- Joined

- May 6, 2013

- Messages

- 3,910

- Reaction score

- 1,941

- Location

- NW Virginia

- Gender

- Male

- Political Leaning

- Undisclosed

Debt relative to what?When the amount of debt becomes so enormous it will have

Respectfully, numbers are just numbers, but they represent something in the real world. Saying "big number bad" is no way to evaluate the value, stability or resiliency of the US dollar. The numbers are big...But it's worth knowing they aren't big at all relitive to total wealth.

If we knock a few zeros off, but keep the ratio's the same, this would be a fantastically successful business.

Let's say $35 billion in debt and $214 billion in assets.

There is so much wealth, that per citizen there is over $636,000 per citizen (Debt Clock removed this bottom row recently so I can't have up to the moment numbers).

So $104k of debt per citizen and $636k in wealth.

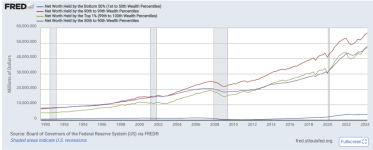

The problem isn't the economy, the problem is, averages are over the entire population. Less than 10% of people have a net of $500k in wealth (subtracting debt per citizen from wealth per citizen). That means that the vast, vast majority of the wealth is in the top 10%. Yet they want you to feel like the bottom 90% is mostly responsible for it.

See the problem?

Here. This is a real chart that shows wealth of the bottom 50%, then next 40$, the next 9% and the next 1%