- Joined

- Jan 14, 2022

- Messages

- 14,663

- Reaction score

- 3,854

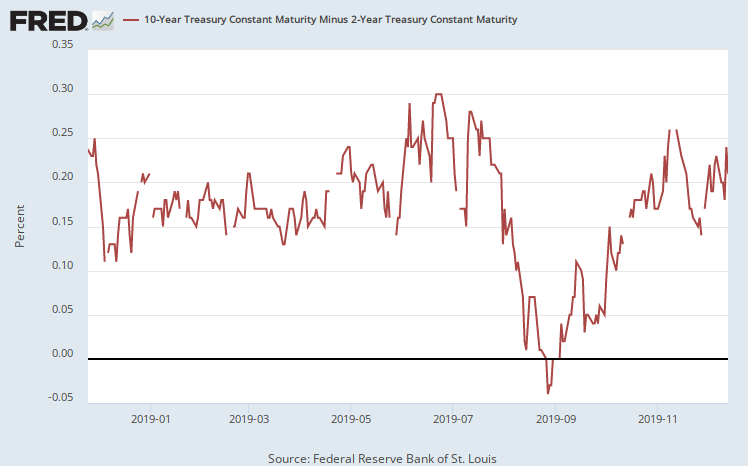

For the first time since 2006, a short term bond is yielding a higher interest rate than a longer one. This is a major indicator of recession. The longer term bonds become garbage, those holding them lose money and they cannot sell them.