- Joined

- Mar 17, 2014

- Messages

- 57,430

- Reaction score

- 15,751

- Location

- Near the Gulf of America

- Gender

- Male

- Political Leaning

- Conservative

I aim to please.That's the most cogent and well articulated responses you've had to one of my posts.

I aim to please.That's the most cogent and well articulated responses you've had to one of my posts.

Sure, but we can aggregate labor productivity across the economy. In other words, thanks to technology we can say that the overall productivity in the economy has increased by some amount. For example, since 1980 the average labor productivity has increased by 2.28 times (the best figure I can find), which means that 1000 workers today can create the same amount of output as 2280 worders in 1980, but, as you've said, that number could be the same, for example picking a strawberry (not a berry btw) is probably no easier today than it was in 1980, but doing a spreadsheet for a business or creating a blueprint for an airliner takes 1000's fewer hours and can be done by much fewer people, so we'll take the average.A few problems with this is that labor productivity is not uniform across the economy and is far more volatile.

I said I've worked for government, but mostly for large milti-billion dollar private companies that you'd recognize, like Dell or Verizon...With this type of thinking I can understand you work in government.

Ok, like I said. there may be a few areas you can make small changes and overall realize pretty significant results. Things like policy changes, training enhancements, reviewing the need for technologies across a business that may no longer be necessary, reviewing travel policies, facilities changes (does the AC need to be on all night?), data centers are now much more tolerant to higher temps, etc, etc, etc, and there are probably dozens more of these easy to understand kinds of changes that don't get make because no one is on the hook to lower costs. But there are many other changes that would require intimate knowledge of an organization or processes in order to truly evaluate the potential waste in these places.First of all, the fraud involved has a low estimate of $221 billion. The high figure is $300 billion MORE

Of course, and I would not be opposed to lowering the cap on federal spending increases by the growth in labor productivity. I think that in practice the variability of this might cause problems which is why it might be better to review this on a periodic basis instead of tying individual years' budget increases on it.Sure, but we can aggregate labor productivity across the economy.

A few thoughts.And reducing spending by that amount would reduce revenues in the private sector by that amount, in fact it would reduce revenues by even more as each dollar spend is spent more than once. I'm not arguing that we should accept the status quo and shouldn't do anything, rather, I would rather spend that money on other things that are needed.

You cannot save your way to prosperity, what we can do is spend less in wasteful areas and redirect that spending to areas of greater efficacy. That is, unless you can explain how not spending ~$2 trillion dollars won't eliminate $2 trillion dollars in revenue somewhere in the economy.

Never made that argument, my argument is that any money saved should be spent in places it's needed.1) I don't know how responsible the argument of "Don't get rid of 100's of billions of dollars of fraud because it'll impact the economy!" really is.

I don't understand the purpose of caps. I do understand the purpose of ensuring that spending is being used in a way that it is accomplishing a worthwhile goal.2) My major suggestion has nothing to do with cutting current spending. Rather, putting caps on future spending INCREASES.

Ahhh...And now we get to the crux of the misunderstanding. This is simply false. I've written on this in the past.Government spending crowds out investment and the private sector economic growth. It is estimated that our debt/GDP levels retard economic growth each year by 1.2%.

You stated (incorrectly) that spending cuts hurt the economy. Yet, the only cuts I suggested was to eliminate the $221-520 Billion in fraud. Eliminate this theft and lower our spending.Never made that argument, my argument is that any money saved should be spent in places it's needed.

That much is obvious. It is a mechanism to bring priorities to the federal budget, incentivize efficiency, reduce our annual deficits—potentially bringing ourselves to actually begin to reduce our overall debt in 15-20 years.I don't understand the purpose of caps. I do understand the purpose of ensuring that spending is being used in a way that it is accomplishing a worthwhile goal.

I’m sure the author of the article that you cut and pasted believes they are correct, and largely they are until the debt/GDP ratio goes over a certain level. The literature varies with some setting it at 77%, others at 80%, and others at 90%. We are at 117% right now.The traditional crowding out theory rests on the flawed assumption of a fixed pool of loanable funds. It posits that government borrowing directly competes with private borrowing, driving up interest rates and discouraging private investment. However, this view overlooks several crucial aspects of modern economies:

- Money Creation and Financial System Dynamics: Governments, especially those that issue their own currency, have the capacity to create new money. This means government spending doesn't necessarily draw from a finite pool of existing savings in the way private borrowing does. The financial system is also more dynamic than the simple loanable funds model suggests. Banks create credit through lending, and government spending can increase reserves in the banking system (borrowing creates deposits), potentially facilitating further lending. Therefore, the mechanism by which traditional crowding out is supposed to occur (increased demand for a limited supply of loanable funds) is fundamentally flawed.

- Focus on Real Resources and Economic Capacity: The true constraint on economic activity isn't primarily financial, but real. It's the availability of real resources like labor, capital, and raw materials. Crowding out, in the real sense, only occurs when the economy is operating at or near full capacity. If there are unemployed resources, government spending can actually increase aggregate demand, leading to increased economic activity and stimulating private investment – a "crowding in" effect. For example, government investment in infrastructure can create jobs, boost consumer spending, and generate new business opportunities, thereby encouraging private investment.

- Fiscal Policy and Economic Stabilization: Government spending and taxation (fiscal policy) play a crucial role in managing aggregate demand and stabilizing the economy. By directly influencing economic activity, fiscal policy can help maintain full employment and price stability. This can be achieved without necessarily relying solely on interest rate adjustments, which are the supposed drivers of crowding out in traditional theory. Effective fiscal policy can create a more stable and predictable economic environment, which can be conducive to private investment.

- Sectoral Shifts vs. General Crowding Out: Government spending can lead to sectoral shifts in economic activity. Resources directed towards public projects are unavailable for other specific uses. This is different from the general crowding out of all private investment implied by the traditional theory. For example, government investment in public transportation might reduce private investment in personal vehicles. This is a reallocation of resources within the economy, not a general reduction in overall investment.

- Inflation as a Constraint: The true limit on government spending is the potential for inflation (demand driven not supply constraint imposed). Excessive spending that outstrips the economy's productive capacity can lead to rising prices. However, this is a macroeconomic constraint related to resource utilization, not a financial constraint related to "running out of money" or "competing with private borrowers."

Ha ha, very funny. I wrote it, Google it if you don't believe me, and I am correct.m sure the author of the article that you cut and pasted believes they are correct

Explain to me why you think debt to GDP matters the way that you claim, please.and largely they are until the debt/GDP ratio goes over a certain level.

What literature?The literature varies with some setting it at 77%, others at 80%, and others at 90%. We are at 117% right now.

And who do you think pays for "servicing the debt"?but more and more of our tax revenue does not go to defense, infrastructure, and services but to service our debt.

I'm not arguing for "unbridled spending" whatever that means. Why don't you give us some examples of this? What are some examples if inefficiencies and how do they differ from inefficient allocation of capital within the private sector?Additionally, unbridled spending leads to inefficiency in government.

Written in a time when the monetary system had just transitioned from a gold redemption system to a gold backed system, both fundamentally different from the fiat system we have today. Keynes was largely correct in his time, I suspect if he were alive today he would do what so many others have been unable or unwilling to do, which is change in light of new evidence. I believe based on your statements that you are also unaware of how fiat affects your assumptions. And you might think fiat is a poor system, I'm not even arguing that, I'm suggesting that your statements thus far lack an understanding of how it works.Keynes’ 1936 book

Quite right, like Republicans an Smith. My favorite is when people attribute the idea of an "Invisible Hand" to Smith, something he only ever mentions twice, once in The Theory of Moral Sentiments and once in The Wealth of Nations, despite the fact that the modern interpretation of the "invisible hand", especially as the political right abuses it, deviates from Smith's original intent. While he acknowledged the role of self-interest, he also emphasized the importance of moral sentiments, ethical behavior, and government regulation in a well-functioning economy. But to your point, yes, people often argue from authority without understanding it.which is largely often quoted by Democrats but seems to be rarely actually read.

Government spending, specifically deviations from the norm should be counter cyclical, but should also be in the context of an understanding of the prevailing economic indicators.the part that never gets included in the Democrat bumper-sticker arguments is that this heightened spending should be temporary!

Again, I'm not arguing that there is spending that is going to places where it isn't needed, what I am arguing is that reductions in spending are counter productive (litterally) also create problems.Considering the GAO estimates there is between $222-500+ billion dollars and estimates that there are $10s of thousands of billions wasted in redundancy it’s hard to argue he’s wrong.

Do conservatives think massive debt created by upper class tax cuts is okay?

Trump’s Wasteful Tax Cuts Lead To Continued Trillion Dollar Deficits In Expanding Economy

If tax cuts actually paid for themselves, they would reduce deficits based on faster growth. Deficits shot up in the wake of the 2017 supply-side tax cuts. And CBO forecasts that those deficits will continue to stay high -- the opposite of tax cuts paying for themselves.www.google.com

Going out of the country this morning for 7 days with limited internet. Let me respond then. I’m enjoying the discussion. Especially knowing I’m right .Ha ha, very funny. I wrote it, Google it if you don't believe me, and I am correct.

Explain to me why you think debt to GDP matters the way that you claim, please.

What literature?

And who do you think pays for "servicing the debt"?

Who do you think benefits from payments on the debt?

I'm not arguing for "unbridled spending" whatever that means. Why don't you give us some examples of this? What are some examples if inefficiencies and how do they differ from inefficient allocation of capital within the private sector?

Written in a time when the monetary system had just transitioned from a gold redemption system to a gold backed system, both fundamentally different from the fiat system we have today. Keynes was largely correct in his time, I suspect if he were alive today he would do what so many others have been unable or unwilling to do, which is change in light of new evidence. I believe based on your statements that you are also unaware of how fiat affects your assumptions. And you might think fiat is a poor system, I'm not even arguing that, I'm suggesting that your statements thus far lack an understanding of how it works.

Quite right, like Republicans an Smith. My favorite is when people attribute the idea of an "Invisible Hand" to Smith, something he only ever mentions twice, once in The Theory of Moral Sentiments and once in The Wealth of Nations, despite the fact that the modern interpretation of the "invisible hand", especially as the political right abuses it, deviates from Smith's original intent. While he acknowledged the role of self-interest, he also emphasized the importance of moral sentiments, ethical behavior, and government regulation in a well-functioning economy. But to your point, yes, people often argue from authority without understanding it.

Government spending, specifically deviations from the norm should be counter cyclical, but should also be in the context of an understanding of the prevailing economic indicators.

Again, I'm not arguing that there is spending that is going to places where it isn't needed, what I am arguing is that reductions in spending are counter productive (litterally) also create problems.

Consider the fact that ALL 7 attempts in the past to curb debt in the US have all resulted in depression. The only recent surplus, which was tiny by comparison resulted in a recession and I would argue was the match that set off the great recession a few years later.

1804-1812: U.S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U.S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U.S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U.S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U.S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U.S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U.S. Federal Debt reduced 36%. Depression began 1929.

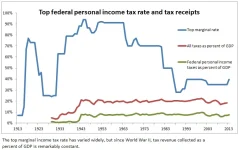

Revenues decreased by the percentage of the cut. Basic math. Revenues increase year over year, every year due to population growth and inflation, barring a recession.Upper class tax cuts are not the drivers of our debt, as revenues have continued to increase.

It’s both increased spending and decreasing revenues.Our spending - driven especially by "emergency measures" and the entitlements - has grown even faster, and is the driver if our debt.

Upper class tax cuts are not the drivers of our debt, as revenues have continued to increase.

z

zThat's true but it increased at a significantly lower rate than was seen under Obama and Biden, thus even increases can be losses if the amount if increase should have been more.

For example, if you get paid 1/2 as much in your check and you point that out to your boss, if he said, what are you complaining about, it's more than you had before you got paid.

View attachment 67546976z

I'm curious, how would you explain higher rates of revenue generation under Obama and Biden compared to Trump?

Revenues decreased by the percentage of the cut. Basic math. Revenues increase year over year, every year due to population growth and inflation, barring a recession.

It’s both increased spending and decreasing revenues.

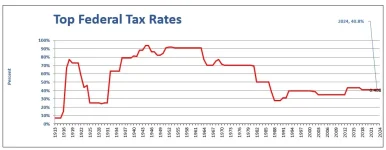

We have 40+ years of data showing it’s a difference maker.Respectfully, not really. Revenues also increased in real terms.

People aren't surprised by tax rates. Folks don't generally get to the end of the year and suddenly discover that the government requires them to provide money. Increased (or decreased) rates change human behavior and results resulting in follow-on adjustments to receipts.

I'm not saying tax rates don't matter at all - but top marginal FIT rates like we are discussing matter so little compared to the size of the issue we are facing that they are basically a rounding error. It's like saying one of the ways we are going to save for a downpayment for a house is by keeping an eye on the ground in parking lots for loose change that fell out of people's pockets. Sure. Technically you could say "it helps", but, that's not going to be anything close to a difference maker.

We have 40+ years of data showing it’s a difference maker.

Why not generate more revenue? Two sides of the same coin.So we need to cut spending.

What a great post, thanks!Never made that argument, my argument is that any money saved should be spent in places it's needed.

I don't understand the purpose of caps. I do understand the purpose of ensuring that spending is being used in a way that it is accomplishing a worthwhile goal.

Ahhh...And now we get to the crux of the misunderstanding. This is simply false. I've written on this in the past.

The traditional crowding out theory rests on the flawed assumption of a fixed pool of loanable funds. It posits that government borrowing directly competes with private borrowing, driving up interest rates and discouraging private investment. However, this view overlooks several crucial aspects of modern economies:

- Money Creation and Financial System Dynamics: Governments, especially those that issue their own currency, have the capacity to create new money. This means government spending doesn't necessarily draw from a finite pool of existing savings in the way private borrowing does. The financial system is also more dynamic than the simple loanable funds model suggests. Banks create credit through lending, and government spending can increase reserves in the banking system (borrowing creates deposits), potentially facilitating further lending. Therefore, the mechanism by which traditional crowding out is supposed to occur (increased demand for a limited supply of loanable funds) is fundamentally flawed.

- Focus on Real Resources and Economic Capacity: The true constraint on economic activity isn't primarily financial, but real. It's the availability of real resources like labor, capital, and raw materials. Crowding out, in the real sense, only occurs when the economy is operating at or near full capacity. If there are unemployed resources, government spending can actually increase aggregate demand, leading to increased economic activity and stimulating private investment – a "crowding in" effect. For example, government investment in infrastructure can create jobs, boost consumer spending, and generate new business opportunities, thereby encouraging private investment.

- Fiscal Policy and Economic Stabilization: Government spending and taxation (fiscal policy) play a crucial role in managing aggregate demand and stabilizing the economy. By directly influencing economic activity, fiscal policy can help maintain full employment and price stability. This can be achieved without necessarily relying solely on interest rate adjustments, which are the supposed drivers of crowding out in traditional theory. Effective fiscal policy can create a more stable and predictable economic environment, which can be conducive to private investment.

- Sectoral Shifts vs. General Crowding Out: Government spending can lead to sectoral shifts in economic activity. Resources directed towards public projects are unavailable for other specific uses. This is different from the general crowding out of all private investment implied by the traditional theory. For example, government investment in public transportation might reduce private investment in personal vehicles. This is a reallocation of resources within the economy, not a general reduction in overall investment.

- Inflation as a Constraint: The true limit on government spending is the potential for inflation (demand driven not supply constraint imposed). Excessive spending that outstrips the economy's productive capacity can lead to rising prices. However, this is a macroeconomic constraint related to resource utilization, not a financial constraint related to "running out of money" or "competing with private borrowers."

lol...These little jibes really aren't necessaryThat much is obvious.

So then explain to us how you can eliminate $220-$520 in private sector revenue (multiplied by the velocity level) won't affect the economy?You stated (incorrectly) that spending cuts hurt the economy. Yet, the only cuts I suggested was to eliminate the $221-520 Billion in fraud. Eliminate this theft and lower our spending.

Again, reducing debt will reduce incomes and will result in deficits or worse. Eliminating federal debt (as a rule) helps no one. Again, explain.It is a mechanism to bring priorities to the federal budget, incentivize efficiency, reduce our annual deficits—potentially bringing ourselves to actually begin to reduce our overall debt in 15-20 years.

The larger the debt the more the country pays in debt service. That is money that could be better spent on anything else.lol...These little jibes really aren't necessary

So then explain to us how you can eliminate $220-$520 in private sector revenue (multiplied by the velocity level) won't affect the economy?

While I'd agree funding used to build a bridge that stops in the middle of a lake is wasteful, but it would result in incomes. Since there are other real shortages in the economy, spending that bridge money on other real infrastructure issues will simultaneously eliminate waste and grow (or maintain growth) in the economy by spending money that is earned by companies and people as real income.

Eliminating spending (generally) doesn't result in anyone in the private sector saving anything. So tell us, you eliminate that spending, what are the benifits?

Again, reducing debt will reduce incomes and will result in deficits or worse. Eliminating federal debt (as a rule) helps no one. Again, explain.

Now I need to say that there are times when reducing debt can be a good idea, but the times that is necessary are the result of a specific economic conditions.