- Joined

- Dec 20, 2009

- Messages

- 75,666

- Reaction score

- 39,922

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

Alright, I gave up on trying to recreate family structure inside of the income statistics, and finally just went ahead and assigned the standard sized family equally to all income strata. That's the biggest methodology criticism I have off the top of my own head for this work. but here it is.

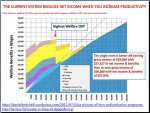

Currently, the tax and welfare structure of this nation are costly and self-destructive. They represent needless harm that we as a people inflict upon ourselves, and worst, they disproportionately harm those in our society who are most vulnerable. In order to achieve the goal of a tax/welfare reform effort that accomplishes the three goals laid out:

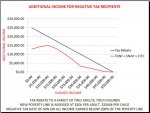

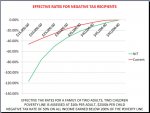

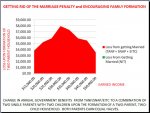

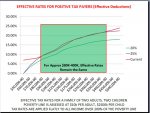

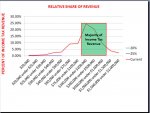

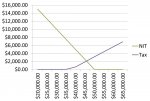

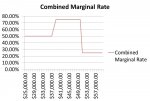

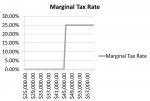

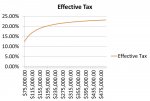

I propose the following: TANF, SNAP, and the EITC will be replaced with a negative income tax of 50% on all income not earned below 200% of the poverty line, with a simple poverty line of $5K per adult and $2500 per child being assigned. If you earn precisely zero dollars, then you are raised precisely to the poverty line - in this manner we can ensure that not a single man, woman, or child in the United States lives in poverty. In addition, a 25% flat tax should be applied to all income earned over 200% of the poverty line. This will make the actual effective tax rate perfectly progressive. Instead of our current system, in which the marginal tax rate on each dollar earned between $218,000 and $388,000 is flat, with the perfectly progressive flat tax, the effective rate increases for each dollar earned, as that is a dollar further away from the 200% of the poverty line. I have run the figures and created the presentation below on the effects, comparing a perfectly progressive flat tax of 20% to a perfectly progressive flat tax of 25%, to the current system.

SOURCES:

TANF Calculator: TANF Calculator

EITC Calculator: Earned Income Tax Credit Calculator

SNAP Calculator: https://dss.sc.gov/content/customers/food/foodstamp/foodstampcalc.aspx

Effective Tax Rates: Warren Buffett’s Tax Story Is Bogus | Cato @ Liberty

Negative Effective Tax Rates: Free 2011 Tax Estimator & Tax Return Calculator - H&R Block®

Current Poverty Line: http://coverageforall.org/pdf/FHCE_FedPovertyLevel.pdf

Population and Income Data derived from the US Census

Program Cost derived from 2012 Budget Proposal

Currently, the tax and welfare structure of this nation are costly and self-destructive. They represent needless harm that we as a people inflict upon ourselves, and worst, they disproportionately harm those in our society who are most vulnerable. In order to achieve the goal of a tax/welfare reform effort that accomplishes the three goals laid out:

1. It should not place undue burden on the poor or provide them with incentives to engage in self-destructive behavior.

2. It should retain a progressive approach while eliminating the ability of politicians to take advantage of it to set bloc against bloc in a cynical search for power, and

3. It should encourage growth that raises all boats and provides opportunities especially to the poor to escape their station.)

2. It should retain a progressive approach while eliminating the ability of politicians to take advantage of it to set bloc against bloc in a cynical search for power, and

3. It should encourage growth that raises all boats and provides opportunities especially to the poor to escape their station.)

I propose the following: TANF, SNAP, and the EITC will be replaced with a negative income tax of 50% on all income not earned below 200% of the poverty line, with a simple poverty line of $5K per adult and $2500 per child being assigned. If you earn precisely zero dollars, then you are raised precisely to the poverty line - in this manner we can ensure that not a single man, woman, or child in the United States lives in poverty. In addition, a 25% flat tax should be applied to all income earned over 200% of the poverty line. This will make the actual effective tax rate perfectly progressive. Instead of our current system, in which the marginal tax rate on each dollar earned between $218,000 and $388,000 is flat, with the perfectly progressive flat tax, the effective rate increases for each dollar earned, as that is a dollar further away from the 200% of the poverty line. I have run the figures and created the presentation below on the effects, comparing a perfectly progressive flat tax of 20% to a perfectly progressive flat tax of 25%, to the current system.

SOURCES:

TANF Calculator: TANF Calculator

EITC Calculator: Earned Income Tax Credit Calculator

SNAP Calculator: https://dss.sc.gov/content/customers/food/foodstamp/foodstampcalc.aspx

Effective Tax Rates: Warren Buffett’s Tax Story Is Bogus | Cato @ Liberty

Negative Effective Tax Rates: Free 2011 Tax Estimator & Tax Return Calculator - H&R Block®

Current Poverty Line: http://coverageforall.org/pdf/FHCE_FedPovertyLevel.pdf

Population and Income Data derived from the US Census

Program Cost derived from 2012 Budget Proposal

Last edited: