-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

First Quarter GDP Revised Down To 1.8%

- Thread starter Bronson

- Start date

- Joined

- Jun 13, 2012

- Messages

- 3,195

- Reaction score

- 1,192

- Gender

- Undisclosed

- Political Leaning

- Libertarian - Right

No, it was to provide enough liquidity to avoid the liquidationist mentality to take hold and to provide stimulus.

It's done nothing but added trillions in debt and killed job growth

Trillions in more debt is the natural result of going into a severe recession. The economy is much better than it was during the dark days of 2008 and 2009. Public debt is not the be all/end all determination of a better economy.

5+ trillion in a little more than 4 years? If you want to claim the economy is better than a few months in late 2008 and early 2009 ... yea I guess but that's not really saying much, especially when you compare this recovery to past recoveries.

- Joined

- Nov 8, 2006

- Messages

- 13,406

- Reaction score

- 8,258

- Location

- Milwaukee, WI

- Gender

- Male

- Political Leaning

- Undisclosed

Honestly I don't think this is a big deal. What this means is that QE will most likely be extended, and asset purchases might even be increased, but doesn't signify anything catastrophic. It just means that the economy isn't recovering as quickly as hoped.

The auto and housing markets are coming back pretty strongly, which are leading indicators.

Debt doesn't matter, and doesn't kill job growth.

The auto and housing markets are coming back pretty strongly, which are leading indicators.

Debt doesn't matter, and doesn't kill job growth.

- Joined

- Jan 2, 2006

- Messages

- 28,177

- Reaction score

- 14,273

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

It's done nothing but added trillions in debt and killed job growth

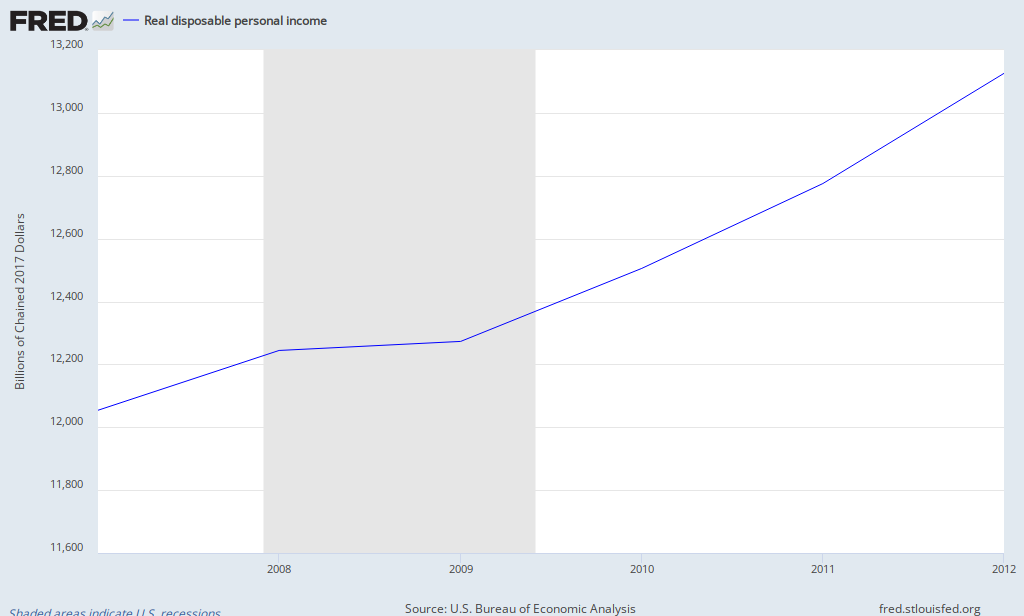

The data shows a different reality:

etc....

5+ trillion in a little more than 4 years? If you want to claim the economy is better than a few months in late 2008 and early 2009 ... yea I guess but that's not really saying much, especially when you compare this recovery to past recoveries.

When was the last time the U.S. experienced a severe financial crisis, not just a recession?

Hint: you have to go back before WWII.

- Joined

- May 22, 2012

- Messages

- 16,875

- Reaction score

- 7,666

- Location

- St. Petersburg

- Gender

- Male

- Political Leaning

- Libertarian

The bottom occurred at the end of the first quarter of 2009.

I am talking about the bubble of QE and Keyenistic spending.

- Joined

- Nov 8, 2006

- Messages

- 13,406

- Reaction score

- 8,258

- Location

- Milwaukee, WI

- Gender

- Male

- Political Leaning

- Undisclosed

I am talking about the bubble of QE and Keyenistic spending.

There is no "QE bubble" and I have no idea what "Keyenistic spending" even means. I don't think you know much about the subject.

- Joined

- May 22, 2012

- Messages

- 16,875

- Reaction score

- 7,666

- Location

- St. Petersburg

- Gender

- Male

- Political Leaning

- Libertarian

There is no "QE bubble" and I have no idea what "Keyenistic spending" even means. I don't think you know much about the subject.

If you don't know that QE creates a bubble or what Keynesian Economics are I know you no nothing about the subject.

jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,664

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

The reason for that is government is in the business of creating more government, the more they spend the more power and control they have over the dependency they create. Amnesty, guns, etc expands their role and dependency voter base fiscal discipline and regulatory reform does just the opposite.

I think its more that they just want to stay in office and live like nobility.

- Joined

- Nov 8, 2006

- Messages

- 13,406

- Reaction score

- 8,258

- Location

- Milwaukee, WI

- Gender

- Male

- Political Leaning

- Undisclosed

If you don't know that QE creates a bubble or what Keynesian Economics are I know you no nothing about the subject.

QE didn't create a bubble. I don't think you know what a bubble is.

I said I didn't know what "Keyenistic spending" means, not Keynesian Economics.

- Joined

- May 22, 2012

- Messages

- 16,875

- Reaction score

- 7,666

- Location

- St. Petersburg

- Gender

- Male

- Political Leaning

- Libertarian

QE didn't create a bubble. I don't think you know what a bubble is.

I said I didn't know what "Keyenistic spending" means, not Keynesian Economics.

The economy is being artificiality held up, inflated, by QE and Keynesian Economics and when it ends the bubble will burst.

Don't know why you can't understand that.

- Joined

- Jan 2, 2006

- Messages

- 28,177

- Reaction score

- 14,273

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

I am talking about the bubble of QE and Keyenistic spending.

Credit easing is not a bubble, nor is Keynesian policy that has been practiced in the U.S. since the 1940's.

- Joined

- Jan 2, 2006

- Messages

- 28,177

- Reaction score

- 14,273

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

If you don't know that QE creates a bubble or what Keynesian Economics are I know you no nothing about the subject.

What bubble?

For the nth time, Keynesianism protects capitalism from self destruction. The populace of a democratic nation will only accept extremely high levels of unemployment for so long. Hence, it is necessary intervention.

Only a true socialist/Marxist will oppose Keynesianism.

- Joined

- May 22, 2012

- Messages

- 16,875

- Reaction score

- 7,666

- Location

- St. Petersburg

- Gender

- Male

- Political Leaning

- Libertarian

What bubble?

For the nth time, Keynesianism protects capitalism from self destruction. The populace of a democratic nation will only accept extremely high levels of unemployment for so long. Hence, it is necessary intervention.

Only a true socialist/Marxist will oppose Keynesianism.

Why would a socialist/Marxist oppose government intervention in the free market, that is what socialist/Marxist is all about.

Keynesianism protects capitalism from self destruction. - On what planet? Keynesianism is nothing more than an excuse to spend a deficit. When is the last time the spending was cut when the economy is going well? Never happens.

- Joined

- Jan 2, 2006

- Messages

- 28,177

- Reaction score

- 14,273

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

Why would a socialist/Marxist oppose government intervention in the free market, that is what socialist/Marxist is all about.

You obviously have no idea what socialism actually entails. It is not, i repeat, is not about government intervention in the economy. Government intervention limits the severity of economic crises.

Keynesianism protects capitalism from self destruction. - On what planet? Keynesianism is nothing more than an excuse to spend a deficit. When is the last time the spending was cut when the economy is going well? Never happens.

Just look at how it has impacted the duration and frequency of the business cycle: http://www.nber.org/cycles.html

- Joined

- Nov 13, 2009

- Messages

- 14,205

- Reaction score

- 4,664

- Gender

- Male

- Political Leaning

- Slightly Liberal

Credit easing is not a bubble, nor is Keynesian policy that has been practiced in the U.S. since the 1940's.

Credit easing does is not a bubble but it causes distortions in how capital is allocated. If the easing goes on too long ( 5 years is pretty long) then this distortion may create a bubble or bubbles in various assets.

- Joined

- Jan 2, 2006

- Messages

- 28,177

- Reaction score

- 14,273

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

Credit easing does is not a bubble but it causes distortions in how capital is allocated. If the easing goes on too long ( 5 years is pretty long) then this distortion may create a bubble or bubbles in various assets.

Maybe, but multiple other catalysts are necessary for an asset bubble to form. The point of any easing program is to reduce the supply of risk free/low risk assets.

- Joined

- Jul 21, 2005

- Messages

- 51,710

- Reaction score

- 35,488

- Location

- Washington, DC

- Gender

- Male

- Political Leaning

- Conservative

Simple question, why did you get upset when previous quarters were adjusted to higher rates (calling it a farce) but accept the lower rate as God's truth?

Furthermore, I take it you are upset at Congress? After all, Congress writes laws and spends money. The Executive Branch does neither.

Also, do you believe stopping QE will increase economic activity, is so how?

These are all good questions for him to answer. Considering all you did was ask questions but not answer anything, perhaps I shall ask some of you as well.

What was your feeling in terms of previous quarters adjusting to higher rates? What's your opinion of this one? Did you give the credit to congress for those previous quarters or the executive branch? Who do you give the blame to in this instance?

To me, the rather piss poor numbers...both positive and negative...for some time is a sign that part of this is simply a cyclical thing that no amount of legislation is truly going to "Fix" on it's own, part of it is the uncertanity created with a very terse and split government, and part of it is an inability to do anything legislatively in the past few years to do anything to truly make a significant stimulating impact over a moderate to long period of time.

- Joined

- May 22, 2012

- Messages

- 16,875

- Reaction score

- 7,666

- Location

- St. Petersburg

- Gender

- Male

- Political Leaning

- Libertarian

You obviously have no idea what socialism actually entails. It is not, i repeat, is not about government intervention in the economy. Government intervention limits the severity of economic crises.

Ok then why would a socialist be against; Government intervention limiting the severity of economic crises?

Socialism is about public ownership of the means of production I am unclear on what you are saying.

- Joined

- Feb 21, 2012

- Messages

- 37,338

- Reaction score

- 10,641

- Location

- US Southwest

- Gender

- Male

- Political Leaning

- Liberal

Weird, you name some mysterious "cyclical" thingy and then procede to say that legislation won't work.....and that legislation was not passed!These are all good questions for him to answer. Considering all you did was ask questions but not answer anything, perhaps I shall ask some of you as well.

What was your feeling in terms of previous quarters adjusting to higher rates? What's your opinion of this one? Did you give the credit to congress for those previous quarters or the executive branch? Who do you give the blame to in this instance?

To me, the rather piss poor numbers...both positive and negative...for some time is a sign that part of this is simply a cyclical thing that no amount of legislation is truly going to "Fix" on it's own, part of it is the uncertanity created with a very terse and split government, and part of it is an inability to do anything legislatively in the past few years to do anything to truly make a significant stimulating impact over a moderate to long period of time.

Let me help enlighten you a bit, even though most of the ARRA was tax breaks, with a smaller portion keeping some state/muni employees in their jobs, it bumped GDP over 2% while in effect and more than paid for itself.

Legislation, fiscal stimulation, can have an effect in the short term....which is what is still needed. The one thing you did get correct is sighting the cause of such legislation not being passed currently, our divided Congress.

- Joined

- Nov 13, 2009

- Messages

- 14,205

- Reaction score

- 4,664

- Gender

- Male

- Political Leaning

- Slightly Liberal

Maybe, but multiple other catalysts are necessary for an asset bubble to form. The point of any easing program is to reduce the supply of risk free/low risk assets.

Here we are talking extreme easing. By that I mean the Fed has not only kept short term rates near zero, but has also reduced the supply of both short term treasuries and MBS growing their balance sheet. Also consider the duration of the easing, five years. If you are running the teachers pension fund as an example funding is based on getting a rate of return of something like 8%. That would be the blend on all investments with fixed assets being a big chunk historically. So either the pension manager can miss his/her target or will have to pay more for riskier bonds or try and buy "bond equivalent" stocks like utilities.

Clearly people don't know when we are in a bubble, else the market would deflate. So while we do not know when interest rates will stabilize if they ever do we will look back at all types of bonds and utility stocks and say that they were in a bubble.

- Joined

- Oct 19, 2012

- Messages

- 12,029

- Reaction score

- 3,530

- Gender

- Male

- Political Leaning

- Progressive

If you don't know that QE creates a bubble or what Keynesian Economics are I know you no nothing about the subject.

QE has stopped a deflationary spiral, which is why despite a huge increase in money supply we still have hardly any inflation. This doesn't compute in you tea party lumpen economic theory.

Keynesian economics is designed, inter alia, to deal with recessions (which are often the result of bubbles, as in the Bush Meltdown). Keynesianism works; austerity doesn't. Just ask the UK.

- Joined

- Oct 19, 2012

- Messages

- 12,029

- Reaction score

- 3,530

- Gender

- Male

- Political Leaning

- Progressive

1.8% is pathetic

Better than any other large western economy at this time, especially the ones who went the austerity route.

But the slow growth has an obvious cause: the foolish cutting of government spending by the Tea Party Occupation Forces in the House. Stooooopid.

- Joined

- May 22, 2012

- Messages

- 16,875

- Reaction score

- 7,666

- Location

- St. Petersburg

- Gender

- Male

- Political Leaning

- Libertarian

QE has stopped a deflationary spiral, which is why despite a huge increase in money supply we still have hardly any inflation. This doesn't compute in you tea party lumpen economic theory.

Keynesian economics is designed, inter alia, to deal with recessions (which are often the result of bubbles, as in the Bush Meltdown). Keynesianism works; austerity doesn't. Just ask the UK.

When Keynesian economics aka spending other people's money runs out of money austerity results.

Austerity is the direct result of Keynesian Economics.

- Joined

- Jan 2, 2006

- Messages

- 28,177

- Reaction score

- 14,273

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

Ok then why would a socialist be against; Government intervention limiting the severity of economic crises?

It severly reduces the risk of proletarian revolution that is advocated by so many socialists, Marxists, and communists.

Socialism is about public ownership of the means of production I am unclear on what you are saying.

To a degree. Socialism is really about social-ownership of the means of production. Hayek's analysis of the calculation problem highlighted the flaws of a centrally planned economy. As a result, more recent socialist thought is based on the concept of worker-ownership. See for instance, Theodore Burczak: Socialism After Hayek.

Socialism after Hayek reinvigorates the socialist quest for class justice by rendering it compatible with the social and economic theories of F. A. Hayek. Theodore A. Burczak advances a new vision of socialism that avoids Hayek's criticisms of centrally planned socialism while adhering to a socialist conception of distributive justice and Marx's notion of freely associated labor. In contrast to the socialist models of John Roemer, Michael Albert, and Robin Hahnel, Burczak envisions a "free market socialism" in which privately owned firms are run democratically by workers, and governments engage in ongoing redistributions of wealth to support human development, yet markets are otherwise unregulated.

Keynesianism prevents the transition that redefines property rights necessary to achieve this end.

- Joined

- Oct 19, 2012

- Messages

- 12,029

- Reaction score

- 3,530

- Gender

- Male

- Political Leaning

- Progressive

When Keynesian economics aka spending other people's money runs out of money austerity results..

I love the "other people's money" meme. It's such teabaggery. So now the idea is that the nations of Europe aren't democracies and rich people are put upon.