- Joined

- Dec 20, 2009

- Messages

- 81,900

- Reaction score

- 45,019

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

This is depressing.

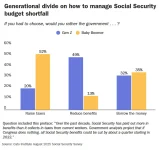

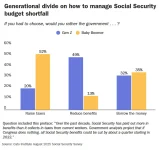

That's interesting. So is the Generational Divide:

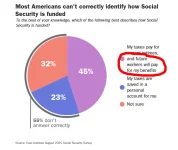

55% of Americans don’t know how Social Security is funded

...A majority of Americans (55%) believe the main purpose of Social Security is to replace seniors’ income. Less than half, 45%, believe the program is to ensure that seniors don’t fall below the poverty line, which is how the program was originally intended. ... An overwhelming majority of nonretired adults (79%) do not believe they will receive their full scheduled Social Security benefits when they retire. About one in ten (13%) go even further, saying they expect to receive nothing at all. ...

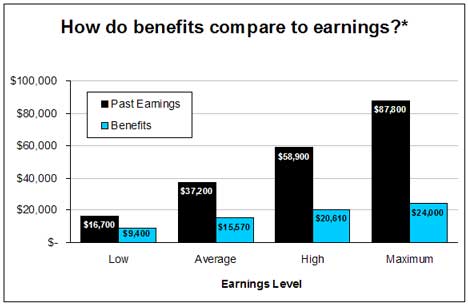

Most (60%) understand that workers who paid more into Social Security get higher benefits than those who paid in less. Fifteen percent think all retirees receive the same benefit, and 25% aren’t sure. However, there are considerable knowledge gaps pertaining to the actual amounts disbursed. Ninety-one percent of Americans did not know that the highest annual Social Security benefit can reach $60,000 a year. When it comes to estimating the average benefits Americans receive, only 25% correctly answered that the average benefit is $20,000–$29,000 per year.....

To avoid tax hikes or benefit cuts, a plurality (38%) of Americans would support switching to a flat Social Security benefit of about $1,800 a month for all retirees regardless of their prior earnings. This would require lowering benefits for high earners and increasing benefits for low earners compared to what they get now. A little more than a quarter (28%) would oppose this change, and 34% aren’t sure either way. Support declines when framed in terms of equality of benefits. Slightly more oppose (35%) than support (32%) switching to a flat monthly benefit when framed as giving everyone the same benefit regardless of how much they contributed to the system. The results suggest Americans may be open to replacing Social Security’s earnings-based formula with a flat benefit for all. However, support for this change appears conditional; many are skeptical unless the alternative is broad benefit cuts or tax increases.....

...A majority of Americans (55%) believe the main purpose of Social Security is to replace seniors’ income. Less than half, 45%, believe the program is to ensure that seniors don’t fall below the poverty line, which is how the program was originally intended. ... An overwhelming majority of nonretired adults (79%) do not believe they will receive their full scheduled Social Security benefits when they retire. About one in ten (13%) go even further, saying they expect to receive nothing at all. ...

Most (60%) understand that workers who paid more into Social Security get higher benefits than those who paid in less. Fifteen percent think all retirees receive the same benefit, and 25% aren’t sure. However, there are considerable knowledge gaps pertaining to the actual amounts disbursed. Ninety-one percent of Americans did not know that the highest annual Social Security benefit can reach $60,000 a year. When it comes to estimating the average benefits Americans receive, only 25% correctly answered that the average benefit is $20,000–$29,000 per year.....

To avoid tax hikes or benefit cuts, a plurality (38%) of Americans would support switching to a flat Social Security benefit of about $1,800 a month for all retirees regardless of their prior earnings. This would require lowering benefits for high earners and increasing benefits for low earners compared to what they get now. A little more than a quarter (28%) would oppose this change, and 34% aren’t sure either way. Support declines when framed in terms of equality of benefits. Slightly more oppose (35%) than support (32%) switching to a flat monthly benefit when framed as giving everyone the same benefit regardless of how much they contributed to the system. The results suggest Americans may be open to replacing Social Security’s earnings-based formula with a flat benefit for all. However, support for this change appears conditional; many are skeptical unless the alternative is broad benefit cuts or tax increases.....

That's interesting. So is the Generational Divide: