- Joined

- Dec 5, 2015

- Messages

- 30,339

- Reaction score

- 7,122

- Location

- Washington

- Gender

- Male

- Political Leaning

- Independent

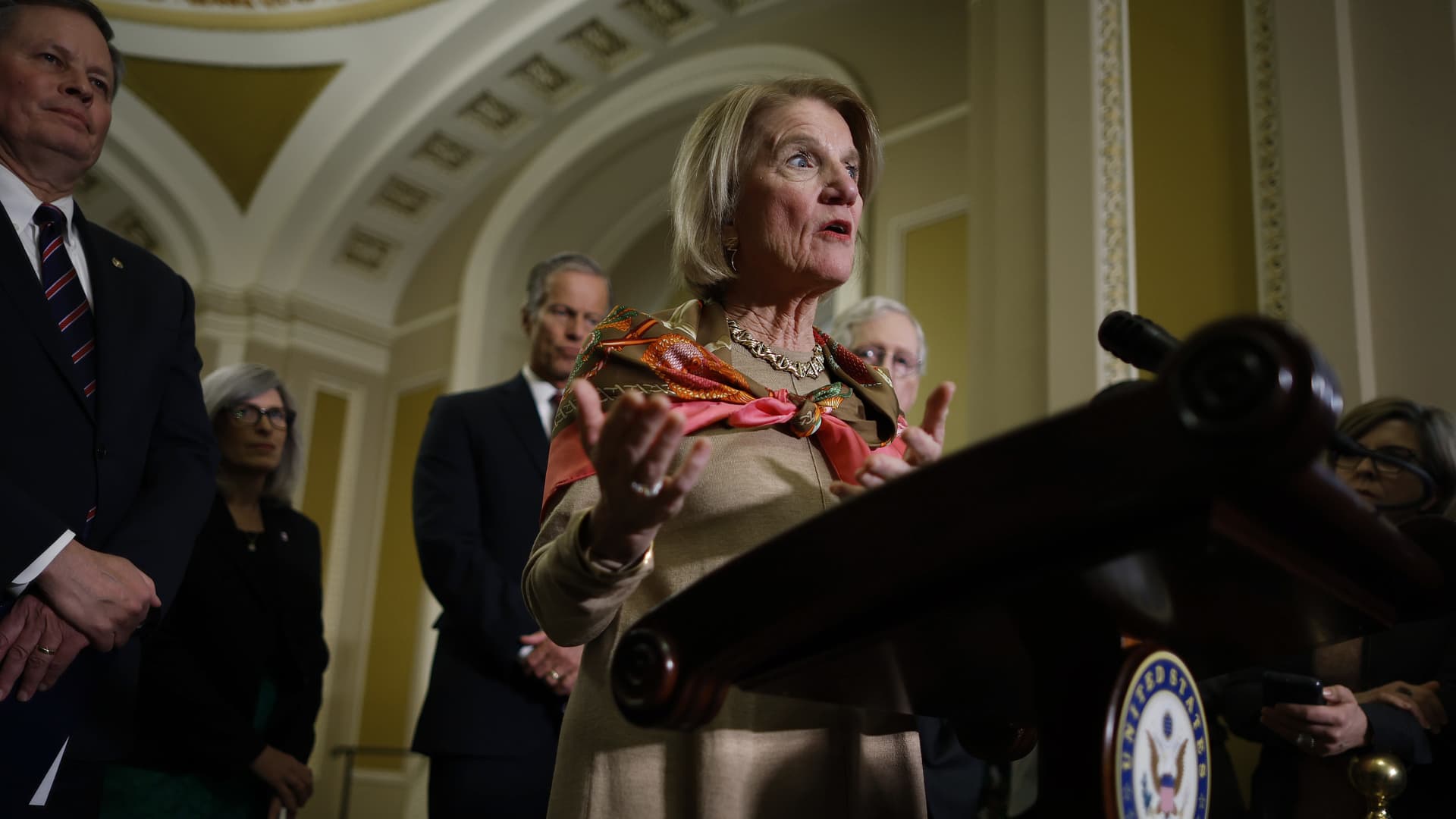

The Senate on Wednesday voted to overturn a Labor Department rule that permits fiduciary retirement fund managers to consider climate change, good corporate governance and other factors when making investments on behalf of pension plan participants.

The final vote in the Senate was 50-46, with two Democratic senators crossing party lines to support the repeal bill: Sen. Joe Manchin of West Virginia and Sen. Jon Tester of Montana. Both are up for reelection next year in conservative-leaning states.

President Joe Biden said Monday that he will veto the Senate bill if it comes to his desk — the first veto of his presidency.

Senate overturns federal rule on ESG investments, Biden vows to veto

President Joe Biden has said he plans to issue the first veto of his presidency.

The entire ESG movement is a fraud. Consider the leading company in the S&P 500 ESG Index (SPXESUP) is.... Exxon, yet Tesla an EV company gets dropped from the index

In no way should fund managers consider social issues and governance in regard to investing. That is just stupid.

:max_bytes(150000):strip_icc()/senior-couple-using-tablet-on-couch-at-home-916125224-b93c19d6deec423d9ea380e684c3a880.jpg)