LOL... the only revisionism is being pushed by Conservatives.

5 Reasons Why Supply-Side Economics Does Not Work

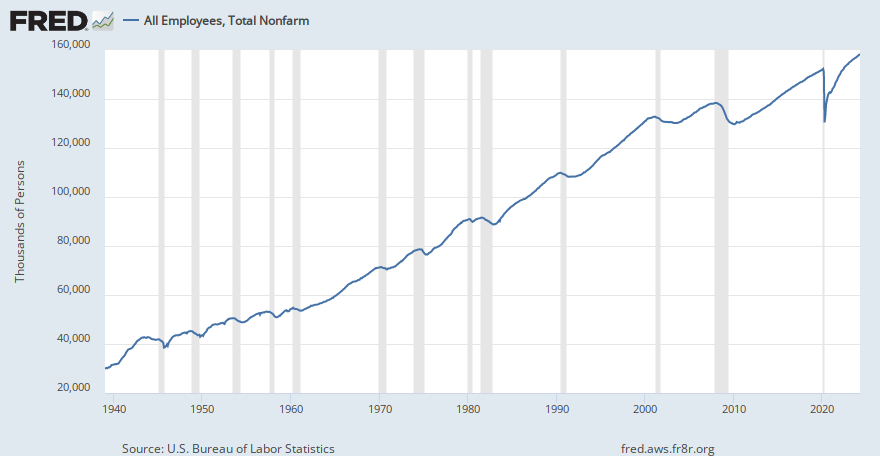

If companies are taxed less, they’ll use their excess savings to employ more staff, supply-siders argue. The problem is that there isn’t a lot of evidence to back that up. From 1982 to 1989, when the United States was governed by Reagan and taxes were cut substantially, the labor force didn’t grow anymore than previously.

Data supporting the popular opinion that lower taxes on the rich spur more investment is also hard to come by. In fact, the Center for American Progress, citing figures from the U.S. Bureau of Economic Analysis, said that average annual growth in nonresidential fixed investment was significantly higher in the non-supply-side 1990s than in the Reagan and Bush decades.

Ironically, in the 1990s, the tax rate for higher earners was raised.

...quickly proved that this statement isn’t based on factual data and that productivity growth actually had been in decline since World War II. According to Roubini, the annual growth rate of productivity hovered around 1.1% from 1973 to 1997 and didn’t change course during the 1980s.

All of the above serves as a reminder that supply-side economics doesn’t always achieve what its advocates say it does and is by no means a guarantee for economic growth. Often, supply-siders point to the 1980s as evidence that these policies engineer economic turnarounds. However, as Roubini points out, the pickup in growth exhibited from 1983 to 1989 came after a severe recession and was nothing out of the ordinary.

More evidence that traditional supply-side policies don’t lift economies was discovered in Kansas. In 2012 and 2013, lawmakers there cut the top rate of the state’s income tax by almost 30% and the tax rate on certain business profits to zero in a desperate bid to energize the local economy. That experiment lasted about five years and didn’t go well, with Kansas’ economy underperforming most neighboring states and the rest of the nation during that period.

In fact, data shows that budget deficits exploded during Reagan’s era of tax cuts. According to the New York University Stern School of Business, the public debt-to-gross domestic product (GDP) ratio rose to 50.6% in 1992 from 26.1% in 1979.

The National Bureau of Economic Research (NBER) similarly shot down talk of tax cuts paying for themselves. Based on its estimates, for each dollar of income tax cuts, only 17 cents will be recovered from greater spending.