant (at around 45% of Total Revenue) ever since the end of WW2,

*Payroll Taxation has largely supplanted both Corporate- and Excise-Taxation

What do you think about the fairness of that tax-distribution evolution shown above? Why should Corporate Taxation shrink? (To give more of the profits made to Upper Management - that's why!)