Principal repaid on debt?

Yes, that's what you wrote.

Where did you come up with that number?

And if interest rates rise to what they were in the late 70's again?

Seriously? We're supposed to base trillions in fiscal policy based on something that almost certainly isn't going to happen? Why not throw in a hypothetical nuclear war, or alien invasion?

Interest rates soared in the late 70s and early 80s because Volcker was trying to tame inflation. The chances that we will hit 11-15% inflation any time soon is, to put it mildly,

highly unlikely.

I'd add that in 2019, you could have asked "what if we get slammed by a pandemic that shuts down 25% of the economy?" Guess what? We're borrowing to do a stimulus, and it hasn't destroyed the economy. It's saving it instead. Who'da thunk it? Oh, I know -- all the economists who know that the time to spend is during a downturn, and that federal debt isn't a real problem.

I agree, government benefits, but it's time the people began to benefit instead of the government.

Your argument makes no sense.

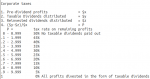

The government benefits from borrowing while interest rates are low. But if the government charges itself a higher rate of interest,

it's still coming from tax revenues and borrowing.

We can't just slap a 30% tax increase on corporations and expect nothing to change. At a minimum, lower profits mean lower stock prices; companies will also be less able to buy back stock. Some of that will come out of cost savings, which means cutting jobs, and chances that C suites will cut

their pay is low. Some companies will need to raise prices, and guess who that hurts?

Again, what can we cut? 70% of spending is Social Security, Medicare, Medicaid, Defense, and interest. We can't just do a 25% across-the-board cut. Whatever you cut will mean lost jobs.

You claim you want to prevent economic pain. But you're also talking about increasing tax revenues by at least 30% and/or cutting spending by 25%, actions which in and of themselves will

cause the economic pain you want to avoid.

The problems are being passed on to each following generation.

And again I ask...

What problems? Deficit hawks have screamed about these problems for 40 years.

Where are the problems? Everything suggested is hypothetical, and one of them (Social Security revenues not meeting outlays) isn't caused by federal debt in the first place! Why aren't they happening now? I just... I just really don't get it.

When a growing majority of the people are becoming made dependent on government, they're less likely to be concerned about federal spending and debt during their lifetime, as they're leaving the costs to future generations.

Uhm... Didn't you

just say that you wanted to leave partisanship out of it?

Citizens left the debts of the 80s to today. Are we getting killed by it? Nope.

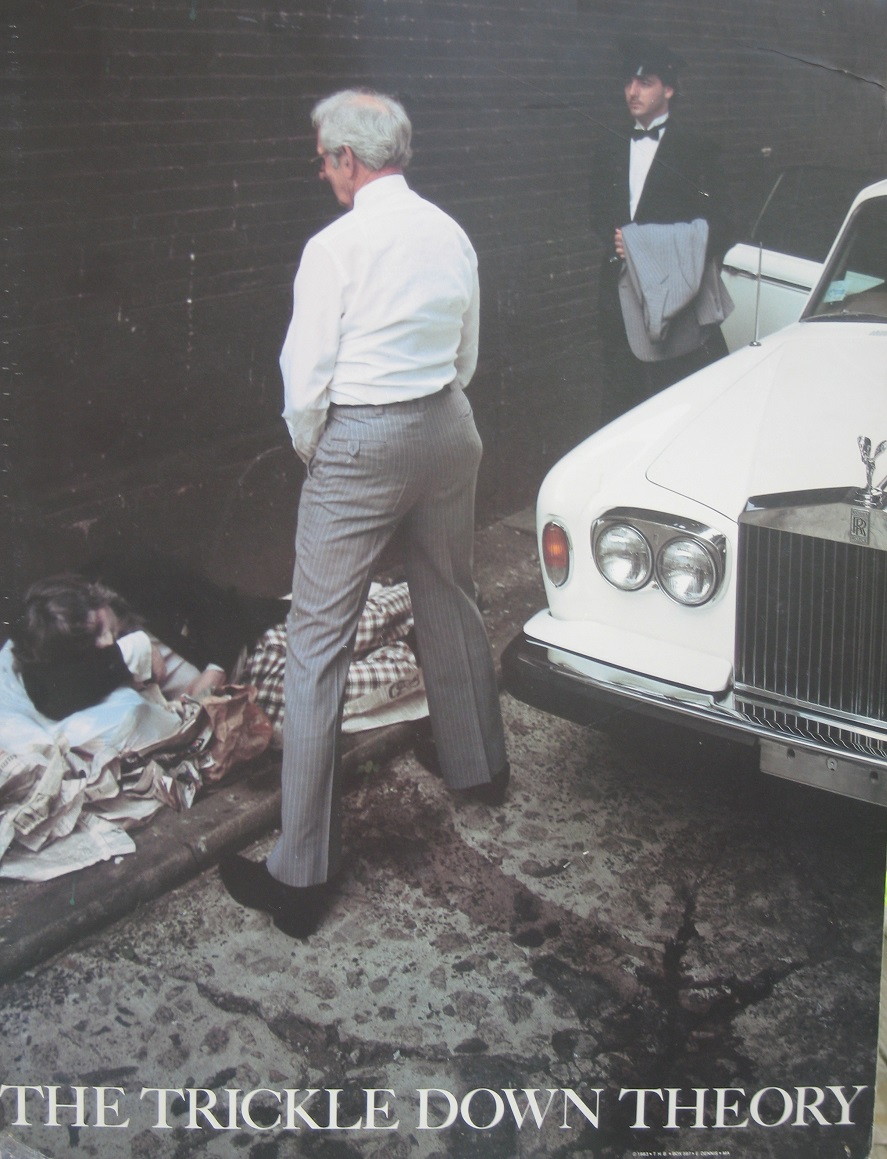

The government isn't making anyone depend on government. Corporations and the wealthy are the ones doing that.

Corporations resist minimum wage hikes, even something as simple as indexing the MW to inflation. They essentially demand an annual erosion in wages.

Corporations condemn unions, even though despite their flaws, unions help keep wages up and protect worker's rights.

Corporations are more than happy to automate or offshore manufacturing. Obviously this means fewer US jobs, and less opportunity for low-skilled workers.

That means more people need to attend college or university. Since government doesn't subsidize that, it means millions of people wind up owing trillions to banks and other lenders -- and that's a debt that cannot be erased via bankruptcy.

And of course, both corporations and the wealthy have decided to die on a hill rather than pay more in taxes.

I assure you, I could go on. The problem isn't that "people might become dependent!" Most people want to work and earn their own way. The problem is that the plutocrats have warped the system in their favor, so that lots of people don't have much of a choice.