- Joined

- Feb 3, 2016

- Messages

- 43,134

- Reaction score

- 16,114

- Gender

- Undisclosed

- Political Leaning

- Libertarian - Right

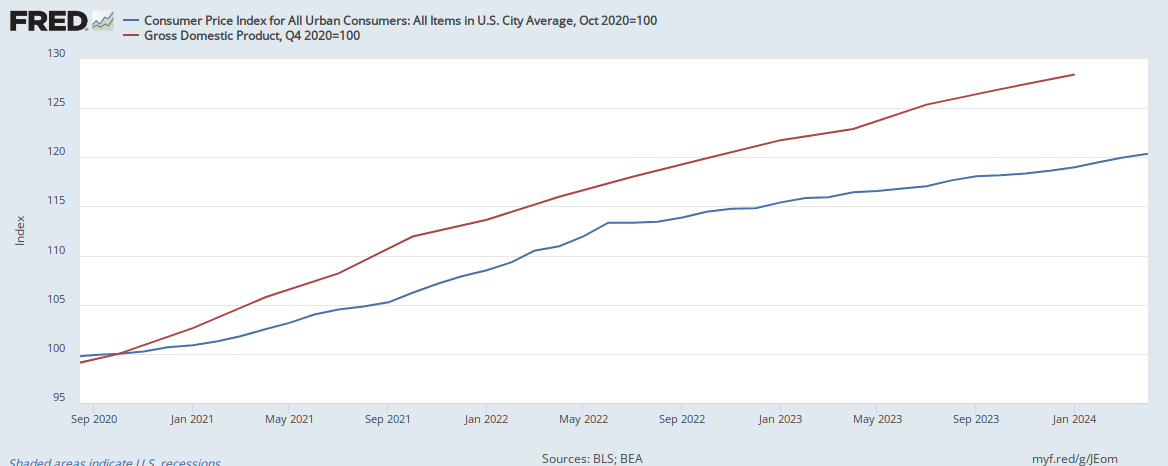

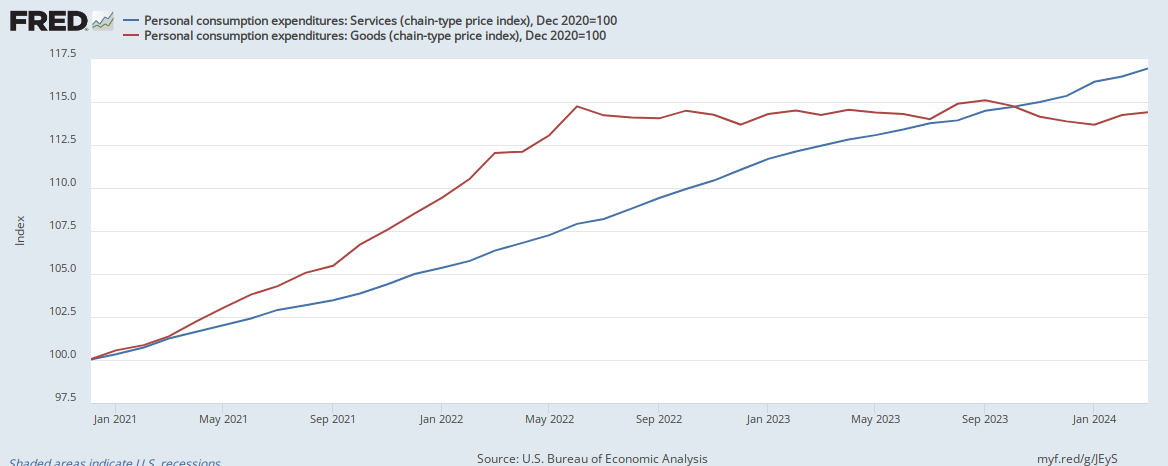

That's one prediction you're trying to turn into three, and we have had inflation. Paul didn't take into account that our status in the world, and our dollar used as a global currency, keeps our dollar artificially propped up. His point would be correct outside of that variable. We'd be 100% ****ed into the ground if the world significantly moved away from trading in dollars. If we were more self contained, as Zimbabwe is, then we actually would be them....no, what I'm doing is describing the actual processes that the federal government and Federal Reserve engaged in over the past two years.

You apparently have the US confused with Zimbabwe.

I'd also add that money which doesn't exist can't cause inflation because... it doesn't exist.

**bzzt** wrong. They're well aware that if a government actually does generate currency and uses it to purchase goods and services, that's going to cause inflation. That is exactly what happened in Zimbabwe -- and it didn't cause 6% YoY inflation, it caused 800% YoY inflation.

Keynesians are also aware that there are enormous deflationary pressures during a downturn. Thus, policies that might normally cause some inflation are actually countering the deflationary pressures.

They're also aware that the anti-Keynesians keep predicting

Such as.... the decade plus where Ron Paul predicted hyperinflation, and it didn't happen?

What did Ron Paul predict in 2002, over the next "5 to 10 years?"

An international dollar crisis will dramatically boost interest rates in the United States.

Price inflation, with a major economic downturn, will decimate U.S. Federal Government finances, with exploding deficits and uncontrolled spending.

Federal Reserve policy will continue at an expanding rate, with massive credit expansion, which will make the dollar crisis worse. Gold will be seen as an alternative to paper money as it returns to its historic role as money.

Ron Paul's Predictions - LewRockwell

Predictions by Congressman Ron Paul, MD Our government intervention in the economy and in the private affairs of citizens, and the internal affairs of foreign countries, leads to uncertainty and many unintended consequences. Here are some of the consequences about which we should be concerned. I...www.lewrockwell.com

3 concrete predictions, all consistent with Ron Paul's views, all dead wrong. (That article, by the way, is jam-packed with failed predictions.)

Back in the real world, Krugman is generally pretty accurate -- and unlike the inflation hawks who keep getting it wrong, he actually admits it when his predictions are wrong.

Paul predicted the housing market crash long before others did.

Paul Krugman Admits He ‘Got Inflation Wrong’ But Stands by ‘Transitory’ Narrative

Economists on the Run

Paul Krugman and other mainstream trade experts are now admitting that they were wrong about globalization: It hurt American workers far more than they thought…