- Joined

- Jan 25, 2010

- Messages

- 35,703

- Reaction score

- 19,313

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

The acceleration of the rate of the aging in China is much higher than in any of those countries.

In 5 years, no country will be aging faster than China.

The economy of china relies on working aged people more than any of the countries you listed.

No one is saying that China is going to collapse in 5 years.

There isn't any way out of what is coming though. They were late in addressing the demographics problem, now they won't be able to avoid a disruption.

The bigger your population is, the more disruptive an aging population is.

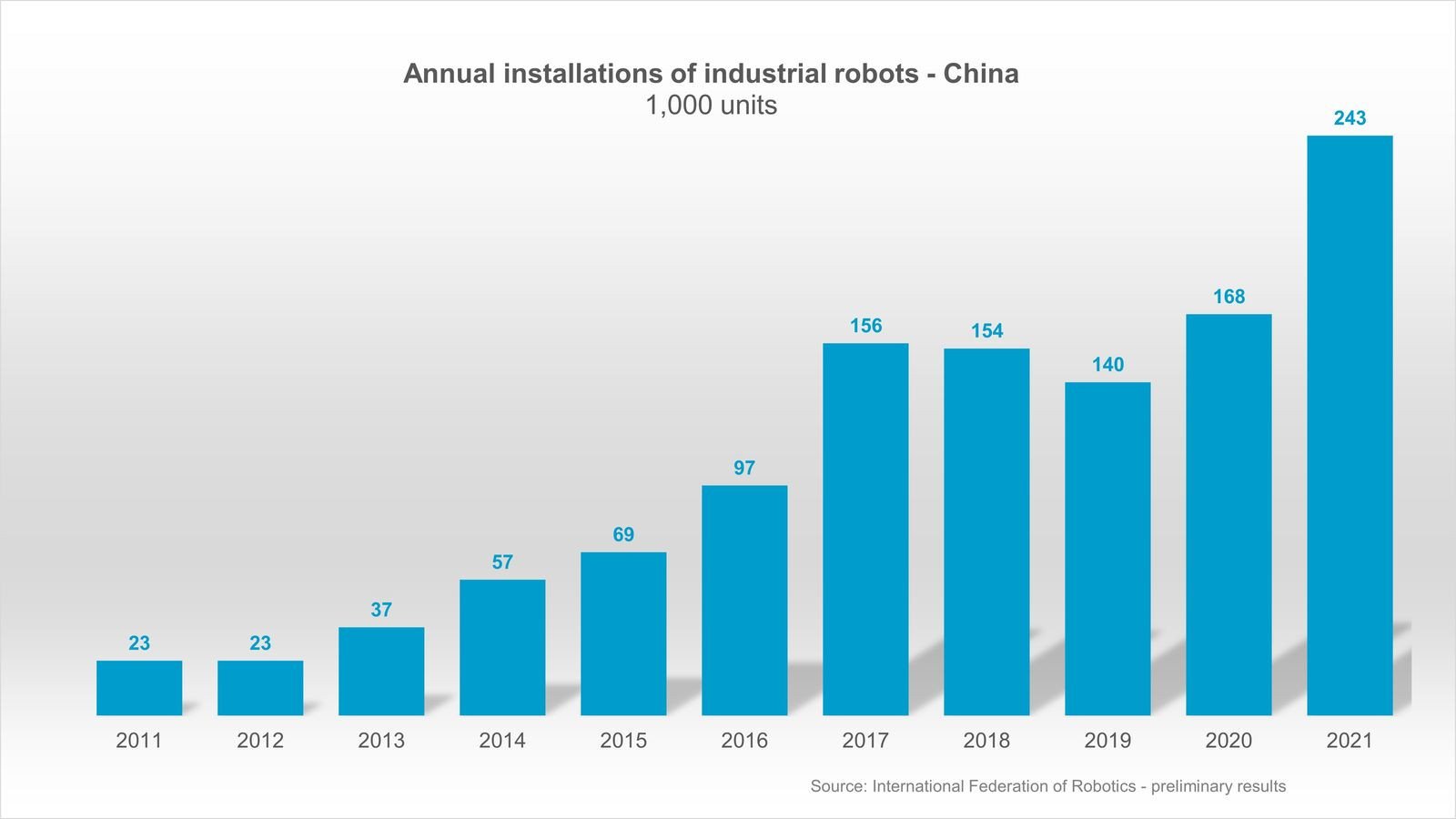

Chins is installing huge numbers of industrial robots. It has the largest number in the world installed and is if i recall correctly the 5th most per capita. It is automating the ports it has and will not need anywhere close to the number of workers to power its industrial output as it did in the past. It is moving up the value chain in manufacturing, which is why the US is now scared.

It will allow more fillipino workers to care for the elderly than Japan or Korea will. If the fillipino workers stay and assimilate culturally they will be accepted as being Chinese, while in Japan or Korea they will not be accepted as Japanese or Korean,

See what happened to ethnic Japanese who moved to Japan from Brazil