Here's the problem with the 4th Amendment argument: it simply doesn't apply. The tax return itself is a public document, in the possession of a public agency. There is no reasonable

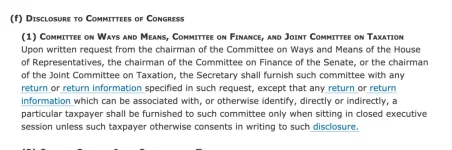

expectation of privacy once it has been sent in. There are statutory expectations, but they only extend as far as the statute itself, which, as noted, has exactly the exception identified earlier. One can't have an expectation of privacy that the statute expressly exempts. Moreover, one

can expect that any number of people would access those documents in their official capacities - as Trump has explicitly acknowledged when he spoke about audits, said he would release them, etc. Among those people with explicit access are prosecutors and legislators.

www.marketwatch.com