More lies.

View attachment 67242781

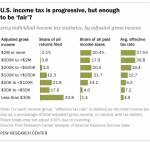

#1 Your middle class tax rate is false.

More like 10%. Middle class from Pew:

#2 The multiplier effect is for practical purposes, independent of the total amount being invested. That you refuse to even guess at the multiplier, is telling.

#3 You are missing the entire other side of the equation. Instead of corporate tax CUTS, there could have been additional taxes on the wealthiest.

Increased tax rate on $500+...another bracket at $1M+, another at $2M+, another at $10M+, etc. You know, progressive taxes.

And yes, those dollar amounts are quite significant. And yes, if given in any way to the broader economy, whether that's through a check to "everyone else", or via goods/services widely distributed and/or infrastructure (You know our roads are important too...not just tanks that never get used...right??)....

So your facts looks wrong, you've dodged again the multiplier difference between cutting corporate tax rates vs giving it (in some way/shape/form) to the <$200K crowd, and you forgot that instead of a corporate tax CUT, they could have added more appropriate progressiveness to the wealthiest American tax brackets.

What's gonna happen?

Corporations are mad at not being richer and all those dollars to sway Republican politicians was a waste, awww.

The wealthiest among us, me included, are a little less wealthy in the coming years. Instead of a yacht, I buy a yacht still because it's not that big of a difference and I'm already wealthy. Oops!

And everyone else, including the infrastructure of the nation, is better off.

And the cherry on top, because of the multiplier you are so scared of, the re-investment of all those dollars from the < $200K crowd back into our economy? Drives the economy greater than the stupid corporate tax cuts.

Where do you think they spend that money...the <$200K crowd? goods/services...it goes right back int the ****ing economy, and all those business owners get business from it to boot.

But keep on lying and showing your'e unable to handle even the most basic economic questions. I didn't throw some complex math problem at you, it was very layman's terms and general (because that's as far as I usually can go), all you had to do was be honest. But you just can't do it can you.

Republicans are typically just like you, 100% full of lies when it comes to the economy.