The tax code shows that the tax rates for all tax payers, me included, were reduced. That is WHY the taxes I paid reduced by 20%.

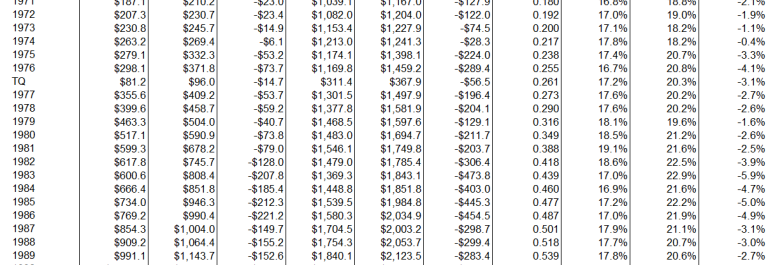

Actual collection of monies by the Feds increased.

Tax rates down resulting in greater take home pay for anyone who was receiving taxable income.

Business activity up resulting in greater tax revenue overall collected in real dollars.

These things happened in the real world which might explain why you missed them.

This article defines and explains the tax reductions of the 2017 Tax Reform in terms that even you might understand:

Trump’s sweeping tax plan permanently extends the federal income tax brackets created during his first term and adds new tax cuts.

smartasset.com

This link shows that the Federally collected tax revenues were up even AFTER the reduced tax rates went into effect.

The federal government generates tax revenue through sources like income and corporate taxes. Learn how much tax revenue the U.S. generates each year.

www.thebalance.com

Is this STILL beyond your grasp?

:max_bytes(150000):strip_icc()/GettyImages-591478749-fb686ce4aa5c4dc1b2ef76949bb8ea81.jpg)