-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Do conservatives think massive debt created by upper class tax cuts is okay?

- Thread starter Yes_Minister

- Start date

- Joined

- Jun 3, 2020

- Messages

- 31,893

- Reaction score

- 10,840

- Gender

- Male

- Political Leaning

- Independent

Explain how increasing taxes would be detrimental. Houses law, isn’t an actual law FYI. It’s a theory similar to the laffer curve.For those interested in jacking up the taxes look up. Hauser's law.

- Joined

- Jun 16, 2021

- Messages

- 7,218

- Reaction score

- 5,309

- Gender

- Male

- Political Leaning

- Undisclosed

Actually it's not a theory. It is based purely on observation and not that accurate. The Laffer Curve is theoretical and far more useful.Explain how increasing taxes would be detrimental. Houses law, isn’t an actual law FYI. It’s a theory similar to the laffer curve.

- Joined

- Jun 3, 2020

- Messages

- 31,893

- Reaction score

- 10,840

- Gender

- Male

- Political Leaning

- Independent

Of course it is.Actually it's not a theory.

Neither are accurate or useful.It is based purely on observation and not that accurate. The Laffer Curve is theoretical and far more useful.

- Joined

- Mar 21, 2024

- Messages

- 4,502

- Reaction score

- 1,882

- Gender

- Male

- Political Leaning

- Slightly Conservative

It based on historical performance.Explain how increasing taxes would be detrimental. Houses law, isn’t an actual law FYI. It’s a theory similar to the laffer curve.

Wealthy people can declare how much income and when easily.

- Joined

- Jun 3, 2020

- Messages

- 31,893

- Reaction score

- 10,840

- Gender

- Male

- Political Leaning

- Independent

Prove itIt based on historical performance.

Huh? What they declare vs what they actually make is easily determined.Wealthy people can declare how much income and when easily.

- Joined

- Mar 21, 2024

- Messages

- 4,502

- Reaction score

- 1,882

- Gender

- Male

- Political Leaning

- Slightly Conservative

Prove it

Huh? What they declare vs what they actually make is easily determined.

I said to look it up but here you go.

Your second sentence shows you just don't understand the advantages of being self-employed or being shielded by a corporate shell.

You don't have to declare your gains until you sell your assets. You don't have to declare anything income until you receive it from your organization and a person can control that. For 24,000 you can shield your assets and earnings offshore. The only income you declare is the income you on-shore for day to day expenses and purchases. If you have a cooperating employer you can defer your compensation until you want it in a lower income year, a lower tax year, or a year you are taking a big deduction.

Not only the rich, but also people who work for only cash basis in labor or for tips, only pay taxes on what they voluntarily declare. If you raise taxes, people tend to declare less and bring less into the US to spend.

How the Super Rich Avoid Paying Taxes ... And What We Can Do About It

How the Super Rich avoid paying Taxes ... And what we can do about it. There's a simple way to force the 1% pay up and make the Tax System more fair to all.

- Joined

- May 6, 2013

- Messages

- 4,020

- Reaction score

- 2,069

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

Well, sort of. In nominal terms that's true. But that's like saying a person at 45 has 10 times the debt as a person at 25. We don't have enough information to determine if that's an issue, agreed? We'd probably consider a person's debt relative to their revenue, or debt to income ratio.The larger the debt the more the country pays in debt service

Thus, measuring debt as "larger" doesn't really tell us anything, of course it's larger, but so is the population, hourly productivity, national wealth and so on.

So let's look at debt as relative to the side of the economy.

I took the liberty of marking up the graph a little to show that from roughly 1983 to 1999 interest paid on the debt as a percentage of the economy was larger than today, and while interest on the debt is rising, unless Trump does something monumentally stupid, we should expect to see these numbers decline as interest rates are slowly falling, though from what I read, banks are hedging right now because Trump has claimed he's going to do some things that most people understand as harmful, like tariffs. Hoping against hope that's empty bluster and he doesn't do anything else crazy, I'd expect to see rates fall which will reduce interest payments.

But, that said, interest payments are payments made to people who hold debt. The US public holds 2/3'rd of all debt, which means that $2 out of ever $3 paid is paid to someone in the economy which means that if supply is adequate, inter5est payments contribute almost $1 trillion dollars in investment and drive demand in the private sector, all of which grows the economy and the reason that i9nterest payments relative to the economy haven't exceeded 3% of GDP all the way back to the early 11940's

It's really important to make a clear distinction between spending allocation and the decision to spend or not to spend. I won't argue with anyone that there are opportunities to shift unnecessary spending from one place to another where it can achieve more "good". But the question of spending or not spending is a whole different animal. Most people quote things like debt held as a percentage of GDP and they point out that it's higher than it's ever been, but that's an observation that lacks any kind of understanding.That is money that could be better spent on anything else.

If we look at government debt to GDP on this chart, we can see that private debt is higher and a MUCH bigger problem that gets almost no attention.

We can see as recently as 2008 debt to GDP was low. The GFC happens and the government takes on private debt, most that of banks and therefore their investors are the ones who profit.

Reductions in spending will increase private sector debt. From Regan all the way though the GFC every president has run on reductions in government debt and private debt has grown. Now to be fair, I'd really like to see a chart that breaks out debt held by the bottom 80% of Americans, because that's really the most important, but I have yet to find that stat.

The other misunderstood factor is that starting in the 1990's the US government trade deficits grows....

Cont...

- Joined

- May 6, 2013

- Messages

- 4,020

- Reaction score

- 2,069

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

Trade deficits result in foreign government's saving US dollars. Today the foreign sector is saving About $7 trillion US dollars. In order to prevent the national economy from running short of dollars (as the dollars being saved aren't circulating in the US economy).. The government sells US bonds and swaps it's dollars for bonds. This is something that was not a factor prior to 1992, so when comparing today with the past, it's important to take the dollars controlled by the foreign sector into account.

This is something called counter-0cyclical policy and I generally agree.Good fiscal policy would be to run deficits during economic downturns to keep things humming

Surpluses are almost always bad. We agree that government should spend more when the economy is doing bad and cut back when the economy is doing well and on the verge of overheating, but a surplus would cause the economy to do worse. I wouldn't want the government's reductions in spending to cause economic slowdowns or worse.and running surpluses when times are good.

"To large" is a relative number that needs to keep the trade deficit into account. Other factors that make a large deficit possible are population and per-person productivity and of course the availability of goods with a emphasis on energy prices which have and overwhelming affect on prices compared to other goods in the market.Always running deficits will lead inevitably to a debt too large to sustain.

uptower

DP Veteran

- Joined

- Nov 8, 2018

- Messages

- 24,064

- Reaction score

- 22,306

- Location

- Behind you - run!

- Gender

- Male

- Political Leaning

- Other

They don't understand how it will affect them

- Joined

- Jun 16, 2021

- Messages

- 7,218

- Reaction score

- 5,309

- Gender

- Male

- Political Leaning

- Undisclosed

By too large I mean that when your debt becomes so large that payments on the debt service equal your revenues, you have no money to spend. This is the theoretical endpoint of running constant deficits. In the long run, constant deficits are unsustainable, and worse they shrink your fiscal policy options for economic stimulus. Balancing the budget and running surpluses helps with this.Trade deficits result in foreign government's saving US dollars. Today the foreign sector is saving About $7 trillion US dollars. In order to prevent the national economy from running short of dollars (as the dollars being saved aren't circulating in the US economy).. The government sells US bonds and swaps it's dollars for bonds. This is something that was not a factor prior to 1992, so when comparing today with the past, it's important to take the dollars controlled by the foreign sector into account.

This is something called counter-0cyclical policy and I generally agree.

Surpluses are almost always bad. We agree that government should spend more when the economy is doing bad and cut back when the economy is doing well and on the verge of overheating, but a surplus would cause the economy to do worse. I wouldn't want the government's reductions in spending to cause economic slowdowns or worse.

"To large" is a relative number that needs to keep the trade deficit into account. Other factors that make a large deficit possible are population and per-person productivity and of course the availability of goods with a emphasis on energy prices which have and overwhelming affect on prices compared to other goods in the market.

- Joined

- May 6, 2013

- Messages

- 4,020

- Reaction score

- 2,069

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

This simply isn't true. You have to remember that, today, interest paid on the debt, about 75-80% of that is paid to interests within the US. In other words, interest paid is adding revenue to the economy resulting in a larger economy relative to interest paid.By too large I mean that when your debt becomes so large that payments on the debt service equal your revenues, you have no money to spend. This is the theoretical endpoint of running constant deficits. In the long run, constant deficits are unsustainable, and worse they shrink your fiscal policy options for economic stimulus. Balancing the budget and running surpluses helps with this.

That said, we've had times in the past when interest paid rose and the economy took some time to catch up and grow faster than interest paid. Historically, Interest paid has never exceeded 3.5% of the side of the economy.

As far as constant deficits being unsustainable, there's a lot that needs to be understood before we can determine the sustainability or unsustainability of deficits. It's like rain. There is a certain amount that is not only sustainable, but necessary. However, if it rained to much it could become more of a problem. Understanding the conditions that might cause deficits to go from helpful and necessary to harmful and destructive is the key and I don't think most people understand how to evaluate the question. Respectfully, yourself included.

Most people tend to think of interest paid like this:

When in reality it's more like this:

The real constraint is based on the domestic and global economies to supply goods and services to the US that the money created is used to purchase.

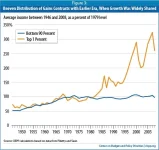

an increasing amount of money is increasingly concentrating into fewer hands.

- Joined

- Jun 2, 2019

- Messages

- 5,427

- Reaction score

- 4,598

- Gender

- Male

- Political Leaning

- Liberal

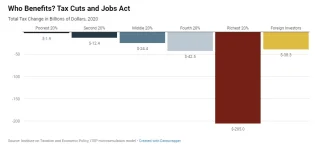

I think that the point is that there is a disparity in tax cuts that benefit the rich more than the rest of us.Upper class tax cuts??? Excuse me but everyone got tax a cut ....If you earn money and pay tax's at ANY level....you got a tax cut.

Obviously the tax cut amounts to more dollar wise...the more money you make...But everyone got it!

I run a small business and have about 35 employees that earn between $35,000 and $70,000 per year. They all got a tax cut which they saw on there very first check stub after the tax cut was enacted.

I'm so ****ing sick of people like you spreading this disinformation about tax cuts for the rich!!!!

Let me guess....you suffer from wealth envy????

For those that make far less, even under 50 grand which most Americans work under, the tax cuts did little to put more cash in their paycheck. And when folks still have a hard time getting by and the see folks who have exponentially more money, getting even more money although they don’t do jobs like theirs…and/or they see how those folks earn their money, like the heads of insurance companies…being upset about that disparity is reasonable.

And they aren’t asking to be made millionaires for nothing…they just want a more equitable system.

- Joined

- Dec 16, 2011

- Messages

- 41

- Reaction score

- 37

- Location

- Virginia

- Gender

- Male

- Political Leaning

- Libertarian - Left

Upper class tax cuts??? Excuse me but everyone got tax a cut ....If you earn money and pay tax's at ANY level....you got a tax cut.

'Short term, trump tax cuts looked good, long term for middle class and poor, safety nets are cut (Social Security, Medicare, etc.), as deficits balloon, as the $4000 per family is finally understood to be$4000 over 8 years. This tax cut will be hung around the Banana Republican neck. The first glimmer of understanding came with the$1.50 per week message that Ryan touted as a great thing. The truth - Trump tax cuts are/were a scam.

Virulent Orange Julius & 2017 tax cut hoodwink.

Devil hiding in the details.

2017Trump signed the Tax Cuts and Jobs Act. It cuts the corporate tax rate from 35 percent to 21 percent beginning in 2018. The top individual tax rate dropped to 37 percent. It cuts income tax rates, doubles the standard deduction, and eliminates personal exemptions. The corporate cuts are permanent, while the individual changes expire at the end of2025.

Ohhhh now you see it & if you are not among the rich now you don't. :-0

Some took the bait & fail to see big picture, are gullible obligingly shooting themselves in the foot then bragging about it...

President Clorox, caught us in our own trick bag.

- Joined

- May 6, 2013

- Messages

- 4,020

- Reaction score

- 2,069

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

“Our framework ensures that the benefits of tax reform go to the middle class, not to the highest earners.” – President Trump, Oct. 11, 2017 [USA Today]Upper class tax cuts??? Excuse me but everyone got tax a cut ....If you earn money and pay tax's at ANY level....you got a tax cut.

“The rich will not be gaining at all with this plan.” – President Trump, Sept. 13, 2017 [The Guardian]

Remember, don't listen to what he says, watch what he does.

The issue isn't that some got a tax cut and other didn't, it's the fact that the top 20% saw over 70% of the additional income, leaving the bottom 80% of Americans to share the last 30% of which half of that went to the 60-80th%

Why decrease taxes overwhelmingly for the top 20%? And, for what it's worth, I'm comfortably in the top 20%.

- Joined

- May 6, 2013

- Messages

- 4,020

- Reaction score

- 2,069

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

Or, of the taxes on that income that you would onshore are less than the interest paid on a loan minus the profits earned in markets (because the money remained unrealized earning investment income) , you can keep that money where it is, and never onshore any of it, avoid taxes avoid investment income loss and just pay interest to a bank.The only income you declare is the income you on-shore for day to day expenses and purchases.

- Joined

- Sep 13, 2014

- Messages

- 20,316

- Reaction score

- 8,124

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Conservative

When taxes are cut, revenue to the federal government generally increases. The Trump tax cuts were no exception, and the middle class has received the greatest benefit from them. Spending is what causes debt.Do conservatives think massive debt created by upper class tax cuts is okay?

Trump’s Wasteful Tax Cuts Lead To Continued Trillion Dollar Deficits In Expanding Economy

If tax cuts actually paid for themselves, they would reduce deficits based on faster growth. Deficits shot up in the wake of the 2017 supply-side tax cuts. And CBO forecasts that those deficits will continue to stay high -- the opposite of tax cuts paying for themselves.www.google.com

- Joined

- Mar 2, 2013

- Messages

- 27,989

- Reaction score

- 9,968

- Location

- Northern New Jersey

- Gender

- Male

- Political Leaning

- Conservative

Uhhh... debt comes from spending.

- Joined

- Jun 16, 2021

- Messages

- 7,218

- Reaction score

- 5,309

- Gender

- Male

- Political Leaning

- Undisclosed

Half right; it comes from spending more than you earn.Uhhh... debt comes from spending.

- Joined

- Oct 14, 2015

- Messages

- 69,024

- Reaction score

- 75,815

- Location

- Massachusetts

- Gender

- Male

- Political Leaning

- Other

Maybe Republicans just don't care about debt as they can always just blame the Dems for it even if they created it?

It's what they do now.

Indeed. Their only concern about spending is the thought that people they consider undesirable might receive some benefit that they don't.

- Joined

- Mar 31, 2020

- Messages

- 57,818

- Reaction score

- 56,527

- Gender

- Male

- Political Leaning

- Other

Guess what?Probably not. He had other priorities. Not to mention having to deal with various levels of RESISTS from you guys

- Joined

- Nov 18, 2016

- Messages

- 59,863

- Reaction score

- 37,046

- Gender

- Male

- Political Leaning

- Liberal

Um...I'm thinking the Dems have an edge on increasing the debt...especially with all the money they are spending...and want to spend...since January.

Deficit spending ALWAYS matter...whether it's Democrats doing the spending or if it's the Republicans doing the spending.

I don't want ANYONE who doesn't absolutely need it to be getting handouts. Dems and Reps love to give handouts...especially when they get money and power in return.

Take your "brown people" card and shove it. It is irrelevant.

Donald Trump disagrees with you.

- Joined

- Mar 2, 2013

- Messages

- 27,989

- Reaction score

- 9,968

- Location

- Northern New Jersey

- Gender

- Male

- Political Leaning

- Conservative

Not necessary earn. More along the lines of what you take in, as the government doesn't earn, it collects taxes.Half right; it comes from spending more than you earn.