- Joined

- Jul 26, 2005

- Messages

- 6,991

- Reaction score

- 1,582

- Gender

- Male

- Political Leaning

- Undisclosed

How many people do they have on welfare and food stamps?

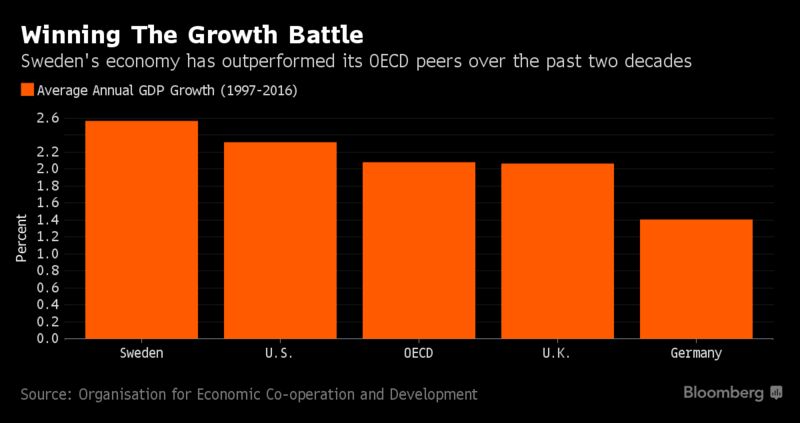

Probably less than USA for example USA have an employment rate of 69.5 percent compared to Sweden that have an employment rate of 76.4 percent.

https://data.oecd.org/emp/employment-rate.htm

Also thanks to collective agreements Swedish workers have gotten real wages increases during the last couple of decades compared to Americans workers that gotten stagnated or even declining wages. While in Sweden the wages are also higher for low wage workers thanks to strong unions and collective agreements. So, we have less working poor.

Swedish workers also have more financial security through unemployment insurances and health insurance so workers can get up to 80 percent of their salaries if they get unemployment, sick or injured. There Swedish workers have paid into those insurances through their salaries and then it comes to unemployment insurance also by a monthly fee.

Last edited: