- Joined

- Dec 20, 2009

- Messages

- 75,687

- Reaction score

- 39,957

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

So, I was trying to decide how to effectively integrate work requirements in order to arrive at the endpoint of A: not punishing the actual single mother due to events outside her control (no policy that does this will pass - or should) while still B) incentivizing marriage and self-improvement.

I decided to use minimum hourly work-requirements.

So, basically: Each Adult (single) is expected to produce 20 hours of work-activity during the average week (the program is run on monthly installments, so this works out to a generalized 80 hours of work a month). A married household, however, is only expected to produce a minimum of 30 per week. This incentivizes marriage with a reduction in work requirements (momma can stay home with the kids while dad picks up another 10 hours somewhere, or any combination therein). Being a Student counts as 10 hours of work every week that you are a student (so, if you take summer months, your work requirements go back to 20), using a reduction in work requirements to incentivize education / self-improvement, the same as we did with marriage (yes, this includes trade school, apprenticeships, and the like). This gets interesting when you see how you change the incentives for education by reducing its costs in terms of lost income, and offers our low-income working classes an easier ramp up.

The reduction in work-measures, however, is more likely to benefit women than men, as women are more likely to prioritize staying home with children, especially when they are young. To incentivize men (and ensure that the plan remained good for single mothers through no honest fault of their own), I added in a child-support component. Because I sat the poverty line at $2500 per kid per year in our initial math, a parent who is not the caregiver loses 50% of the FPL per child from their NIT check/deposit to the caregiver. So (using generalized gender roles, which yes, will be reversed in some situations) just as women can benefit from an increased ability to stay home with their children via marriage, men will be able to enjoy their full benefits, instead of signing them over.

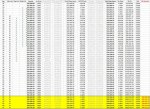

So, a quick example of how these changes would follow a low-income couple with two children who are previously unmarried, and deciding on whether or not to tie the knot would look like:

View attachment 67206533

For each instance, I made the assumption that the individuals involved would only be doing the bare minimum necessary to get government assistance.

Fusing this with my http://www.debatepolitics.com/polls/85770-social-security-fix.html]Social Security Proposal[/url] for a man who

Begins working at age 18 making the minimum wage.

Has a child out of wedlock at age 20

Gets married at age 24

Has two children within the marriage

See's a Rate of Return of 6%

total over the lifetime looks like: