washingtonpost.com

Inflation In Sept. Highest Since '80

Federal Benefits To Rise Up to 4.1%

By Nell Henderson

Washington Post Staff Writer

Saturday, October 15, 2005; A01

Hurricanes Katrina and Rita helped make energy prices soar in September at the fastest rate on record, contributing to the highest monthly consumer price inflation in 25 years, the government reported yesterday.

The inflation spike means payments to millions of Americans receiving Social Security and other federal benefits will rise next year by the largest amount since 1991, because of automatic cost-of-living adjustments.

However, average wages for most workers have risen more slowly than prices over the past 12 months, leaving workers with less spending power than a year earlier.

Energy prices have eased a bit this month and other prices show no sign of breaking out of control, analysts said. The worst monthly inflation increase in a generation does not signal a return to the economic turbulence of the 1970s and early '80s, with double-digit inflation and interest rates. Global competition and a vigilant Federal Reserve should prevent that, they said.

But consumers will probably have to live with higher prices and rising interest rates for months to come. That mixture, at a time when household debt is high and savings are low, is already slowing economic growth, several analysts said.

"I don't think these high energy prices are going away anytime soon," said Richard A. Yamarone, director of economic research at Argus Research Corp. That leaves households with less money to spend on other things, when many non-energy companies are trying to raise their prices, he said. "Consumers are pulling back."

Consumer prices rose 1.2 percent last month and 4.7 percent in the 12 months that ended in September, according to the Labor Department's consumer price index. That was the biggest monthly advance since March 1980, and the steepest annual rise since May 1991.

The CPI increase primarily reflected energy prices, which rose 12 percent last month -- the biggest monthly increase since the government began collecting such data in 1957.

Energy prices have been rising for more than two years as the global demand for oil has grown and supplies have remained tight. Prices spiked in September after the Gulf Coast hurricanes shut down and disabled oil rigs, refineries and pipelines. Much of the lost production has been restored. Meanwhile, the government warned last week that high natural gas prices will push household heating bills up this winter.

The federal government automatically adjusts many benefit payments to help recipients keep up with inflation. For example, Social Security payments to more than 50 million retired and disabled workers will rise 4.1 percent in January. For senior citizens enrolled in Medicare, part of their increase will be consumed by rising health insurance premiums, which are deducted from Social Security checks.

Millions of recipients of other federal benefits -- including military, Foreign Service and civilian federal retirees -- also will receive a cost-of-living adjustment, known as a COLA, in their monthly checks.

The annual COLA is one of the foundations of the Washington-area economy. More than 327,000 civil service retirees and spouses of deceased retirees and more than 174,400 military retirees live in the District, Maryland and Virginia. Nationwide, there are about 2.4 million civil service retirees and about 1.9 million military retirees.

The size of the annual COLA is based on the change in a variation of the CPI over the federal fiscal year, which ended Sept. 30.

But most U.S. workers don't get automatic cost-of-living adjustments to their pay. After taking inflation into account, average weekly wages for production and non-managerial workers -- who make up more than 80 percent of the workforce -- fell 1.2 percent last month, the Labor Department said in a separate report. Those earnings bought 2.7 percent less than they did a year earlier, after adjusting for price increases.

The figures released yesterday revealed the steepest annual decline in average hourly and weekly wages, adjusted for inflation, since the early 1990s, said Jared Bernstein, senior economist at the Economic Policy Institute.

"We are in the midst of a protracted wage slump," Bernstein said, noting that pay increases are not pushing up inflation now as they did in past decades.

In the 1970s, when more workers belonged to unions and had COLA clauses in their contracts, higher oil prices did cause wages to rise, which propelled more price increases. But since the early 1980s, there has been "no evidence of pass-through" from energy prices to prices other than those for food and energy, Janet L. Yellen, president of the Federal Reserve Bank of San Francisco, said in a recent speech.

"Unacceptably high inflation remains just a risk, not the most likely outcome," she said.

So far, most businesses are not passing on their energy costs by raising other prices, the CPI report showed. The so-called core-CPI, which excludes food and energy prices, rose just 0.1 percent for the month and 2 percent over the past year.

Prices rose in September for food, housing, medical care, new cars and education, while declining for clothing, hotel rooms, personal computers and rental housing.

But several companies, including consumer-product giants Clorox Co., Procter & Gamble Co. and Kimberly-Clark Corp., have announced plans to raise prices next year, Yamarone said.

And consumer expectations of future inflation rose again this month, the University of Michigan reported yesterday. Fed policymakers worry that higher inflation expectations might cause shoppers to accept higher prices, allowing them to take off.

The Fed cannot "let the inflation virus infect the blood supply and poison the system," Richard W. Fisher, president of the Federal Reserve Bank of Dallas, said in a speech last week.

Fed officials have said they probably will keep raising interest rates in coming months to keep inflation down. Higher rates dampen borrowing and spending, slowing economic growth and making it harder for businesses to raise prices.

The central bank raised its benchmark short-term rate to 3.75 percent last month. Fed officials have not said how high the rate will go, but many analysts and investors think it will rise to around 4.5 percent early next year.

Yamarone said he doesn't think inflation will rise out of control. But, he said, "if we have a very cold winter, we're in for very stormy economic times."

© 2005 The Washington Post Company

this report from the washington post describes a very poor situation coming up in dec.

one that will need quite a bit of borrowing so I doubt the debt cancelation would help

It looks like consumers are pulling back is a poignant remark.

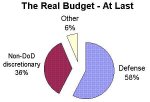

meanwhile Defense spending isnt suffering none

http://www.washingtonpost.com/wp-dyn/content/article/2005/10/14/AR2005101400510_pf.html