- Joined

- Jun 3, 2009

- Messages

- 30,870

- Reaction score

- 4,246

- Gender

- Male

- Political Leaning

- Very Conservative

Unfortunately over simplified measures graphed can skew the perspective. A litmus test certainly, but one that needs to be looked at in detail and explained to be understood. Lots of things that effect it from aging population, earners, buying power, more single households…

So adjusted for inflation: 1960 middle class:

$28,500-$84,000 [68%] -> [41% Today]

Today it's

$41,500-122,000 [45%] [sounds bad, but controlled for population growth we've added not substracted people to the middle class since 1960]

With todays middle class range, 47% of those households are duel income. 36% being university educated[46% of total graduates]. Those below: 69% worked part-time and below and 48% were single person households. In the middle class range only 21% of households were single person and 35% worked part-time or below.

My point being. Economically the average family has still been improving even with those negative factors like increase in dual incomes. 80% of American married families are middle class and above, 93% above 1960 cut off. Those below the middle class are majority non-family households and a poor comparison without accounting for some of the factors of why they are there.

In other words:

50% of seniors are below middle class. 65% of single person households. 76% of no earners. 58% of those that didn't work. 40% of those who worked only worked part-time. I would also note 50% of these with these low-incomes are still home owners.

When you control the worst year in post-WWII American History it was early 1980s.

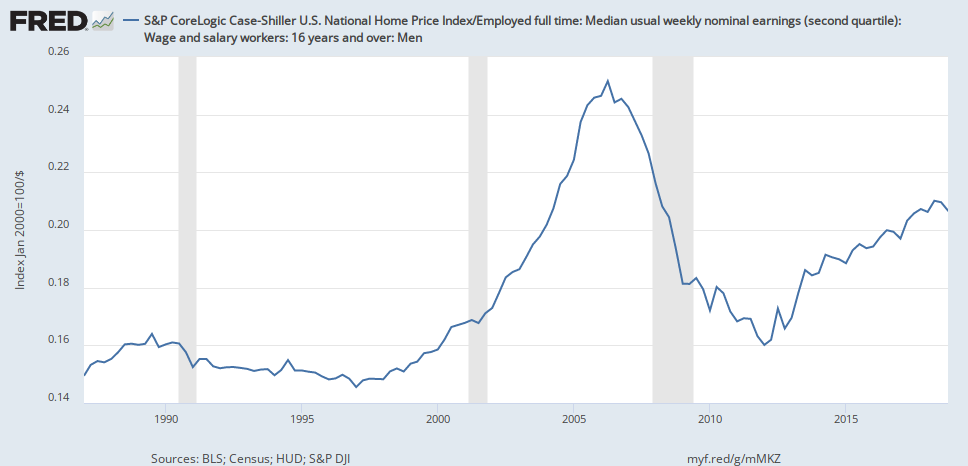

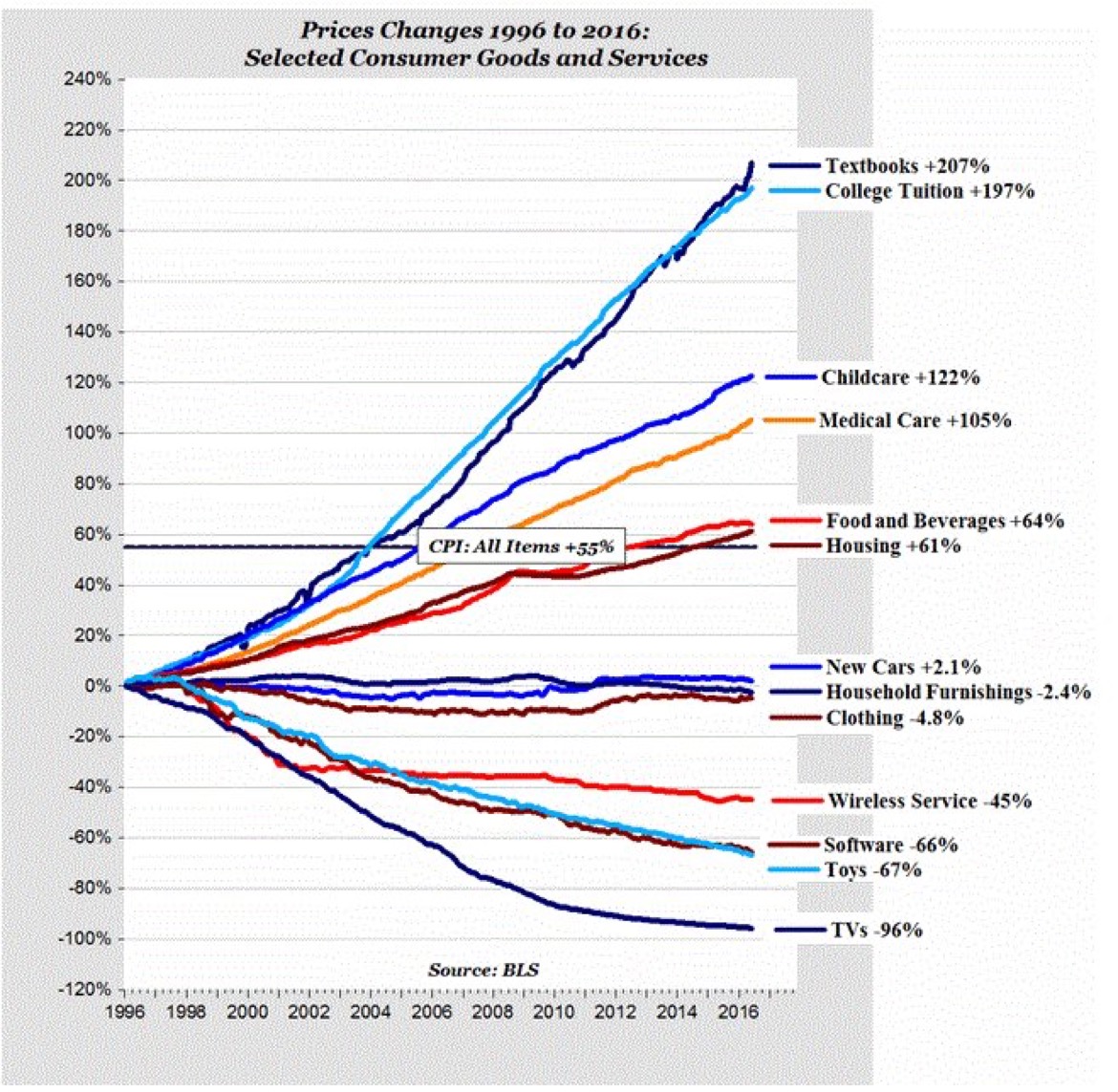

The problem is that you're considering inflation to be the cost of living. There's just one problem: the cost of living has outpaced inflation.

The necessities of life are more expensive, while the toys have become cheaper. That is, the necessities of life were cheaper for those living in the 60s than for the middle class today.

Most opportunities require tech literacy not an advanced education. Tech litercy is freely available via the internet.

That said, I also am also concerned at the trends for both spouses to working and children not getting proper parenting and community. The divorce rate, single partent homes, abortion, debt, drug use, environmental impact, obsiety, depression, non-violent crimnality, no entry level jobs for young adults....

We are far from an ideal or have not progressed without costs. Debt remains the hardest factor to compare and contrast and may including public and private well cancel out all the above stated gains. How do you suppose we account for it though? At this point the public debt falls 90% burden falls on predominately duel income families in the top incomes not equally. Majority of middle class rarely even pays current equal tax bill and carries the majority of the burden in terms of private debt.

'Usury' restrictions, laws and regulations may be a better bet. Wage earners are often doing little else to adapt to rapid economic changes. The fact one's labour was worth x in 1960 and y rather than x+ in 2020 is mostly a result of changing market forces not non-earner manipulation. Market forces benefits are universal by nature but certainly can leave some out. The opposite to market forces is always enforced monopolization(either by public or private actors). You will never stregthen market outcomes by restricting market forces only counterbalancing natural monopolization. If you replace private 'usery' with public taxation you are only shifting the doer not attacking usury within the system.

Taxing earners less may help in the shortterm only to hurt us in the longterm. *cough* pensions *cough*

The public system is the least in check, inflation corrected taxes dollars per citizen have risen every year meanwhile benefits paid out at a much lower rate. Those connected to the top level of the public purse beign the most benefited (hence the lobby industry). It is also entirely funded by wealth transfer. So how does making 'wealth transfer' more public verse private help the average earner? The only way would be if more earner worked for the public which is just more indirect as any benefit above market is just a de-facto subsidy.

I'm not interested in making wealth transfer public versus private. I want to eliminate wealth transfer. Less debt, no debt based currency, and the end of tax subsidies for unearned income.