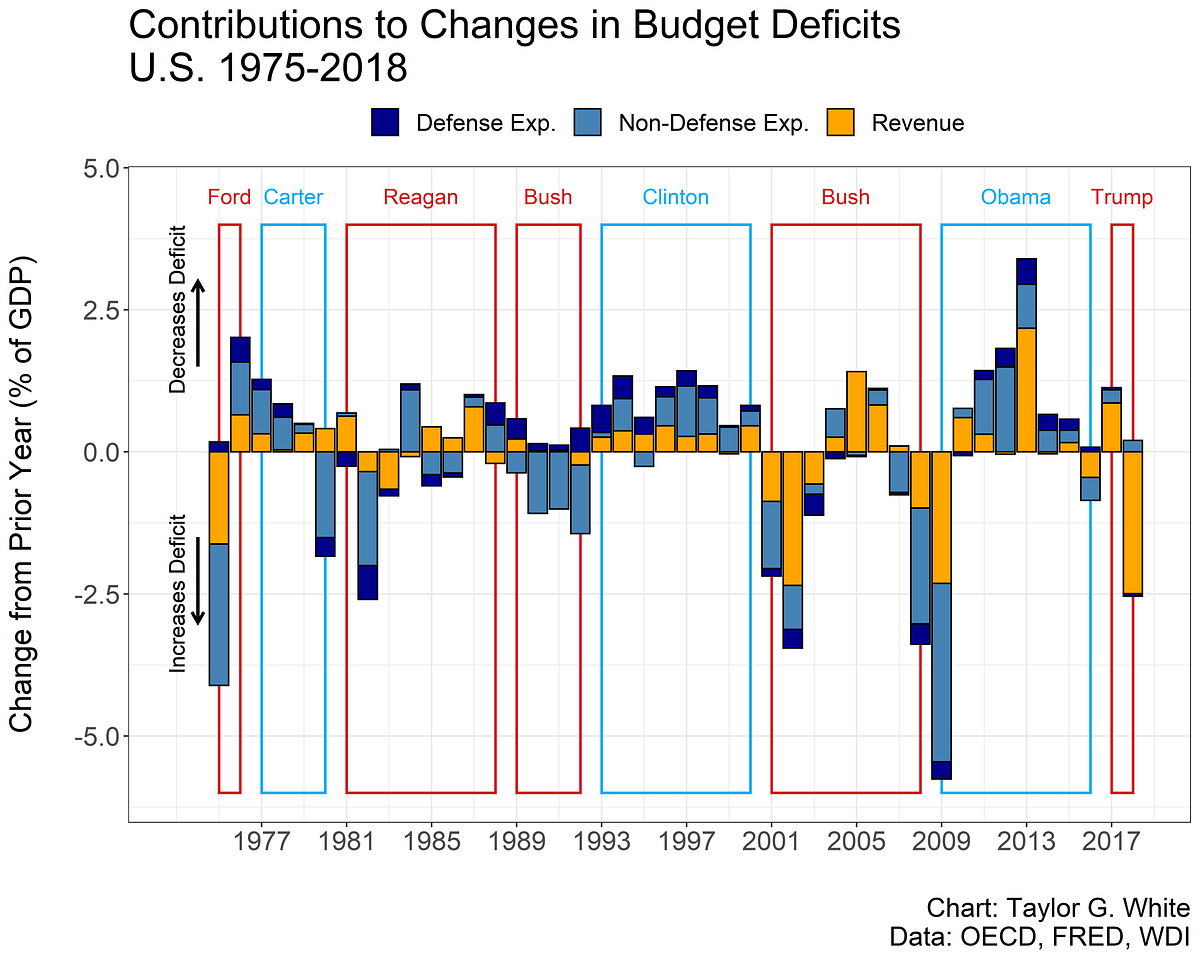

Kind of a nonsense question since debt is caused by excessive spending. Revenue is up. Spending is up more. Theres your massive debt.

Ok, lets assume not taking money from someone is spending and has to be 'paid for'. According to the CBO, revenue is about the same as always relatively. And up in real numbers, from 3268bn in 2016 prior to the tax cuts, to 3842bn in 2021, an increase of 400bn per year in revenue. And that did indeed come from faster economic growth, from 1.7% in 2016 to 2.9% by 2018. Slightly lower in 2019, but thats about 3 trillion in additional GDP. So the tax cuts are more than paid for.

If taxes arent the problem then, lets look at spending. In 2016, the govt spent about 4 trillion. Minus 3.2 trilllion revenue equals 800bn in debt. In 2020, it was 6.5 trillion. In 2021 it was 6.8 trillion.

So, its pretty obvious whats causing massive debts.

Pre tax cuts - Revenue 3.2 trillion Spending 4 trillion

Post tax cuts - Revenue 3.9 trillion

Spending 6.8 TRILLION

Oh and thats before the proposed additional 3.5 trillion Biden Plan. Even if they manage to pay for 30% of it short term, with tax increases, thats adding another 200bn in debt and increasing.

Notes Notes Unless this report indicates otherwise, all years referred to when describing the budget outlook are federal fiscal years, which run from October 1 to September 30 and are designated by the calendar year in which they end. Years referred to in describing the economic outlook are...

www.cbo.gov

www.google.com

www.google.com

www.google.com

www.google.com