- Joined

- Jan 13, 2021

- Messages

- 18,442

- Reaction score

- 4,052

- Location

- Dripping Springs, Texas

- Gender

- Male

- Political Leaning

- Centrist

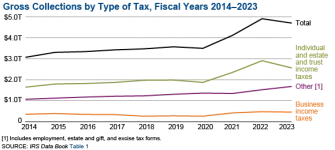

Considering the tax is on Profit/INCOME, likely very little more than they get now.Given how many extremely wealthy we now have in the country, I'm not sure of how much income it would bring in. It might be substantial. I dunno'.

But Trump needs to do this increase to diffuse the traction the Dem talking-point has been getting.

And while Trump may not fear Bernie & AOC personally, I'm sure he sees the crowds they're bringing in.

Too many ways to offset profit, and billionaires taking it as income is even less likely.

:max_bytes(150000):strip_icc()/GettyImages-591478749-fb686ce4aa5c4dc1b2ef76949bb8ea81.jpg)